By Lloyd Segal

It’s 2020; a crazy C-R-A-Z-Y year. We are in the land of the unknown. Things are happening for the first time that none of us have ever seen before. You must take it for what it is and adapt as best you can. But ask yourself, when this pandemic is over (and it will be inevitably) will you be able to look back and be proud of what you accomplished during this incredibly difficult period? With that in mind, let’s wash our hands, put on our facemasks, and get under the hood…

Pending home sales.

Pending home sales continued to rebound across the country in June as Americans rushed to buy homes despite the pandemic. The index of pending home sales rose 16.6% in June as compared with May, the eternally-optimistic National Association of Realtors reports. The increase comes after pending home sales experienced the largest monthly rise on record last month. Compared with a year ago, contract signings are up 6.3%, a sign of how sharply the market has rebounded from its coronavirus-related low. Consumers are taking advantage of record-low mortgage rates resulting from the Federal Reserve’s maximum liquidity monetary policy. The index measures real-estate transactions where a contract was signed for a previously-owned homes but the sale has not yet closed. The continued rebound in pending home sales suggests that the real-estate market is thriving in spite of the continued rise in COVID-19 cases across the country. Two main factors are driving the surge in home-buying activity. First, many buyers appear to be entering the market looking to make up for lost time. As such, the rise in sales is a reflection of the delays caused by the coronavirus outbreak. Second, historically low mortgage rates have created a sense of urgency among Americans looking to purchase a home and lock-in those low rates. Nevertheless, there’s still a shortage of homes available for sale as some sellers continue to stay on the sidelines rather than list their properties for fear of exposing their homes (and themselves) to infection. This supply limitation will inherently limit how many deals close in the months ahead.

Pending home sales continued to rebound across the country in June as Americans rushed to buy homes despite the pandemic. The index of pending home sales rose 16.6% in June as compared with May, the eternally-optimistic National Association of Realtors reports. The increase comes after pending home sales experienced the largest monthly rise on record last month. Compared with a year ago, contract signings are up 6.3%, a sign of how sharply the market has rebounded from its coronavirus-related low. Consumers are taking advantage of record-low mortgage rates resulting from the Federal Reserve’s maximum liquidity monetary policy. The index measures real-estate transactions where a contract was signed for a previously-owned homes but the sale has not yet closed. The continued rebound in pending home sales suggests that the real-estate market is thriving in spite of the continued rise in COVID-19 cases across the country. Two main factors are driving the surge in home-buying activity. First, many buyers appear to be entering the market looking to make up for lost time. As such, the rise in sales is a reflection of the delays caused by the coronavirus outbreak. Second, historically low mortgage rates have created a sense of urgency among Americans looking to purchase a home and lock-in those low rates. Nevertheless, there’s still a shortage of homes available for sale as some sellers continue to stay on the sidelines rather than list their properties for fear of exposing their homes (and themselves) to infection. This supply limitation will inherently limit how many deals close in the months ahead.

Gross Domestic Product.

In case you haven’t heard, the U.S. economy just suffered its worst quarter (April–June) in our nation’s history, with GDP falling a historic 32.9! The Commerce Department report highlights how deep and dark the hole is that our economy cratered into this summer. Sharp contractions in personal consumption, exports, inventories, investment, and spending by state and local governments, converged to bring down GDP, which is the combined tally of all goods and services produced by our economy during the quarter. Personal consumption, which historically accounts for about two-thirds of all activity in the U.S., subtracted 25% from the Q2 total, with services accounting for nearly all that drop. Spending also slid in health care and goods (such as clothing and footwear). Inventory investment drops were led by motor vehicle dealers, while equipment spending and new family housing took hits when it came to investment. Prices for domestic purchases, a key inflation indicator, fell 1.5% for the period, compared with a 1.4% increase in the first quarter. Bottom line: the numbers are alarming but all self-inflicted, with about half the quarter reflecting the sudden shutdown and the other half the slow re-opening. That said, GDP reflects the hole out of which we must now climb out of as we rebound in the remaining months of this bizarre year. Neither the Great Depression, nor the Great Recession, nor any of the more than three dozen economic slumps over the past two centuries, have ever caused such a sharp decline over such a shockingly short period of time. Ironically, this particular tumble, unlike previous declines, owes to a very different source than any of its predecessors: a government-induced shutdown aimed at combating a pandemic

In case you haven’t heard, the U.S. economy just suffered its worst quarter (April–June) in our nation’s history, with GDP falling a historic 32.9! The Commerce Department report highlights how deep and dark the hole is that our economy cratered into this summer. Sharp contractions in personal consumption, exports, inventories, investment, and spending by state and local governments, converged to bring down GDP, which is the combined tally of all goods and services produced by our economy during the quarter. Personal consumption, which historically accounts for about two-thirds of all activity in the U.S., subtracted 25% from the Q2 total, with services accounting for nearly all that drop. Spending also slid in health care and goods (such as clothing and footwear). Inventory investment drops were led by motor vehicle dealers, while equipment spending and new family housing took hits when it came to investment. Prices for domestic purchases, a key inflation indicator, fell 1.5% for the period, compared with a 1.4% increase in the first quarter. Bottom line: the numbers are alarming but all self-inflicted, with about half the quarter reflecting the sudden shutdown and the other half the slow re-opening. That said, GDP reflects the hole out of which we must now climb out of as we rebound in the remaining months of this bizarre year. Neither the Great Depression, nor the Great Recession, nor any of the more than three dozen economic slumps over the past two centuries, have ever caused such a sharp decline over such a shockingly short period of time. Ironically, this particular tumble, unlike previous declines, owes to a very different source than any of its predecessors: a government-induced shutdown aimed at combating a pandemic

Case-Shiller Index.

Home-price appreciation maintained a steady pace in May amid the pandemic, according to the Case-Shiller 20-city Price Index. The index posted a 3.7% year-over-year gain in May, down from 3.9% the previous month. Phoenix continues to lead the country with a 9% annual price gain in May, followed once again by Seattle with a 6.8% increase. Tampa, Fla., came in third, with a 6% uptick. But a look at the individual cities in the 20-city index shows that home-price growth could be slowing. Overall, the pace of price growth only increased in three of the cities Case-Shiller analyzed. Home prices have remained mostly insulated from the pressures of the coronavirus pandemic thus far. Falling mortgage rates have boosted the demand for homes among buyers, as the record-low interest rate environment has made purchasing properties more affordable for many people. At the same time, though, the supply of homes for sale nationwide remains severely constrained. Many home sellers have stayed on the sidelines and held off from listing their properties because of infection fears related to the coronavirus. But even before the pandemic, the country’s housing inventory was falling well short of demand. For years, the formation of new households exceeded the pace of home-building, creating a shortage. That gap between the demand for homes and the country’s inventory has pushed prices higher. And that gap explains why home prices continue to rise even if the job market takes another hit from the pandemic. There are some signs though that prices could end up falling. The house price index released last week by the Federal Housing Finance Agency indicated that home-prices nationally fell 0.3% on a monthly basis between April and May, despite a 4.9% annual gain. Finally, the godfather of the Case-Shiller index, Robert Shiller, predicts that home prices may decline in urban cities across the country as the pandemic accelerates buyers shift toward suburban and rural areas.

Mortgage Rates.

According to Bankrate’s latest survey of the nation’s 20 largest mortgage lenders, the benchmark 30-year fixed mortgage rate is 3.090% with an APR of 3.380%. The average 15-year fixed mortgage rate is 2.740% with an APR of 3.060%. The 5/1 adjustable-rate mortgage (ARM) rate is 3.300% with an APR of 4.040%. APRs and rates are based on no existing relationship or automatic payments. For these averages, the customer profile includes a 740 FICO score and financing a single-family residence (with 20% down).

According to Bankrate’s latest survey of the nation’s 20 largest mortgage lenders, the benchmark 30-year fixed mortgage rate is 3.090% with an APR of 3.380%. The average 15-year fixed mortgage rate is 2.740% with an APR of 3.060%. The 5/1 adjustable-rate mortgage (ARM) rate is 3.300% with an APR of 4.040%. APRs and rates are based on no existing relationship or automatic payments. For these averages, the customer profile includes a 740 FICO score and financing a single-family residence (with 20% down).

Office Rents.

California office spaces are expected to keep getting emptier (and their rent prices will likely keep declining) as the fallout of the pandemic persists, according to a new survey of commercial real estate developers and financiers by the Allen Matkins/UCLA Anderson School. With efforts to slow the spread of the coronavirus forcing offices to shut down, companies have adapted to a decentralized model in which employees increasingly work from home. Even when they’re eventually allowed to reopen, offices still won’t resume business as usual. They will be required to follow safety protocols that can be expensive, putting additional strain on budgets stretched thin by the pandemic-ravaged economy. Besides, many workers won’t even want to return, for fear of catching the virus. As a result, demand for office space has tumbled. Last quarter, office leasing in Los Angeles County was at its lowest point since the Great Recession! One-third of builders surveyed said they’re cutting back plans for new office developments by more than 15%, and three-quarters said they were experiencing stress related to current tenant leases. Retail space is taking an even more severe hit. For retail properties, the survey suggests no light at the end of the proverbial tunnel. The current view is that retail properties will be generating significantly lower rents indefinitely. Why? Because the pandemic has accelerated a trend toward online shopping and away from in-person shopping. So, retail spaces (i.e. brick and mortar stores) are really going to suffer. Industrial real estate, on the other hand, seems to be in a much better position due to the rise of e-commerce. People staying home during the pandemic are a boon for warehousing development (in order to handle the increased distribution to consumers). The industrial space market will continue to build to handle the increased volume. In Southern California, 60% of the surveyed developers said they are planning at least one industrial development in the next year, and 39% are planning multiple projects.

Consumer Confidence.

Consumer confidence swooned in July amid a rash of new coronavirus cases in many states. The index of consumer confidence fell to 92.6 this month from a revised 98.3 in June, the Conference Board reports. The level of confidence is still above its pandemic low of 85.7, but it’s likely to be a long time before it returns to its pre-crisis peak. For example, the index stood near a 20-year high at 132.6 in February before the pandemic struck. This index signals a rocky economic recovery in the months ahead. It suggests that the recovery has shifted into a slower gear, as consumers become more cautious about the outlook as virus cases continue to escalate. Consumers have grown less optimistic about the short-term outlook for our economy and remain subdued about their financial prospects. Such uncertainty about the short-term future does not bode well for our recovery, nor for consumer spending. Thankfully, massive federal aid and other measures to prop-up our economy have helped stave off worse financial straits for millions of Americans already struggling to survive. More than 30 million people are receiving unemployment benefits. And hopes for a quick economic recovery from the coronavirus have been dashed by an explosion in new cases in Texas, California, Florida and other hotspots. Our economy will likely continue suffering regular ups and downs until the virus is brought under control or a vaccine is discovered.

Consumer confidence swooned in July amid a rash of new coronavirus cases in many states. The index of consumer confidence fell to 92.6 this month from a revised 98.3 in June, the Conference Board reports. The level of confidence is still above its pandemic low of 85.7, but it’s likely to be a long time before it returns to its pre-crisis peak. For example, the index stood near a 20-year high at 132.6 in February before the pandemic struck. This index signals a rocky economic recovery in the months ahead. It suggests that the recovery has shifted into a slower gear, as consumers become more cautious about the outlook as virus cases continue to escalate. Consumers have grown less optimistic about the short-term outlook for our economy and remain subdued about their financial prospects. Such uncertainty about the short-term future does not bode well for our recovery, nor for consumer spending. Thankfully, massive federal aid and other measures to prop-up our economy have helped stave off worse financial straits for millions of Americans already struggling to survive. More than 30 million people are receiving unemployment benefits. And hopes for a quick economic recovery from the coronavirus have been dashed by an explosion in new cases in Texas, California, Florida and other hotspots. Our economy will likely continue suffering regular ups and downs until the virus is brought under control or a vaccine is discovered.

Durable Goods.

Durable goods orders continued to recover in June, rising 7.3% on the heels of May’s 15.1% jump. The increase in orders in June was led by consumers buying automobiles and companies buying fabricated metal products. Orders for new cars and trucks leapt 86% last month as auto makers made up more lost ground after getting slammed early in the pandemic. On the other hand, aircraft manufacturers posted a whopping 462% decline in bookings. Boeing has seen demand for its planes dry up after a plunge in global travel during the coronavirus outbreak (see Boeing story below). That said, durable goods still have a long way to go to make up the massive declines in March and April, with overall orders remaining 16.0% below February. Fabricated metal products registered the largest improvement, up 4.5%, followed by primary metals (+3.6%), machinery (+2.7%), electrical equipment (+1.2%), and computers & electronic products (+0.1%). While computers and electronic products showed the smallest improvement in June, the category has been remarkably stable throughout the coronavirus contraction. Orders are up since February (pre-pandemic), probably reflecting extra computer equipment needed to help people work from home. But remember, while the second quarter was bad – terrible in fact – activity turned a corner in June and continues to recover. The third quarter (July, August & September), which we are roughly 1/3rd of the way through, is on track to see continued growth.

Durable goods orders continued to recover in June, rising 7.3% on the heels of May’s 15.1% jump. The increase in orders in June was led by consumers buying automobiles and companies buying fabricated metal products. Orders for new cars and trucks leapt 86% last month as auto makers made up more lost ground after getting slammed early in the pandemic. On the other hand, aircraft manufacturers posted a whopping 462% decline in bookings. Boeing has seen demand for its planes dry up after a plunge in global travel during the coronavirus outbreak (see Boeing story below). That said, durable goods still have a long way to go to make up the massive declines in March and April, with overall orders remaining 16.0% below February. Fabricated metal products registered the largest improvement, up 4.5%, followed by primary metals (+3.6%), machinery (+2.7%), electrical equipment (+1.2%), and computers & electronic products (+0.1%). While computers and electronic products showed the smallest improvement in June, the category has been remarkably stable throughout the coronavirus contraction. Orders are up since February (pre-pandemic), probably reflecting extra computer equipment needed to help people work from home. But remember, while the second quarter was bad – terrible in fact – activity turned a corner in June and continues to recover. The third quarter (July, August & September), which we are roughly 1/3rd of the way through, is on track to see continued growth.

Federal Reserve.

The Federal Open Market Committee left interest rates unchanged last week and noted that economic activity and jobs “have picked up somewhat in recent months” while pledging again to use its full range of tools to support further improvement. “Following sharp declines, economic activity and employment have picked up somewhat in recent months but remain well below their levels at the beginning of the year,” the Fed said in a statement after two days of talks. But economists are worried because the latest unofficial data suggests the U.S. economy is sagging again. In a unanimous decision, the Fed voted to keep its federal funds rates close to zero. The central bank again said it would keep rates near zero until employment recovers and inflation picks up. The central bank also kept the pace of asset purchase steady at $120 billion per month. The Fed is buying $80 billion of Treasurys and $40 billion of asset-backed mortgage securities to support the economy. Further, the Fed is expected to tie any future interest rate increase to higher inflation. Jerome Powell says the central bank will not consider raising short-term interest rates until inflation is seen rising above its 2% target. But many economists think the Fed has already informally adopted this approach.

The Federal Open Market Committee left interest rates unchanged last week and noted that economic activity and jobs “have picked up somewhat in recent months” while pledging again to use its full range of tools to support further improvement. “Following sharp declines, economic activity and employment have picked up somewhat in recent months but remain well below their levels at the beginning of the year,” the Fed said in a statement after two days of talks. But economists are worried because the latest unofficial data suggests the U.S. economy is sagging again. In a unanimous decision, the Fed voted to keep its federal funds rates close to zero. The central bank again said it would keep rates near zero until employment recovers and inflation picks up. The central bank also kept the pace of asset purchase steady at $120 billion per month. The Fed is buying $80 billion of Treasurys and $40 billion of asset-backed mortgage securities to support the economy. Further, the Fed is expected to tie any future interest rate increase to higher inflation. Jerome Powell says the central bank will not consider raising short-term interest rates until inflation is seen rising above its 2% target. But many economists think the Fed has already informally adopted this approach.

Weekly Jobless Claims.

The number of Americans who filed new claims for unemployment benefits last week totaled 1.434 million, the Labor Department reports as the pandemic continues to ravage our economy. It was the 19th straight week in which initial claims totaled at least 1 million. But more disappointing is the fact that it is the second consecutive week in which initial claims rose after declining for 15 straight weeks. “Continuing Claims” — which are composed of those receiving unemployment benefits for at least two straight weeks — rose by 867,000 to 17.018 million for the week ending July 18. (Data on continuing claims is delayed by one week.) Thus, the level of weekly claims remains shockingly elevated and the rise in continuing claims definitely reflects the re-closings over the past few weeks that we’ve seen in some states where the virus has flared-up. For example, initial claims filed in our own California totaled 249,007. California is among the states that have seen a resurgence in coronavirus cases as state officials eased quarantine and social distancing measures. The stark reality is our economic recovery will be bumpy and uneven until we have a vaccine where most of the world’s population can be mass inoculated.

Boeing.

If you think you’ve had a difficult time this pandemic, consider Boeing. The airplane manufacturer lost $2.4 billion during the last quarter and has laid off 35,000 workers this year. Ouch, that would give anyone air sickness. But the news only gets worse from here, so fasten your seat belt because this is going to be very bumpy! Boeing’s revenues fell 25% to $11.81 billion from $15.75 billion a year earlier, and their shares fell to $166.01, down more than 50% over the past year. The commercial aircraft unit suffered the most with a 65% drop in revenue from a year earlier to $1.6 billion as deliveries of new planes crashed. Add all of that to their beleaguered 737 Max program. If you remember, Boeing was in crisis before the coronavirus because of the fallout from two fatal crashes of its 737 Max that claimed 346 lives. The resulting lengthy grounding of the 737 Max, along with the financial pain of airlines, has driven up cancellations and scared off new orders for new Boeing jetliners this year. The company only booked a single order in June and suffered nearly 200 cancellations! Worse, Boeing has more than 470 planes sitting on the tarmac that haven’t been delivered to customers, most of them 737 Max jets (that may never be delivered). And if all of that weren’t bad enough, Boeing is also ending production of its legendary 747, a plane that has been its primary money-maker for more than five decades and is credited with spurring the boom in travel worldwide. International demand has been particularly soft, hurting the outlook for Boeing’s widebody commercial planes, like the 787 Dreamliner. Boeing expects turbulence ahead as demand for new aircraft won’t return until the second half of next year, depending on the timing of a coronavirus vaccine. The International Air Transport Association, a trade group that represents most of the world’s airlines, says it does not expect global passenger air travel to take-off again until 2024. (Question: Did I incorporate enough aeronautical terms in this story?)

If you think you’ve had a difficult time this pandemic, consider Boeing. The airplane manufacturer lost $2.4 billion during the last quarter and has laid off 35,000 workers this year. Ouch, that would give anyone air sickness. But the news only gets worse from here, so fasten your seat belt because this is going to be very bumpy! Boeing’s revenues fell 25% to $11.81 billion from $15.75 billion a year earlier, and their shares fell to $166.01, down more than 50% over the past year. The commercial aircraft unit suffered the most with a 65% drop in revenue from a year earlier to $1.6 billion as deliveries of new planes crashed. Add all of that to their beleaguered 737 Max program. If you remember, Boeing was in crisis before the coronavirus because of the fallout from two fatal crashes of its 737 Max that claimed 346 lives. The resulting lengthy grounding of the 737 Max, along with the financial pain of airlines, has driven up cancellations and scared off new orders for new Boeing jetliners this year. The company only booked a single order in June and suffered nearly 200 cancellations! Worse, Boeing has more than 470 planes sitting on the tarmac that haven’t been delivered to customers, most of them 737 Max jets (that may never be delivered). And if all of that weren’t bad enough, Boeing is also ending production of its legendary 747, a plane that has been its primary money-maker for more than five decades and is credited with spurring the boom in travel worldwide. International demand has been particularly soft, hurting the outlook for Boeing’s widebody commercial planes, like the 787 Dreamliner. Boeing expects turbulence ahead as demand for new aircraft won’t return until the second half of next year, depending on the timing of a coronavirus vaccine. The International Air Transport Association, a trade group that represents most of the world’s airlines, says it does not expect global passenger air travel to take-off again until 2024. (Question: Did I incorporate enough aeronautical terms in this story?)

Monday Morning Quarterback.

Congress is currently debating a second stimulus package to help American families through the pandemic. The issue now is whether the $600 weekly unemployment benefits should be continued, slashed, or worse, discontinued. Some argue that paying laid-off workers $600 exceeds what they received in salary thereby discouraging them from returning to work. But that argument is specious for several reasons.

First, do you know anybody that is actually refusing to return to work because they are receiving $600 a week staying home? Didn’t think so. As any attorney will tell you, there is always anecdotal evidence to support any argument, but even this is far-fetched (particularly in California). I’m sure there is somebody somewhere relaxing right now on a chaise lounge sipping a pina colada because they’re receiving $600 a week? But really, for the millions and millions of unemployed American workers that weekly $600 is crucial to their survival (plus it injects money into our economy).

First, do you know anybody that is actually refusing to return to work because they are receiving $600 a week staying home? Didn’t think so. As any attorney will tell you, there is always anecdotal evidence to support any argument, but even this is far-fetched (particularly in California). I’m sure there is somebody somewhere relaxing right now on a chaise lounge sipping a pina colada because they’re receiving $600 a week? But really, for the millions and millions of unemployed American workers that weekly $600 is crucial to their survival (plus it injects money into our economy).

Second, whenever their opposition to the $600 weekly benefits is questioned, Senators proudly point to a May article in Barron’s entitled “$600 Unemployment Benefits are Keeping People from Returning to Work.” But that title is terribly misleading and a gross distortion of the facts. The source for the article is the Federal Reserve’s May Beige Book. But the Beige Book says nothing like that. The Beige Book actually cited three distinct reservations raised by reluctant workers, not just unemployment benefits. The Beige Book explained that workers were more fearful of returning to work for health concerns during a pandemic (getting infected at work) and the lack of child-care (while schools are closed) than losing the $600 weekly checks. The Federal Reserve of Philadelphia reported similar findings among its contacts, including the fear of infection (if they returned to work) and lack of child-care as the primary reasons for not returning to work, not the $600 unemployment benefits. The Federal Bank of Chicago’s survey went even further and found that unemployed workers (receiving $600 weekly benefits) searched for work more aggressively than those whose benefits expired or who have not received them at all. The study also found that once individuals exhausted their benefits their search efforts dropped precipitously. That would indicate that unemployment benefits enhance the desire to return to work rather than discourage it.

Third, the above findings make sense when you consider the hard numbers. $600 a week for 52 weeks is $31,200 per year. Over 98% of American workers earn more than $31,200 per year. So why would any worker in their right mind refuse to return to work (and get paid more) rather than staying home and receiving $600 each week ($31,200 for one year)? Even if you add additional state benefits, people can still earn more if they return to work. For example, the median income is California is $71,000 and 98% of workers earn more than $31,200 per year. Does anyone truly believe that workers are content staying home (with $600 per week) and not want to return to work and earn more? Does a worker really want to reject a stable job opportunity rather than receiving $600 a week that they know is only temporary? That simply defies logic.

Third, the above findings make sense when you consider the hard numbers. $600 a week for 52 weeks is $31,200 per year. Over 98% of American workers earn more than $31,200 per year. So why would any worker in their right mind refuse to return to work (and get paid more) rather than staying home and receiving $600 each week ($31,200 for one year)? Even if you add additional state benefits, people can still earn more if they return to work. For example, the median income is California is $71,000 and 98% of workers earn more than $31,200 per year. Does anyone truly believe that workers are content staying home (with $600 per week) and not want to return to work and earn more? Does a worker really want to reject a stable job opportunity rather than receiving $600 a week that they know is only temporary? That simply defies logic.

Bottom Line: Over 30 million unemployed American workers are dependent on that weekly $600 check to feed their families, pay their rent and utilities, purchase medical supplies, and buy the necessities of life during the pandemic. And all of that consumer spending is the very lifeblood of our economy. Continuing these weekly unemployment benefits is a much more efficient way to pump money into our economy. So the imperative is for Congress to pass the second stimulus bill as quickly as possible and help American families survive and preserve our entire economy, rather than punishing them by cutting unemployment relief.

LAREIC Monthly Meetings.

As you know, we canceled our April through August meetings due to the pandemic, and now we must cancel all meetings until the end of the year (or the coast is clear). Our home at the Olympic Collection also remains closed. And, no, we’re not doing Zoom (for now). When California (and/or Los Angeles) terminate all restrictions, we will resume our monthly general meetings, Gold meetings, and real estate seminars. In the interim, thank you in advance for your understanding and for being a valued member and friend of LAREIC. We will keep you updated as the situation evolves and look forward to resuming activities as soon as we safely can. Please register on our website, www.LAREIC.com, for further updates.

As you know, we canceled our April through August meetings due to the pandemic, and now we must cancel all meetings until the end of the year (or the coast is clear). Our home at the Olympic Collection also remains closed. And, no, we’re not doing Zoom (for now). When California (and/or Los Angeles) terminate all restrictions, we will resume our monthly general meetings, Gold meetings, and real estate seminars. In the interim, thank you in advance for your understanding and for being a valued member and friend of LAREIC. We will keep you updated as the situation evolves and look forward to resuming activities as soon as we safely can. Please register on our website, www.LAREIC.com, for further updates.

Annual Los Angeles Real Estate Grand Expo.

Our annual Grand Expo is the largest and most exciting real estate event in Southern California. Last year we had 14 national speakers, 64 vendors, and over 800 investors and real estate professionals attending! (The Grand Expo is a joint production of the Los Angeles Real Estate Investors Club, Realty 411, and Sam’s Club). We originally scheduled this year’s Grand Expo for September 26, moving from the Olympic Collection to UCLA (to accommodate the huge crowds). But because of the pandemic, we were forced to postpone until November 14. We received word from UCLA that their entire campus is closing down until the end of the year. So we have officially moved our Grand Expo to Saturday, January 30, 2021. To get the latest updates, please register at www.LAGrandExpo.com.

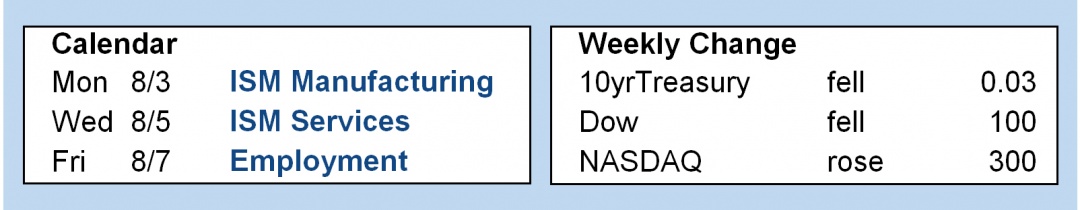

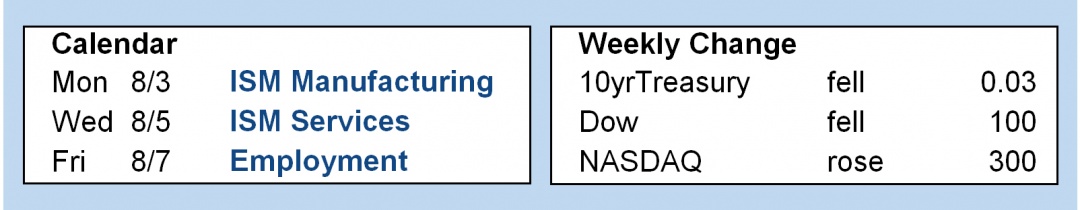

This Week.

Looking ahead, investors will continue watching for news about medical advances, vaccine development, government stimulus programs, Fed monetary policy changes, and plans for reopening (or re-closing) our economy. Beyond that, the ISM national manufacturing index will be released today and the ISM national services index on Wednesday (8/05). But clearly the highlight of this week will be the monthly Employment report to be released this Friday (8/07). This data on the number of jobs, the unemployment rate, and wage inflation will be the most highly anticipated economic data of the month.

For further information, comments, and questions:

For further information, comments, and questions:

Lloyd Segal

President

Los Angeles Real Estate Investors Club

www.LAREIC.com

[email protected]

310-409-8310

Image by Nattanan Kanchanaprat from Pixabay

Image by Nattanan Kanchanaprat from Pixabay