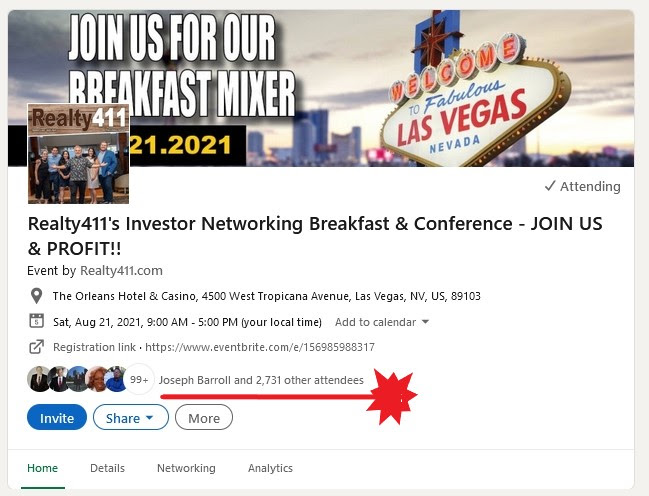

Realty411 Las Vegas Real Estate Breakfast Mixer

DOWNLOAD OUR AGENDA, CLICK HERE!

UPDATE: OUR LAS VEGAS EVENT HAS BEEN EXTENDED. OUR NEW EVENT HOURS ARE 8:30 AM TO 6 PM

It’s time to learn from renowned real estate & wealth-building educators:

* Dawn Pitts, Business Development Executive, Ignite Funding * Randy Hughes, Mr. Land Trust * Jonah Dew, The Money Multiplier * Brad Blazar, Private Capital Expert * Jeremy Rubin, The Friendly Flipper * Paul Finck, The Millionaire Maverick * Bill Walsh – Powerteam International * Paul Wilkins, Probate Finance Expert * Justin Ford, Top Producer, eXp Realty * Anthony Patrick, New Harvest Ventures * Linda Pliagas, Realty411 & REI Wealth Magazines * Christoph Malzl & Jonathon Metoyer, LandVoice.com * Get Funded & Learn to RAISE BILLIONS in Private Capital * Discover Insider Information about Investing in Probates

CANNOT ATTEND IN PERSON? NO PROBLEM, WE ARE ALSO VIRTUAL – REGISTER AND WE WILL SEND YOU A LINK TO OUR LIVESTREAM.

ONLY INVESTORS RESIDING OUTSIDE OF NEVADA WILL BE ADMITTED VIRTUALLY.

ONLY INVESTORS RESIDING OUTSIDE OF NEVADA WILL BE ADMITTED VIRTUALLY.

Be Sure to Read Our Two New Issues, Click Below