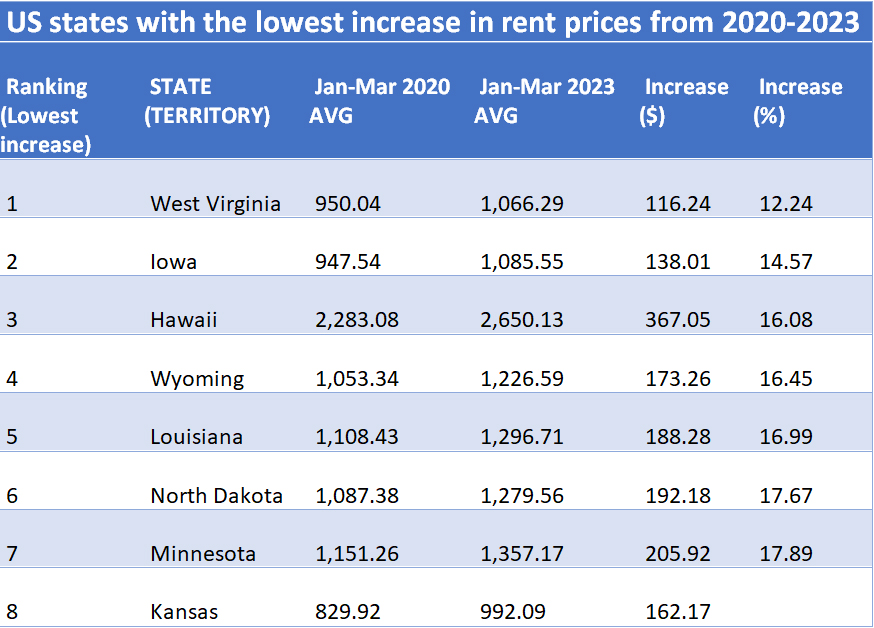

New Data Reveals the Most and Least Affordable US States for Renters

- West Virginia has seen the smallest increase in rent prices over the past three years

- Colorado cities have seen the biggest increase in rent prices over the past three years.

- Iowa has seen the second smallest increase in rents prices

Research reveals that West Virginia has seen the smallest increase in rent prices over the past three years. Colorado is the state where major metropolitan areas are the most expensive for renters as of 2023.

Moving Companies Experts MovingFeedback analysed data from Zillow.com to reveal the US states whose major metropolitan statistical areas (MSA) have seen the lowest/highest increase in average rent prices over the past three years.

ADVERTISEMENT

West Virginia has seen the lowest percentage rise in rent prices since 2020 of only 12%. In the first three months of 2020, the average rent price in WV was $950.54, compared to an average of $1,066.29 across January, February and March in 2023. This is a 4.5 times smaller decrease than the state with the largest increase, Colorado.

Coming in second is Iowa with a 15% increase in rent prices in just three years. Renters in MSAs were paying on average $947.54 between January and March 2020 and are now paying $1,085.55; a $138.01 increase.

Hawaii ranks as the state who’s major MSAs had the third smallest increase in average prices for renters. In the first three months of 2020, rent prices were $2,283.08. The state has seen a $367.05 increase in price, to an average of $2,650.13 between January and March 2023.

In fourth position is Wyoming where renters have experienced an average 16.45% increase in prices. An increase of $173.26 can be seen in this state over the past three years.

Louisiana places as having the fifth largest increase in rent, going from $1,108.43 in early 2020, to $1,226.59 in 2023; a 17% increase over the three-year period.

In sixth position is North Dakota where the major MSAs’ average rent price has increased from $1,087.38 to $1,296.56, coming in just below Louisiana with a 17.67% increase.

Coming in seventh is Minnesota with a 17.89% increase in rent prices over the past three years. Renters are now paying $1,151.26 compared to $1,357.17 in 2020.

ADVERTISEMENT

Kansas is the state with the eighth highest increase in rent prices of 19.54%.

In ninth position is Wisconsin where renters are paying on average $935.81; a $1,133.63 increase compared to 2020.

Massachusetts places tenth in the rankings with a rent percentage increase over the past three years of 21.48%.

Colorado has been named the most expensive US state for renters in its major metropolitan areas. The state has seen the biggest increase in rent prices over the past three years of 54%. In the first three months of 2020, the average rent price in MSAs in the state was $2,439.56, compared to an average of $3,757.93 across January, February and March in 2023. This is a 4.5 times larger increase than the state with the smallest increase, West Virginia.

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411Expo.com or our Eventbrite landing page, CLICK HERE.