Seller-Carryback Note Terms

By Bruce Kellogg

Introduction

It is well known among real estate investors that some of the best deals occur when the seller is persuaded to carry some, or all, of the financing. This article introduces the seller-carryback note, and provides a menu of terms that can be negotiated into the note. So far as drawing up the note is concerned, most closing agents ( i.e., escrow offices and attorneys) have what they call a “cookbook” of legally-correct note terms, so buyers and sellers need not be concerned with such details.

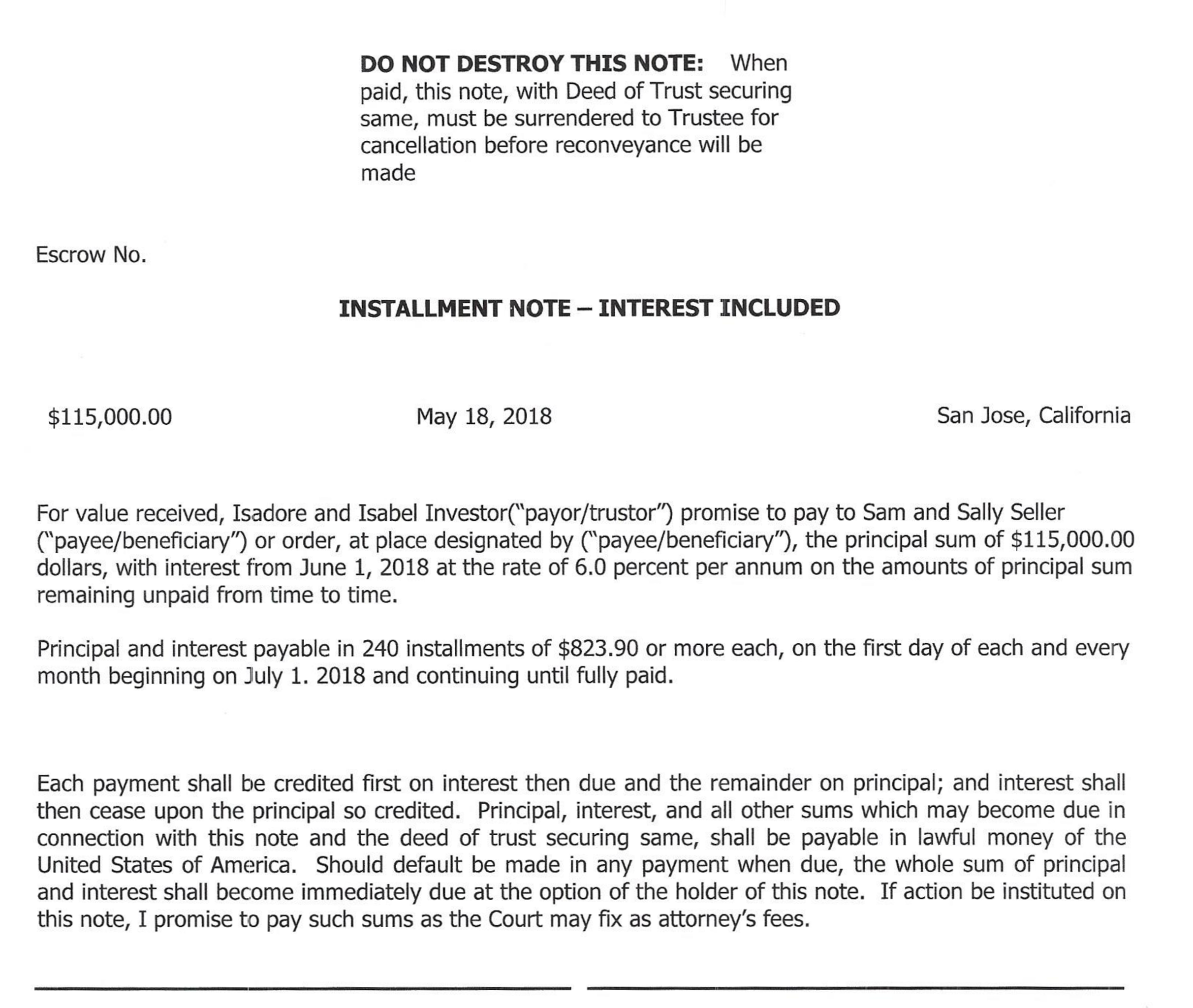

For reference, a sample installment note is attached. Additional terms can be added off the menu as desired.

1) “Request for Notice of Delinquency” – This is actually not a term in the note. It is prepared in escrow and recorded, instead. Its purpose is for the senior lienholder(s) to notify the carryback seller in the event the owner is not paying them. It protects the seller by allowing them to jump in early to protect their interest.

2) “Unsecured” – This also is not a term of the note. It should be inserted at the top of the note to indicate that there is no security instrument (i.e., mortgage or deed-of-trust) securing the note to the property. Its use is not recommended!

3) “Late Charge” – Most notes have a “late charge”, such as 3% of the payment after 10 days past due. Some states have regulations for owner-occupied properties. Most investment transactions are not regulated in this way.

4) “Due on Sale or Transfer” (“Alienation”) Clause

This term is included to protect the seller from the property being sold or transferred to a party other than the original buyer. After all, the secondary buyer might not be creditworthy.

This term has an enforcement feature wherein the seller can force a payoff or foreclose to recover the property. However, in order to be enforceable, this term must also be included in the security instrument (mortgage or deed-of-trust). Other note terms do not need to be included in the security instrument, but this one does.

5) “Assumption” – If the parties desire for the note to be assumable, this can be included in the note. Usually, some criteria are included to protect the seller. Often, the note says that the seller’s approval “cannot be unreasonably with-held” when there are protections included.

6) “Balloon Payment” – When a note is not “fully-amortized” such that a balance remains at maturity, this is called a “balloon payment”. If this applies, the note should be written to clearly include this feature to protect both parties from misunderstanding.

7) “Option to Extend” – If a “balloon payment” is involved, writing an “option to extend” into the note could prevent a rough ending if refinancing or selling conditions are unfavorable. It could extend for a year or two with a fee paid to the seller, or a “partial-paydown” made.

8) “Interest-Only” – describes the arrangement where the payments consist only of interest, and a “balloon payment” occurs at maturity.

9) “Zero Interest” – involves payments of principal only, with no interest being charged. This term is a sweetie for buyers!

10) “Deferred Interest” – involves interest accruing to maturity, when both principal and interest are due. Although this helps cash flow, unlike zero interest it is very risky. Rapid appreciation will be essential for this to succeed, and losing the property is a realistic possibility!

11) “Skip a Payment” – Sometimes, if the parties are relating well, it is possible to include a term allowing the borrower to skip a payment in the event of job loss, rental vacancy, or other misfortune. This can be made part of the note, or dealt with at the time. Including it ahead of time is preferable for a more stable transaction.

12) “Substitution of Collateral” – Sometimes, an enterprising buyer will negotiate with the seller the right to move the note and secure it to a different property. This is usually done to sell, exchange, or refinance the property. There should be criteria stated to protect the note-holder, but approval “should not be unreasonably with-held” if the criteria are met.

13) “Right of First Refusal” –Sometimes, an enterprising buyer will realize that the seller might decide to sell the note at a discount to raise cash in the future. Including this term gives the buyer first shot at buying their own debt back at a discount, effectively lowering the purchase price.

14) “Graduated Payment Mortgage (GPM)” – is a note engineered such that interest and/or payments start low, then increase gradually over the years. It makes for easier ownership but can become a trap in the later years. For this reason, the Dodd-Frank legislation prohibits this type of loan on 1-4 unit owner-occupied properties, but it is still legal for investment property transactions of all kinds.

15) “Shared Appreciation Mortgage (SAM)” – is a popular note term when prices are high and still rapidly rising, or when interest rates are high. The note is written so that the seller receives payments that are “sub-market”, but also receives a percentage of the property’s appreciation upon sale or maturation of the note. It is useful, but not very common.

Conclusion

Clearly, these note terms are not appropriate for every transaction, nor would sellers agree to all of them. The objective is for buyers to negotiate as many that are advantageous as they can!

Good luck!

Bruce Kellogg

Bruce Kellogg has been a Realtor® and investor for 36 years. He has transacted about 500 properties for clients, and about 300 properties for himself in 12 California counties. These include 1-4 units, 5+ apartments, offices, mixed-use buildings, land, lots, mobile homes, cabins, and churches. He is available for listing, selling, consulting, mentoring, and partnering. Reach him at [email protected], or (408) 489-0131.