What About “Cap Rate?”

By Bruce Kellogg

It’s a popular and confusing measure!

You had to ask! It’s probably the most used real estate investment metric lately. Many people, syndicators and trainers especially, are talking about it. It turns out that there are more than one version of it, and they are not consistent. So, here goes!

Realtor.com’s Version

Realtor.com describes Cap Rate as “How much you earn on an investment”, and they measure it as Net Annual Income divided by Purchase Price, expressed as a percentage. They say to calculate the annual rent, but what if there are coin laundry machines, and the garages are rented extra, or rented as storage units? Do you see the problem here? Now, should the Purchase Price include closing costs, and the new roof that was installed immediately after closing? Do you see the problem here?

ADVERTISEMENT

One thing all versions have in common is that debt on the property is not included. It is computed as though there is no debt. That is how Cap Rates can compare properties with each-other. So that’s good.

Realtor.com quotes a Realtor and attorney who says, “Cap Rate is a proxy for determining the risk of an investment.” Hmmm. More on that shortly.

Realtor.com says Cap Rates usually range from 4% to 12%. A lower rate makes the property more expensive, usually.

Investopedia’s Version

Investopedia regards Cap Rate as a “rate-of-return on investment” that can be used to “compare similar real estate investments”. It “indicates the property’s intrinsic, natural, and unlevered rate of return.” Yes, intrinsic and natural. We like that!

ADVERTISEMENT

So, Investopedia says Cap Rate = Net Operating Income divided by Current Market Value. Except when it says Net Operating Income divided by Purchase Price. The first one differs from Realtor.com’s definition, but the second one is the same. Clear now?

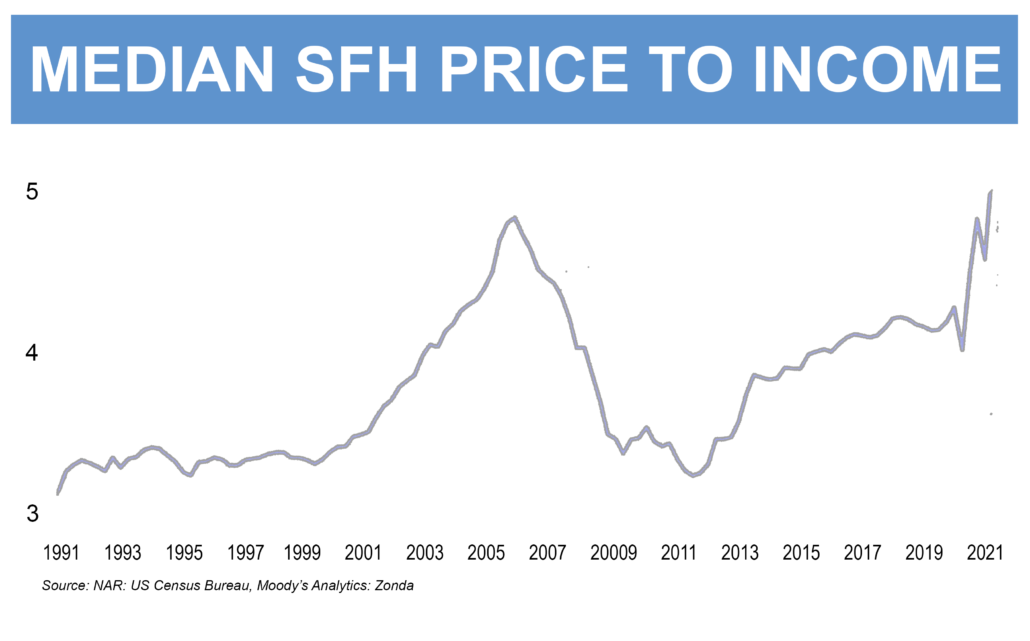

Some sources say to use actual rents and expenses from the previous year to compute a Cap Rate. Nowadays with so much syndication going on, they go beyond that to PROJECTING income, costs, and Cap Rates out 3,5,7 years for the life of the project. One prominent national syndicator with about 30 projects recently said he likes to buy in the 5-Cap range, add value, then sell in the 3-Cap range. Now that multiunit sales are 5-Cap or higher due to increased interest rates and wealthy clients becoming less wealthy anymore, he might find his model being a challenge. Cap Rates generally rise as interest rates rise, and as Yogi Berra famously said, “Predicting is risky, especially when it’s about the future.”

What’s this about risk?

According to Investopedia “a lower Cap Rate corresponds to a better valuation and a better prospect of returns with a lower level of risk. On the other hand, a higher value of Cap Rate implies relatively lower prospects of return on property investment, and hence a higher level of risk.”

So, here are some of the risks they mention:

- Age, location, and status of the property

- Tenants’ solvency and regular receipt of rentals

- Term and structure of tenant lease(s)

- The overall market rate of the property and the factors affecting its valuation

- Property type: multifamily, office, industrial, retail, or recreational

- Macroeconomic fundamentals of the region as well as factors impacting tenants’ businesses

As a practical example, suppose you have two indentical 20 year-old 4-plexes. One is next to a small shopping center containing a convenience store, a nail parlor, a bar, and a “strip club”. The second one is next to a good-size church with a medical clinic across the street. Which is likely to have the lower (“better”) Cap Rate? So, that’s risk.

An Educational Example

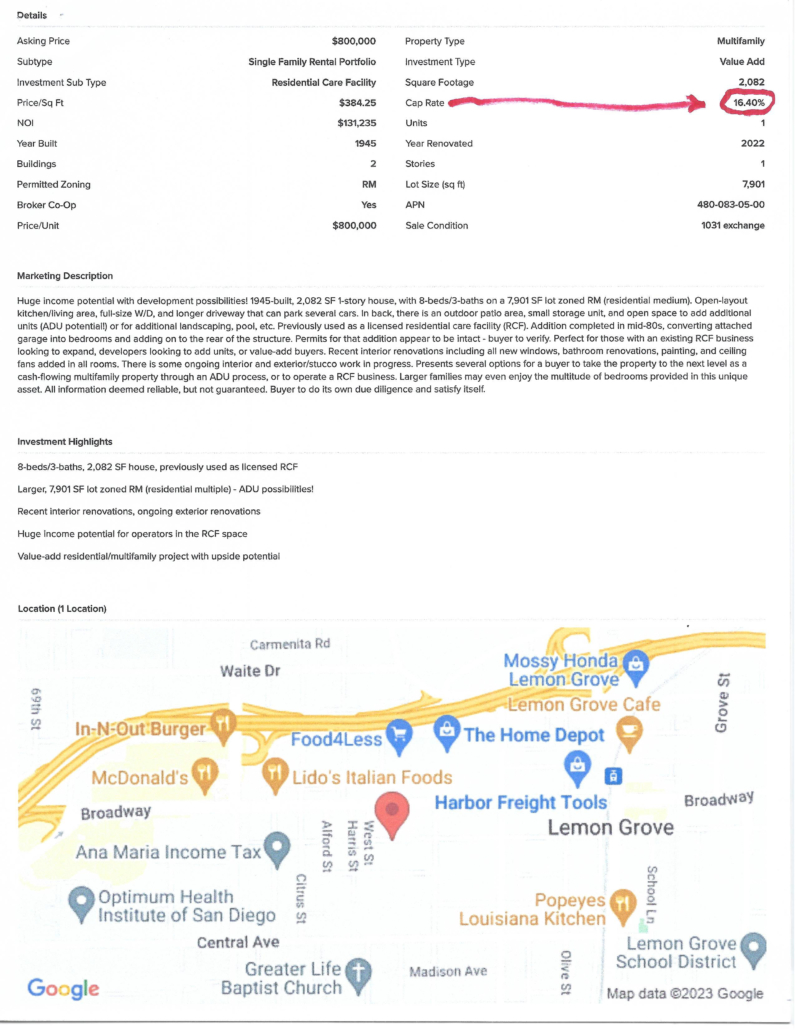

Exhibit “A” is a listing of a vacant 78 year 0ld 2082 sf. house on a city lot. The agents say it’s a single-family residence (SFR), but it can be turned into a Residential Care Facility as a “value add” opportunity. Maybe add an ADU since the lot size is apparently sufficient.

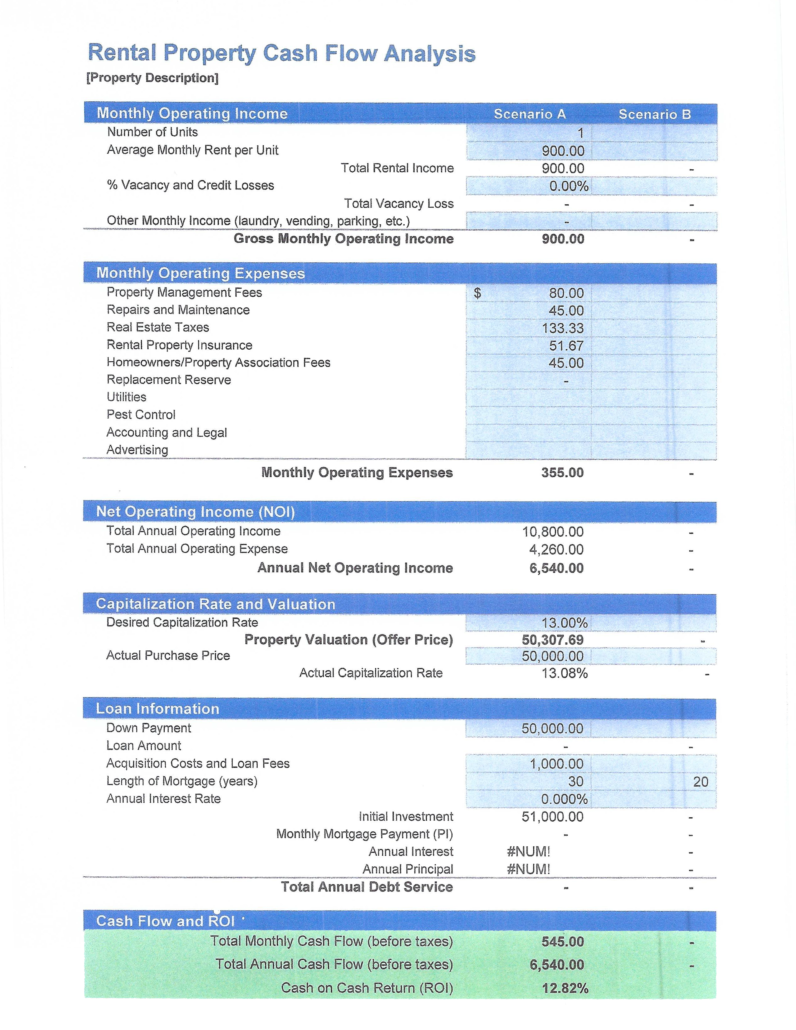

The second page shows a Cap Rate of 16.40%! That’s amazing! They figured that to two decimal places on a vacant property! It’s not really a miracle. They PROJECTED the Residential Care Home on to the property.

Here is the lesson:

This is a PROJECTED Cap Rate. Who knows what will happen? It is basically meaningless. Yogi was right.

Conclusion

Cap Rate is one measure out of about ten that are useful for real estate investment analysis. It has value on larger projects like multiunits and other commercial properties, but on smaller residentials, say 1-20 units, it’s not necessary. Just compute the cash flow, and see if you like it.

Cap Rate has several formulas, which can be confusing and even contradictory. If you’ve decided to use it, select a formula that has meaning for you and apply it consistently to your investment decisionmaking.

Calculating investment metrics is “desk work”. Necessary, of course. But also needed is “field work”. Go investigate the property. Where are the bar and “strip club”? Or the church and medical center? Remember, you can improve the property, but not the neighborhood.

And don’t put too much stock in anybody’s projections. The property needs to make sense today.

Bruce Kellogg

Bruce Kellogg has been a Realtor® and investor in California for 44 years. He purchased about 350 investment properties for himself, mostly with high leverage and tax-deferred exchanges. In the process, he made three fortunes, and experienced three real estate downturns since 1980. He has transacted about 550 properties for clients, creating fortunes for several. His first book, Real Estate Investing Wisdom, is in publication, and he can be reached at [email protected] or (408) 489-0131.

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411.com or our Eventbrite landing page, CLICK HERE.