Brandon Cobb Leads Investors To High Performing Recession Resistant Assets

By Tim Houghten

Founder of The House Buyin’ Guys and HBG Capital, Brandon Cobb is leading investors to new forms of high performing and recession resistant assets this year.

We recently caught up with him to find out what he is investing in now, why, his take on the markets, and how to make great investment choices among uncertainty.

Expanding & Diversifying

We last caught up with Brandon in the midst of the pandemic in 2020. His company was thriving through COVID, with double digit growth, great spreads on deals and lots of volume in the single family space. It was their best year up until that point.

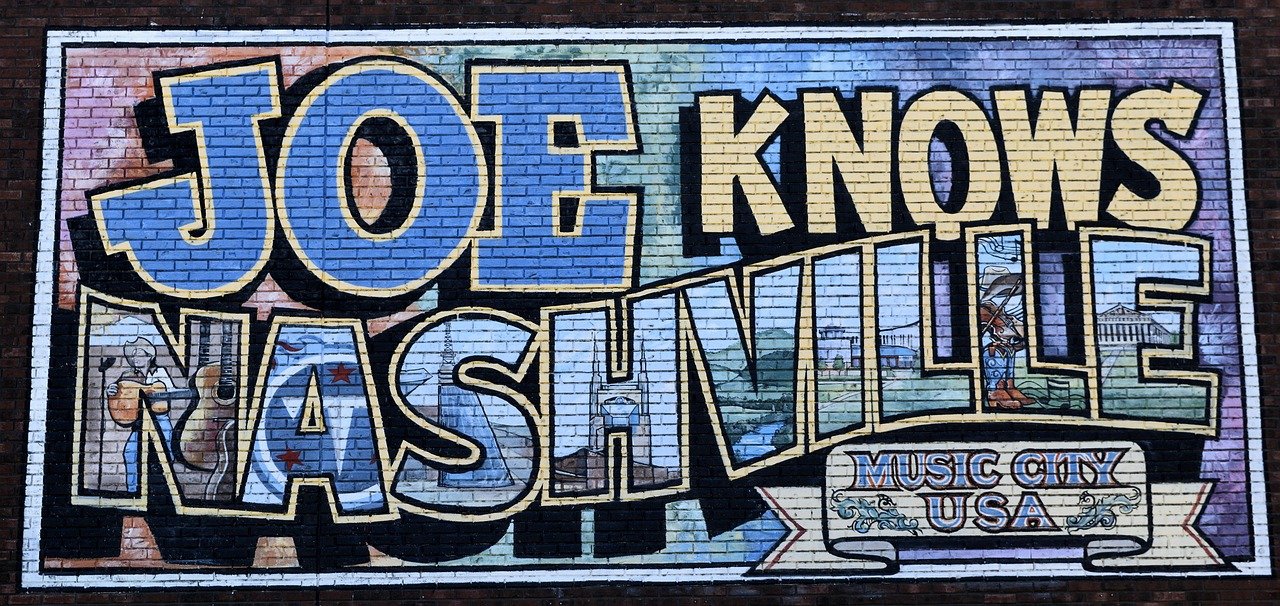

Image from Pixabay

Their building, rehabbing, flipping and wholesaling ventures in the Middle TN market were exploding, especially as many investors had chosen to sit on the sidelines afraid of the market. Single family inventory was plentiful, deeper discounts were widely available, competition was low, and on the flip side deals ended up selling for incredible profits as house prices boomed.

Of course, as others watched this success and wanted a piece of it, everyone wanted to jump back into the market at the same time and mimic it. Inventory disappeared and green investors have bid up home prices to wild highs in many parts of the country.

Brandon and his Middle Tennessee business are still doing very well there. Yet, he has also evolved his strategies and opened up new opportunities for investors.

Although deeply tragic on a personal level, the pandemic has been very good to many financially as well. Brandon has found many investors with plentiful capital looking to deploy it in the right assets, and especially in the real estate space.

The truth is that no one knows what the medium term holds for the economy, country and real estate. There are many wildcard factors that could be played. For now, it seems like the outlook remains incredibly strong through the end of the year. In the long run we all know that real estate has proven to be invaluable.

While it looks like the worst may be over, many analysts still see the potential for a recession in the near future as the impacts of recent policies add up and become evident.

After a long and insane run, analysts, including the Chief Investment Strategist of Bank Of America are predicting the global economy and public stock market are headed for at least a ‘flash recession’ in the second half of 2021. In fact, with the exception of a few categories like real estate, healthcare, and utilities which have covered up losses elsewhere, behind the scenes many commodities have fallen by over 20%. Even Peter Theil’s big tech company has reportedly been making big moves into tangible assets. Jeff Bezos has hit the news headlines for a few times for selling off his Amazon stock and bolstering his personal real estate portfolio instead.

All this together prompted Brandon to start giving investors access to more high quality and bigger deals in new places.

Image from Pixabay

He’s been flying around the country, and even the world to source and vet the best opportunities. Including a 384 unit, $42M apartment building with 97% occupancy that they helped close on in Daytona Beach, FL.

There Are Great Performing, Solid Deals Out There

Despite some misinformation and over exaggeration in the media, and the real competition and compressed returns in the single family market there are high performing assets to buy into. There are acquisition opportunities which have not only proven to thrive through COVID (and hence should through any other crises), but are ideally situated to survive and even see improved performance in a potential recession.

Brandon sees opportunities lying in the multifamily and commercial real estate space.

You have to look a little further for them, dig a little deeper, have better connections and a stronger network and do more investigation, but they are out there.

What Brandon Is Investing In Now

With the launch of HBG Capital, Brandon has created a new platform enabling other investors to participate in the deals he is engaging in, and to learn how he is doing it.

While he makes no guarantees of performance, and past performance isn’t always an indicator of future performance, he has produced stable double digit returns for investors throughout the years and at least up until now.

Today he is helping those with capital to invest, those who want to smooth out their returns and avoid the extreme volatility of the public stock market, and desire hard asset backed investments. As well as busy high income earners who simply know that they need to diversify their asset allocation into real estate, but don’t have the time to do it all themselves.

In the multifamily space HBG Capital is mainly focused on 100 unit plus acquisitions to benefit from all of the economies of scale that they offer.

On the commercial real estate front he says they are again looking at recession resistant properties like self-storage and assisted living complexes.

It’s All About The Due Diligence: Integrity & Equity

Success in real estate investing, and especially in times like these all comes down to the due diligence. Doing your homework and screening opportunities.

Image from Pixabay

In fact he says his firm only pursues 2% to 3% of deals they are presented with, after they’ve gone through their rigorous vetting process.

He says the two most important factors in this are:

1. The integrity of the person you are dealing with, and their capabilities

2. The amount of equity in the deal and current existing performance

Most deals fail to pass these factors.

Brandon has also just published a new book on the subject, which you can download for free on their website www.HBGcapital.net

‘Due Diligence: 100 Questions Passive Investors Should be Asking Before Investing’ is the book that outlines everything you should ask and know before making an investment, and how he and his firm are qualifying opportunities.

More Ways To Outperform

Image from Pixabay

Other ways Brandon and his teams have continued to outperform the market no matter what comes along include the following:

- Keeping the construction in-house to combat asset management, inflation, and other external threats

- Keeping the map open to invest where the best deals are

- Adjusting your buying criteria with the market changes and outlook

- Regularly review your past deals to see what’s working best and where you are leaving money on the table

- Partner with world class operators with proven track records

Conclusion

Even despite pandemic lockdowns and restrictions real estate investors like Brandon Cobb have proven to survive and thrive. As the market continues to grow, those leading the way are continuously expanding and diversifying into new assets.

To make the best investments in this sector now, be sure you are doing your due diligence, and are aligning with great partners.

Equip yourself for this with Brandon’s new book for free, and check out HBG Capital’s process at HBGCapital.net.

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411.com or our Eventbrite landing page, CLICK HERE.