Tips To Minimize Your Risk & Maximize Your Profits (Part 2)

“Real estate is definitely a path to be seriously considered in building your wealth. Where to invest varies depending on the location of the investment as well as market timing. My investment choices change as often as the market does. Being sensitive and aware of changing market trends is helpful to know where to invest and the most profitable strategy to follow”.

What was just quoted was a highlight to part of this real estate investing article series of minimizing risks and maximizing profits for investors. You can review the first 3 rules here: “Top 7 Tips To Minimize Your Risk & Maximize Your Profits P1”.

article continues after advertisement

Top 7 Tips To Minimize Your Risk & Maximize Your Profits

Rule #4 – Use a Tried and True Strategy

Why make all of the mistakes others have already made if you don’t have to? Find a good investment strategy that works with your goals and stick to it. You will be tempted and pulled in many directions by all the different gurus out there saying their way is best.

Find a mentor and coach with experience in today’s market and then follow where they lead. After all, why would you walk through a mine field alone if there was someone else familiar with the route who could lead you safely through?

Rule #5 – Have Attorney Review Contracts

Hire a professional real estate attorney to review all your processes and paperwork before utilizing it in your market. Because most trainers and coaches are not attorneys, as much as we try, we cannot be experts on laws in every state in the U.S. For this reason, it is vital for you to make sure the contracts and steps you are taking are not going to lead you to the courthouse.

Anyone can sue anyone these days. The way to avoid this is to first of all, always be nice and come from a place of caring in your dealings with others. Don’t avoid dealing with situations personally or you may find a costly summons to court forcing you to deal with things the expensive way. A second way to avoid litigation is to assure your paperwork and procedures are legal to the best of your ability.

I know attorneys can be expensive which is why I signed up to use a service that offers me unlimited consultations and a certain number of document reviews for only $50.00 a month. I recommend this way to be the most cost effective resource to be able to accept advice from a licensed real estate attorney in any state.

Rule #6 – Have Basic Computer Skills

You will want to know how to use email, internet and office products like Microsoft Word and Excel (Google had free versions of these). It is helpful to know how to create graphics but not necessary. You will need high speed internet to enjoy utilizing this wonderful tool and avoid the frustration of being unable to watch videos and waiting for pages to load.

You can do your entire real estate business from a computer. You will absolutely need to type contracts and do research and there is no faster, easier way than this. If you do not know how to use email, the internet and basic word on a computer, find a class you can take to learn the skills you lack. If you have tried to do business without these tools, you will find them to turbo-charge your business once you have them.

article continues after advertisement

Rule #7 – Diversify Your Investments

Don’t put it all into one area or one type of real estate. So how did I go from having no money to the prosperity I enjoy today? It started with a book called the “One Minute Millionaire” by Mark Victor Hansen and Robert G. Allen. This book showed me I could really have the kind of lifestyle I desired, if I would diversify my income, while at the same time making wise investments.

I studied this philosophy on money found in this book as well as in others like it. Then, I did something many are too afraid to do, “I put what I learned to work in my life”. I currently divide my income into various investment strategies such as real estate, stocks, business ownership, savings, Money Market, IRA’s, and others.

However, since I see that 40% of today’s billionaires made it in real estate, I have chosen to place a large percentage of my time and money into this strategy. What type of real estate do I invest in? This varies about every 6 months depending on the market conditions as I mentioned earlier. I also have relationships with “power team” of experts so we have all the correct data to consider our strategy as the market changes.

In summary, there is no hard fast rule that applies to all investing – except one. That is this. In order to profit from your investments, we have found it important to diversify them. Consider different types, different areas and different strategies that make the most sense, therefore bringing you the highest return on your investment.

Tamera Aragon

Tamera Aragon is a professional online entrepreneur and has bought and sold over 300 properties, establishing her as an expert in the real estate investing field. Since 2003, she has purchased over 10 million dollars in real estate and currently holds properties all over the world. Tamera’s focus is on the booming Foreclosure market, buying Pre-foreclosures, REOs and Short Sales. Tamera who is a noted Author, Success Trainer, Speaker & Coach, shows her passion for helping others with the 17 websites she has created and several specialized products to support fellow investors throughout the world. When Tamara is not busy running her website, she is very involved with her Fiji joint ventures and investments. Tamera Aragon is one of the few trainers and coaches who is really “doing it” successfully in today’s market. Tamera’s experience has earned her a solid reputation in the industry as well as the respect and friendship of many of the top national real estate investment and internet marketing experts. Tamera Aragon believes her success has garnered her the financial freedom to fully enjoy her marriage and spend quality time with her children.

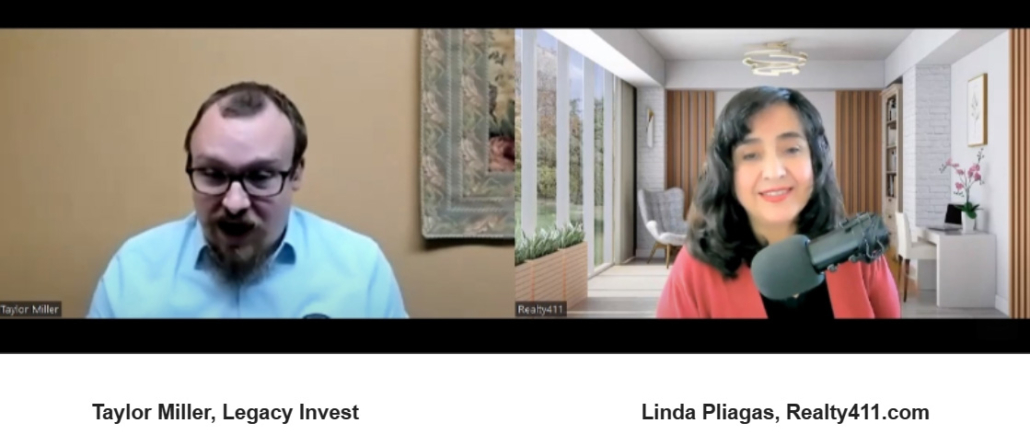

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411Expo.com or our Eventbrite landing page, CLICK HERE.