What Lies Ahead for Real Estate and the Lending Market in the Coming Months

By Edward Brown

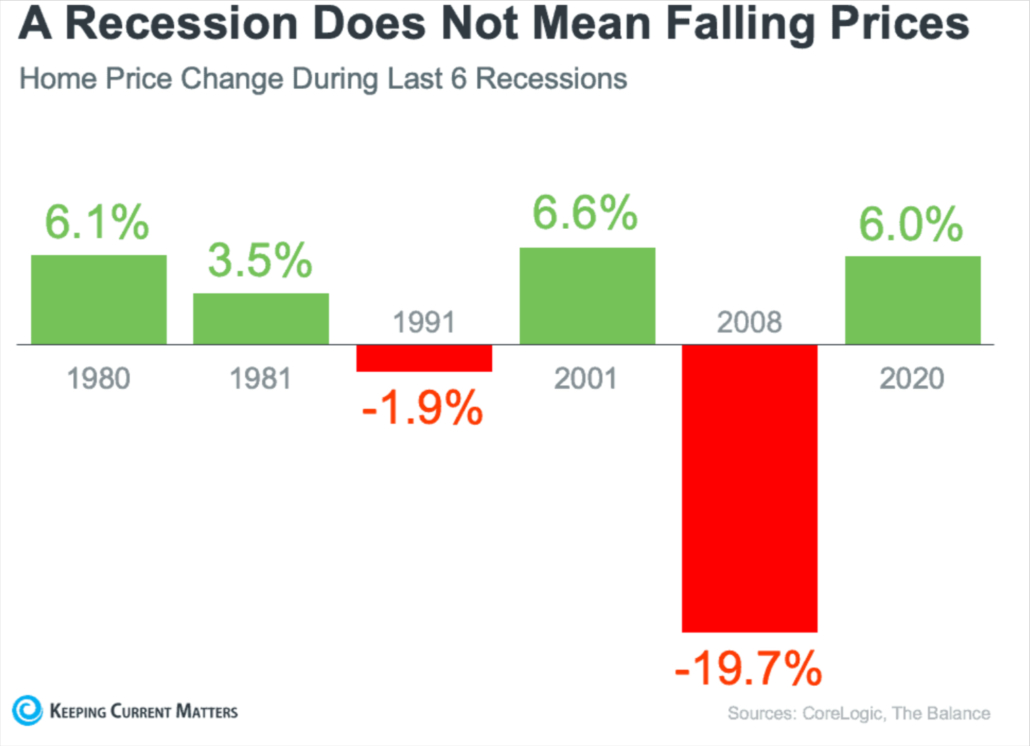

Many fear a recession looming in the coming months that will negatively affect real estate prices. In a typical recession, house prices usually drop. According to the Joint Center for Housing Studies at Harvard University, housing prices dropped in four out of five recessions that have occurred since 1980. During those recessions, house prices dipped on average about 5% for each year the economy remained down; However, in the Great Recession in 2008, the average price dropped by nearly 13%.

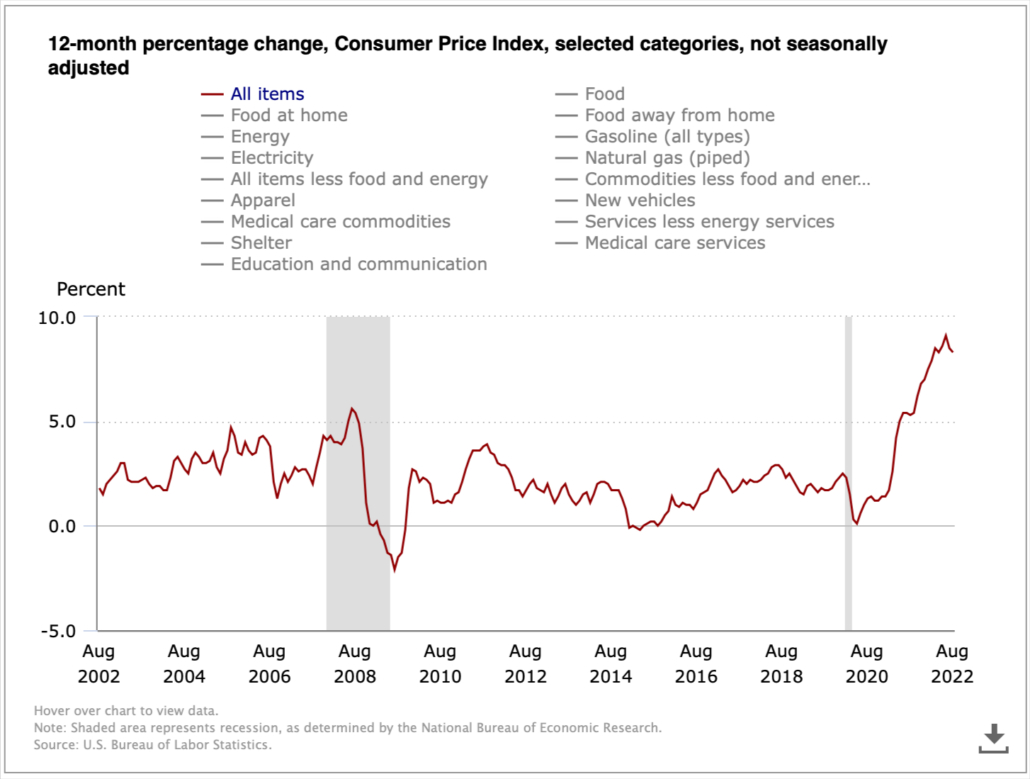

During the recession of 1980, inflation started to skyrocket, much like we have been experiencing in this past 12 months. However, there are vast differences between the recession of 1980 and the possible one to come. First, the population in the United States in 1980 was just over 226.5 million people. Today, there are over 333 million people according to the US Census Bureau. Everybody needs a place to live, and supply has not kept up with demand. Many cities have dissuaded builders by imposing large fees as well as taking too long to issue permits. This could be due to downsizing of government staff, but another phenomenon that was not as prevalent in 1980 as compared to today is that neighbors have a lot more say in what goes in their neighborhood. When there are too many roadblocks, many builders shift to fix and flip.

In addition, there is still a large supply chain issue left over from Covid. Also, costs of materials and labor has substantially increased. Lastly, finding qualified trade workers has been quite a challenge for builders.

ADVERTISEMENT

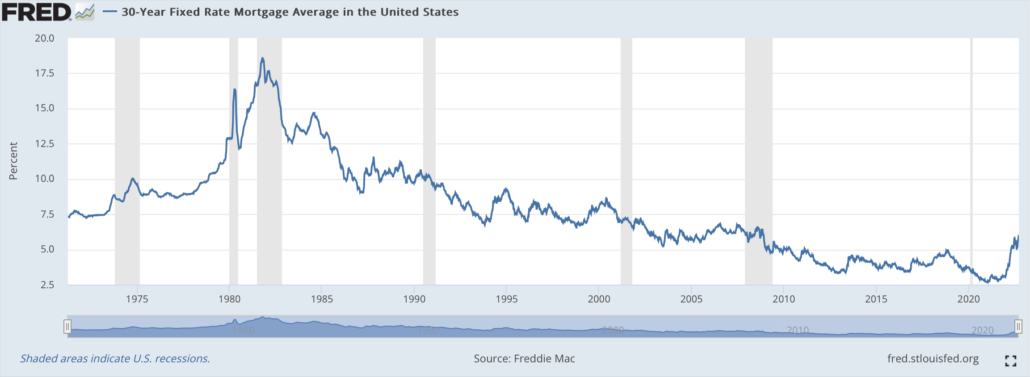

One of the major differences in the early 1980s as compared to today is the interest rate on mortgages. By 1981, mortgage rates were as high as 19%. Although current rates at 6% seem incredibly high [since they bottomed out in the 2+% range during Covid], they are still less than a third of what they were in 1981. It is true that house prices have substantially increased since 1981, but so have wages.

Some factors that affect the demand side of home purchases are that millennials are coming into the market in droves. These same millennials

witnessed their parents’ difficulties during the Great Recession, but enough time has passed, and millennials are now in positions of starting families as well as becoming a strong impact in the workforce.

Probably one of the most overlooked area of why demand should at least come close to supply [to keep residential real estate prices relatively stable] is that there were millions of homeowners who refinanced when rates were very low. These homeowners will not be able to replace their current mortgage rate for the foreseeable future.

Thus, there has to be a compelling reason for these people to sell their house. Currently, the Fed is trying to tame inflation by raising interest rates. This has started to work, albeit slow and not strong enough. Anyone buying groceries will say that true inflation is closer to 15% rather than the 6% the government is touting.

Raising the interest rates usually causes a recession, as costs of production are impacted. If a recession then causes interest rates to decline [due to lack of demand and falling inflation], we may see the refinance market pick up again and more mobility of home buyers driving up demand again. So far, there has been a slowdown in sales volume. This, in combination with slower refinances, has caused many mortgage companies to lay off workers. For the private lending industry, this should cause volume to move in their direction.

ADVERTISEMENT

Private lending use to be the last resort for many borrowers, as the costs were higher for these borrowers; however, with the smaller pool of lenders due to the layoffs as well as mainstream banks making it harder for borrowers to qualify due to the uncertainty of the economy, private lenders have moved up the chain with regard to the choice of lenders for those needing to borrow. In addition, we may likely see more bank regulations due to the downfall of Silicon Valley Bank and Signature Bank.

The Fed wants to exude stability in the market, so they will probably clamp down on what banks are allowed to lend on as we saw the Great Recession produce new regulations via Dodd-Frank.

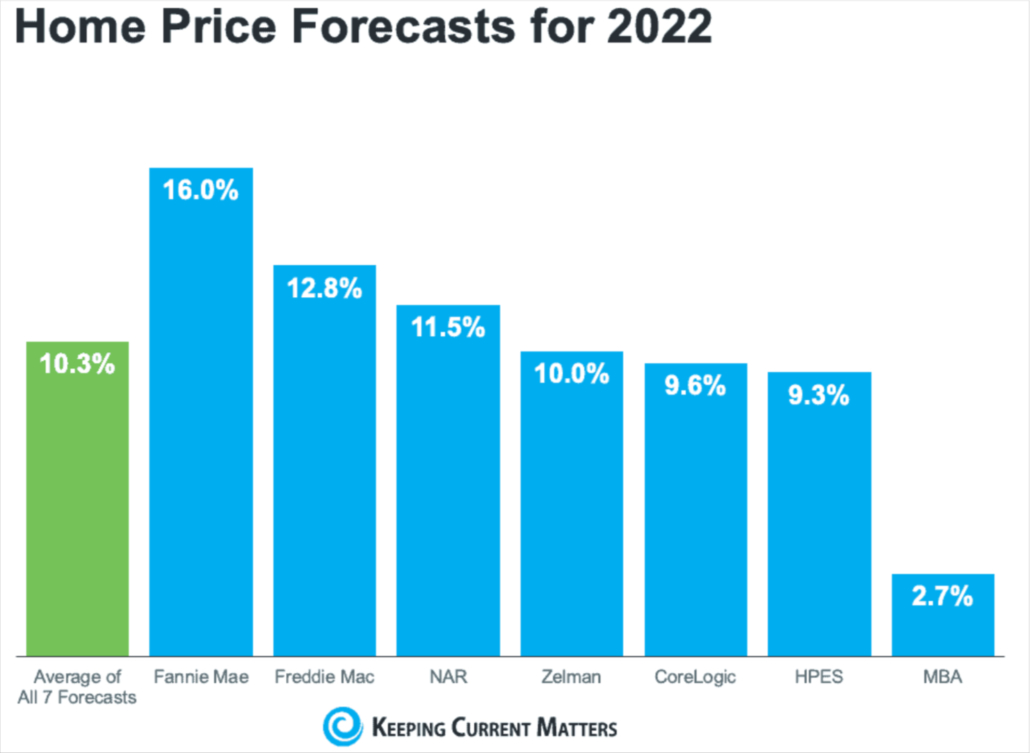

There may be a drop in real estate prices over the coming months, but it most likely will not be what we saw in the Great Recession, as that was a credit issue, where the banks were too lax in giving loans to borrowers who may not have had the income to repay. Current regulations make lending much stricter, so borrowers have to show the ability to repay the loan. Thus, even a coming recession should not see a tremendous drop in real estate prices.

ABOUT EDWARD BROWN

Edward Brown currently hosts two radio shows, The Best of Investing and Sports Econ 101. He is also in the Investor Relations department for Pacific Private Money, a private real estate lending company.

Additionally, Edward has published many articles in various financial magazines as well as been an expert on CNN, in addition to appearing as an expert witness and consultant in cases involving investments and analysis of financial statements and tax returns.

Edward Brown, Host

The Best of Investing on KTRB 860AM

The Answer on Saturdays at 8pm

and Sports Econ 101 on Saturdays

at 1pm on SiriusXM channel 217

21 Pepper Way

San Rafael, CA 94901

[email protected]

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411Expo.com or our Eventbrite landing page, CLICK HERE.

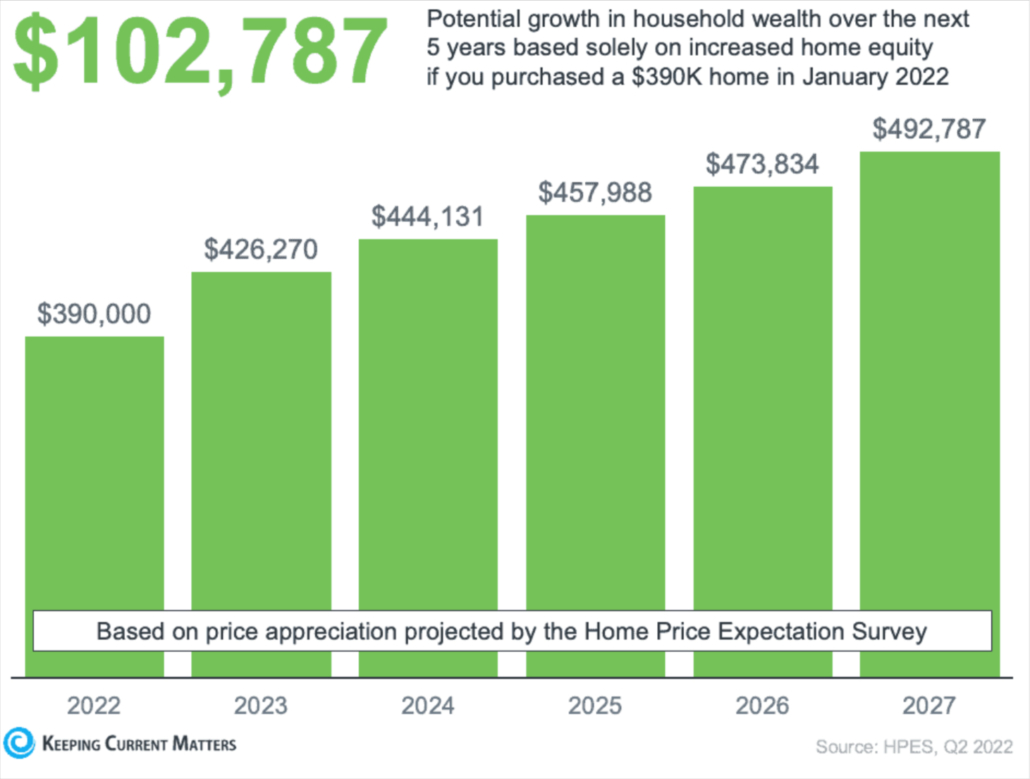

To lessen the risk of any big swing in the market, the answer is to diversify your investment portfolio so all your eggs aren’t in one basket. The problem many individuals faced in 2008 was that most of their 401k or other retirement accounts were tied up in stocks and mutual funds. When the market tanked, so did their accounts. Now imagine if half of those funds were diversified into buy and hold real estate. For many, the outcome could have been vastly different. Here’s why.

To lessen the risk of any big swing in the market, the answer is to diversify your investment portfolio so all your eggs aren’t in one basket. The problem many individuals faced in 2008 was that most of their 401k or other retirement accounts were tied up in stocks and mutual funds. When the market tanked, so did their accounts. Now imagine if half of those funds were diversified into buy and hold real estate. For many, the outcome could have been vastly different. Here’s why.

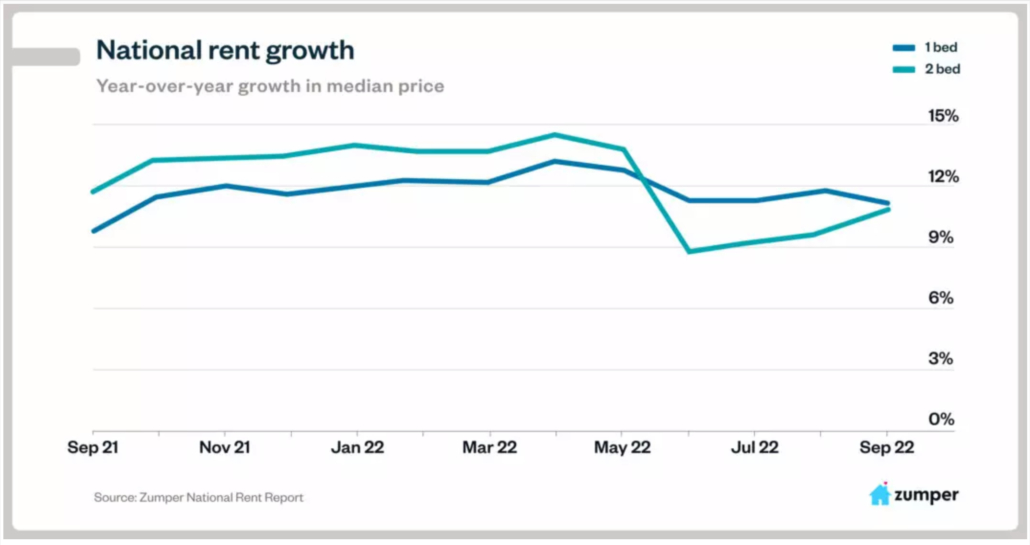

Something else to consider is how you are using the power of inflation to your advantage. Most 401k plans aren’t able to keep up with inflation. With the small returns and high managements fees, unless you are able to invest a lot in those funds, you may not even be able to keep up with the rate of inflation. However, with rental property, you are working with inflation to win in two ways. First, your mortgage payment doesn’t change. Let’s say when you purchased the property it was a $500 per month payment. If the market tanks, it’s still a $500 payment on a fixed rate loan. If the market is great, same payment. When the market is doing well, your asset, if all goes as planned, is increasing in value. You’re actually earning value on the asset while effectively reducing the value of the money you’re paying due to inflation. Second, you will likely be able to increase the rental amount between 1%-5% per year. That’s additional cash flow and value you will be receiving yearly.

Something else to consider is how you are using the power of inflation to your advantage. Most 401k plans aren’t able to keep up with inflation. With the small returns and high managements fees, unless you are able to invest a lot in those funds, you may not even be able to keep up with the rate of inflation. However, with rental property, you are working with inflation to win in two ways. First, your mortgage payment doesn’t change. Let’s say when you purchased the property it was a $500 per month payment. If the market tanks, it’s still a $500 payment on a fixed rate loan. If the market is great, same payment. When the market is doing well, your asset, if all goes as planned, is increasing in value. You’re actually earning value on the asset while effectively reducing the value of the money you’re paying due to inflation. Second, you will likely be able to increase the rental amount between 1%-5% per year. That’s additional cash flow and value you will be receiving yearly.