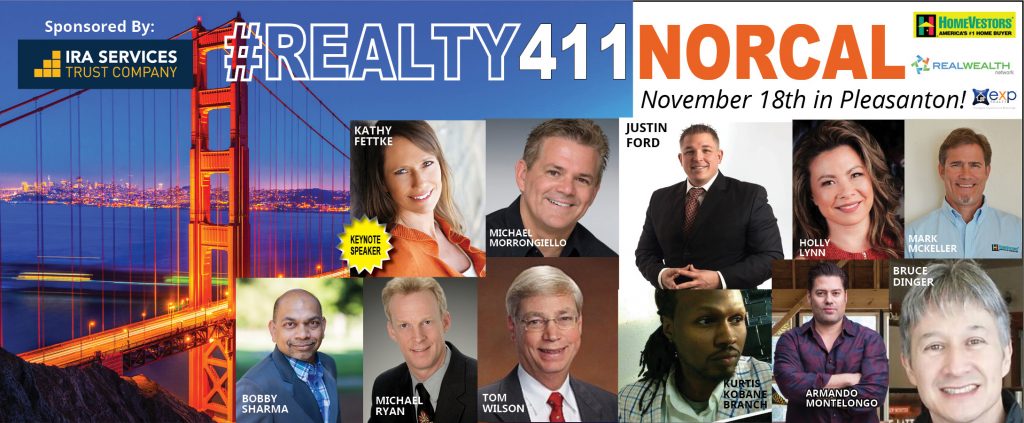

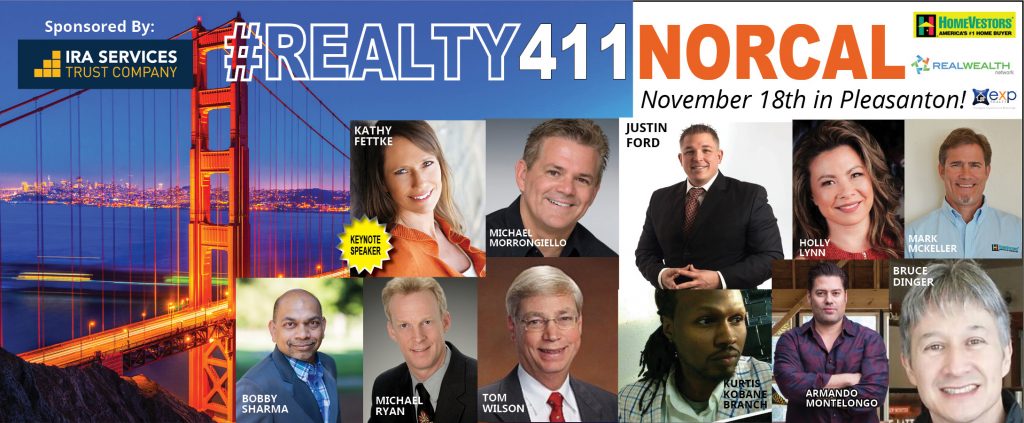

Don’t Miss this Informative, Educational Cash-flow Conference!

Realty411 expos are created and hosted by a California accredited investor with 24 years experience in print journalism. Realty411’s publisher has owned property and invested in California since 1993 and is an active accredited investor with numerous both in-state and out-of-state rental properties.

We are already successful real estate entrepreneurs and antique dealers based in Santa Barbara County (known as the “American Riviera”). Our complimentary expos and magazines were designed to assist and empower others to also growth wealth with real estate. We also believe in diversification and enjoy learning other investing options. We own multiple businesses as well.

Our expo offers FREE ADMISSION, plus join us early for your BONUS TICKET for complimentary coffee, pastries and Mediterranean appetizers! We like to have fun too.

NO SALES – LEAVE YOUR WALLET AT HOME – FREE PARKING

Learn How to Profit in this NEW Economy with Real Estate and Personal Finance Strategies to Position You for Wealth!

DATE:

Saturday, November 18th

EXPO TIME:

9 am to 5 pm

LOCATION:

Four Points Pleasanton

5115 Hopyard Rd, Pleasanton, CA 94588

—- SPONSORED BY IRA SERVICES TRUST COMPANY —-

>> Learn from HomeVestors, We Buy Ugly Houses – America’s #1 Home Buyer in the Nation. They have purchased 75,000 homes in total thus far!

>> Meet Michael Ryan, Your Local Mortgage Leader and How He Can Help you Build Your Portfolio

>> Find Out How to Buy Fantastic A+ Class Property with as LIttle as $50K

>> Find Out Why Diversification is So Important – Learn How to Build MSI (Multiple Streams of Income)

>> Learn FOREX – the Largest Economy in the World, which Trades Trillions of Dollars PER DAY!!

>Meet a Real Estate Broker who is adding Trading Into His Life and Portfolio.

>>Find Out Why, How and Where He Trades – Don’t miss this inspirational presentation

>> Learn About Self-Directing Your IRA Services Trust Company and so much more!

> FIND THE FUNDS YOU NEED FOR YOUR REAL ESTATE DEALS, BUSINESS EXPANSION,

PLUS LEARN MULTIPLE STREAMS OF INCOME AT THIS EXCITING AND UNIQUE EVENT – AS SEEN IN ALL THE LOCAL MEDIA – SINCE 2007, REALTY411 HAS PRODUCED COMPLIMENTARY EXPOS AND PUBLICATIONS – OUR MISSION IS TO INCREASE FINANCIAL EDUCATION AND HELP AS MANY PEOPLE AS POSSIBLE INVEST IN REAL ESTATE TO IMPROVE THEIR RETIREMENT!

TICKETS TO AN EVENT OF THIS CALIBER NORMALLY SELL FOR HUNDREDS OF DOLLARS.

BE SURE TO TAKE ADVANTAGE OF THIS OPPORTUNITY. WE ARE THE “ORIGINAL” REALTY INVESTOR MAGAZINE!

COMPLIMENTARY NETWORKING BREAKFAST MIXER AND APPETIZERS IN THE AFTERNOON FOR OUR BREAKS!

NETWORK WITH EXHIBITORS, COMPANIES, REAL ESTATE GROUPS, CLUBS, AND SERVICE PROFESSIONALS – THIS IS THE PLACE TO BE!

* Mingle with Companies * Meet Local Leaders & Out of Area Investors * NON-Stop Tips for Real Estate Success

We Want & Can Help YOU Succeed As We Have. Bring Lots of Cards.

Mingle with Local Leaders & Industry Professionals from Around the Nation!

Hosted by Realty411 – Publisher of National Real Estate Magazines

Influential Real Estate People & Business Owners Attending!

MEET THE REI DIRECTORS FROM NORTHERN CALIFORNIA HERE!

Find Potential Partners, New Friends, Build Your Circle of Influence.

Remember Your Net Worth = Your Network

* Celebrate Real Estate in Your Market!

Our discussions cover a wide range of topics:Commercial & Residential Real Estate * Private Lending * Raising Capital * Networking Tips to Grow Your Influence * Strategies to Increase ROI * Gain Perspectives on TOP Local & National HOT Markets * Fix & Flips * Buy and Hold + Wholesaling, Notes & More… We have investors joining us from many states!

YOUR NET WORTH IS EQUAL TO YOUR NETWORK

We are hosting this event to help increase your contacts

and to further your potential in this industry, so don’t miss out!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Learn Investor Tips to WIN in Real Estate in 2017 at this Event, Join Us!

Learn Investor Tips to WIN in Real Estate in 2017 at this Event, Join Us!

No matter what, please mark your calendar so you don’t miss out on this fantastic real estate and finance expo. Our goal is to provide fantastic resources to help you learn about real estate or grow as an investor. We know your time is valuable, so we have wonderful books, magazines, and other gifts to give away.

Build NEW friendships and business collaborations with some of the industry’s TOP Leaders. Plus, guests will discover new resources to FUND deals. Joining us are incredible speakers, sophisticated investors, & VIP Industry Leaders.

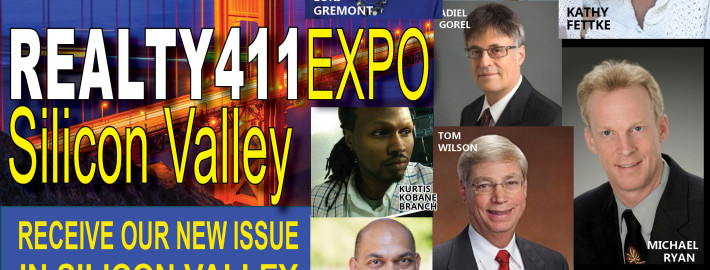

LIVE AND JOINING US FROM CALIFORNIA… KATHY FETTKE WITH REAL WEALTH NETWORK!

Kathy Fettke is Co-CEO of Real Wealth Network and best selling author of Retire Rich with Rentals. She is an active real estate investor, licensed real estate agent, and former mortgage broker, specializing in helping people build multi-million dollar real estate portfolios that generate passive monthly cash flow for life.

With a passion for researching real estate market cycles, Kathy is a frequent guest expert on CNN, CNBC, Fox, Bloomberg, NPR, CBS MarketWatch and the Wall Street Journal. She was also named among the “Top 100 Most Intriguing Entrepreneurs” by Goldman Sachs two years in a row.

Kathy hosts two podcasts, The Real Wealth Show and Real Estate News for Investors — both top ten podcasts on iTunes with listeners in 27 different countries. Her company, Real Wealth Network, offers free resources and cutting edge education for beginning and experienced real estate investors. Kathy is passionate about teaching others how to create “real wealth,” which she defines as having both the time and the money to live life on your terms.

DISCOVER TAX LIEN CERTIFICATES WITH AMERICA’S #1 AUTHORITY ON THE TOPIC: MR. TED THOMAS!

Ted Thomas is America´s tax lien certificate investing and tax deed authority and an international speaker who has dedicated himself to finding and teaching the best investment strategies that can create wealth with minimum risk and easy to learn, that can help everyone including senior citizens and young people, and that’s why he chose Tax Lien Certificate and Tax Deed investing because it is Predictable, Certain and Secure.

Ted has developed in-depth training programs that show you step-by-step how to profit from tax lien certificates and tax deeds. Don’t miss this fantastic presentation at our event. Invest one day in your education and discover profitable new niches in real estate that may change your life.

Investing in Cash Flow – Doing Well by Doing Good

Topstone Investment, LLC (“Topstone”) started in 2013 with two clear objectives – Do Well by Doing Good. At the core of our operations are the values associated with “social investing’. To us, it is more than simply ROI, it is a holistic approach to solving and tackling issues often encountered in the inner city.

The company’s founders found a niche in buying, rehabbing and renting out Section 8 Properties in the Midwest (Kansas City, MO and Saint Louis, MO) markets. Since 2013 the company has acquired over 310 single family residences and rehabbed many to provide the residents with a clean, safe, upgraded home that they can live in. Topstone has acquired a large volume of homes such that certain neighborhoods have improved significantly. Residents are thrilled to be living in a ‘new, fixed up home’ where the property management team actually listens to them.

We work closely with the local Section 8 Housing Authorities to provide families with homes in which the residents can safely raise their families. In return, we have had very low turn over compared to other Section 8 operators and that in turn results in greater cash flow for our company and our investors.

Since 2013, Topstone has expanded into several new markets and has built a ‘local team’ in each of the new markets. We currently offer investment opportunities to investors that are looking for solid passive returns on their funds.

Meet Bobby Sharma – Partner, Chief Technology Officer

Bobby Sharma has had success with Silicon Valley startups and technology companies. Mr. Sharma brings years of Silicon Valley technology experience to help the company scale its operations and communications with investors. Mr. Sharma has helped implement tools to allow for better tracking of properties, rehabbing, leasing, payments, etc. Mr. Sharma has also built a platform to provide investors with greater insights into new opportunities and tracking current investments.

LEARN AND MEET TOM K. WILSON, CEO OF WILSON INVESTMENT PROPERTIES

Tom K. Wilson began building his personal real estate portfolio in the 70’s. He first invested as a part-time activity, and then after thirty years managing manufacturing and engineering in some of Silicon Valley’s pioneering technology companies, he put his business and management experience toward full-time real estate investing. Mr. Wilson has bought and sold more than 3,500 units and over $250 million of real estate, including three condo conversion projects, nine syndications, and eight multifamily properties. He founded and owns Wilson Investment Properties, Inc., a company that has provided over 500 high cash flow, high-quality, rehabbed and leased residential properties to investors. Active in real estate associations, Mr. Wilson is a frequent speaker on real estate investing where his candor and competency makes him an audience favorite. As part of his outreach, Tom provides mentoring to new investors. His weekly radio show Real Estate Radio Power Investing provides extensive education on real estate investing.

Get Educated with Adiel Gorel, CEO, ICG – International Capital Group

Adiel Gorel is the CEO of ICG, a prominent real estate investment firm located in the San Francisco Bay Area. Since 1983 he has successfully been assisting thousands of investors with purchasing U.S. properties. Through ICG he has personally invested in hundreds of properties for his own portfolio and was involved in the purchase of over 5,500 properties for ICG’s investors in Phoenix, Las Vegas,Jacksonville, Orlando, Tampa, Dallas, Houston, San Antonio, Austin, Oklahoma City, Salt Lake City, to name just a few.

Mr. Gorel holds a master’s degree from Stanford University. His professional experience includes Management and Director Positions in firms including Hewlett- Packard, Excel Telecommunications, and Biotechnology firms.

LEARN WITH BRUCE DINGER – CEO OF KENNSEI TRADING

Bruce Dinger is many things; a serial entrepreneur, a professional trader, a real estate investor, a hedge fund manager, a public speaker, an educator. Most importantly, he is a wealth builder.

Bruce’s passion is to create generational wealth using multiple revenue streams, and his ethos is to impart his knowledge through mentorship programs and public speaking to others.

Michael Morrongiello – LOCAL LEADER, BAWB – “How to Create Cash Flow with Expensive NorCal Properties.”

Michael Morrongiello is an active investor who specializes in Real Estate & Real Estate “Paper” investments. Widely known as having one of the most knowledgeable & creative minds in the paper business, Michael started creating paper as a result of his own Real Estate investment activities in the early 1980’s. He is very active in the Buy/Sell renovation business of properties here in the SF Bay Area.

Michael is the author of; Paper into Cash – The Convertible Currency-the definitive home study course that assists you in structuring seller financed transactions while creating marketable Notes and The Unity of Real Estate and “paper” – a course book that outlines numerous real world in the marketplace transaction scenarios and solutions where Real Estate and financing techniques involving “paper” can be effectively used.

Michael is also the program director for BAWB- the Bay Area Wealth Builders Association- an educational support group for both the beginning and seasoned real estate investor.

Meet BILL WALSH – America’s Small Business Expert®

Bill Walsh a venture capitalist and is the CEO/Founder of the Success Education/Business Coaching firm Powerteam International. Bill hosts and speaks at events all over the world! His passion is to empower entrepreneurs and business owners to create massive success. He is the best selling author of the book “The Obvious”, is an amazing speaker, radio personality and movie celebrity. He has a very successful background in finance and marketing. He has spent over two decades working with start-ups to major global brands to help them increase sales, productivity and overall success. He is an innovator with a remarkable ability to determine and build success plans to help business owners seize immediate market opportunities.

For everyone that owns a business or would like to capitalize their entrepreneurial dream, his message will enlighten them with knowledge and action principles to turn that passion into success! Bill has an extensive background in foreign currency trading, real estate development and building businesses in more than 30 countries. Over the past two decades, his firm has specialized in helping companies launch, grow and create exponential valuation in the market.

In 2005, he formed his own company, Powerteam International to spread his message to a wider audience. Powerteam International provides Success Education programs around the world. The programs are designed for individuals, companies, and organizations that are interested in creating even more success. Bill is committed to raising the awareness of entrepreneurs, business owners and organizations world wide!

Bill is Sharing How to Build 7 Figure Business

Turn your passion into a Real Business

Sales and Marketing Automation

Time Management Secrets

How to generate 24/7 Income

How to Maximize Your Internet Marketing

Armando Montelongo, Star of “Flipping Nightmares” and former star of A&E’s “Flip This House” – Armando is the ORIGINAL real estate reality star, and is consistently ranked as one of the most successful Hispanics in business.

REHAB SECRETS WITH ARMANDO MONTELONGO FORMER STAR OF A&E’s “FLIP THIS HOUSE”

Armando Montelongo, Star of “Flipping Nightmares” and former star of A&E’s “Flip This House” – Armando is the ORIGINAL real estate reality star, and is consistently ranked as one of the most successful Hispanics in business.

The OG of house flipping, Armando Montelongo, is back with a new television show, new houses to flip and the same ‘don’t-give-a-#%&$!’ attitude that made him famous.

Armando first burst onto the scene in 2006 with a nearly three-year run on “Flip This House,” and then largely steered clear of television. He made a few appearances, including a 2015 episode of CBS’ “Undercover Boss,” and some others. Meet Armando IN PERSON at this event!

Learn with Justin Ford – Difference Maker, Champion, Entrepreneur, Leader, Visionary

From struggle to success, Justin Ford truly lives the saying “It’s not how to start but how you finish.” At the age of 19, with his life in disrepair, Justin made the critical decision to turn it all around. Now at the age of 34, Justin has become a successful Entrepreneur, Business Owner, Real Estate Broker, Investor, Motivational Speaker, TV talk show host, Author, and Mentor.

He has earned numerous achievement awards, and demonstrates daily that talent, drive and ambition really do lead to success. Justin also excels as an inspirational youth and marketplace speaker. People can feel his powerful presence when he walks into the room. He wants to make a difference, and he takes that responsibility extremely seriously. Justin’s passion and desire to see people rise to success leaves a lasting impact as he challenges all to become the champion they were created to be.

Justin lives in Metro Detroit with his wife and four children. The love and support of his family helps fuel his passion for success in all avenues that he pursues. In his spare time, Justin loves to travel and donate his time to The Positive Zone Project Foundation, which empowers high school students through character education and leadership development, while providing tools for building successful lives.

Justin will introduce our guests to an amazing financial strategy: FOREX. Trading foreign currencies is a trillion-dollar a day industry and individuals, as well as insitutions and corporations are capitalizing on movement of currency. All trading can be done on your phone, 24 hours per day. Justin and his team are actively trading on FOREX with a company that has opened up the knowledge and access to trading to average, regular people without a traditional financial background.

Learn how to Implement a NEW Strategy into Your Portfolio and LIFE for FINANCIAL FREEDOM and to also diversify your holdings and knowledge. We never stop learning and growing and neither should you.

Here is more information about FOREX from Investopedia:

What Is Forex?

The foreign exchange market is the “place” where currencies are traded. Currencies are important to most people around the world, whether they realize it or not, because currencies need to be exchanged in order to conduct foreign trade and business. If you are living in the U.S. and want to buy cheese from France, either you or the company that you buy the cheese from has to pay the French for the cheese in euros (EUR). This means that the U.S. importer would have to exchange the equivalent value of U.S. dollars (USD) into euros. The same goes for traveling. A French tourist in Egypt can’t pay in euros to see the pyramids because it’s not the locally accepted currency. As such, the tourist has to exchange the euros for the local currency, in this case the Egyptian pound, at the current exchange rate.

The need to exchange currencies is the primary reason why the forex market is the largest, most liquid financial market in the world. It dwarfs other markets in size, even the stock market, with an average traded value of around U.S. $2,000 billion per day. (The total volume changes all the time, but as of August 2012, the Bank for International Settlements (BIS) reported that the forex market traded in excess of U.S. $4.9 trillion per day.)

One unique aspect of this international market is that there is no central marketplace for foreign exchange. Rather, currency trading is conducted electronically over-the-counter (OTC), which means that all transactions occur via computer networks between traders around the world, rather than on one centralized exchange. The market is open 24 hours a day, five and a half days a week, and currencies are traded worldwide in the major financial centers of London, New York, Tokyo, Zurich, Frankfurt, Hong Kong, Singapore, Paris and Sydney – across almost every time zone. This means that when the trading day in the U.S. ends, the forex market begins anew in Tokyo and Hong Kong. As such, the forex market can be extremely active any time of the day, with price quotes changing constantly.

Read more: Forex Tutorial: What is Forex Trading?

DON’T MISS THIS INCREDIBLE AND ACTION-PACKED DAY BROUGHT TO YOU BY REALTY411 MAGAZINE!

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

r. Teresa R. Martin, Esq. is the founder of Real Estate Investors Association of NYC (REIA NYC). REIA NYC (www.reianyc.org) is a premier real estate investment association serving the New York City marketplace. Its primary focus and mission is “helping our members build, preserve, and harvest multi-generational wealth” in the areas of real estate investments, business ownership and personal development.

r. Teresa R. Martin, Esq. is the founder of Real Estate Investors Association of NYC (REIA NYC). REIA NYC (www.reianyc.org) is a premier real estate investment association serving the New York City marketplace. Its primary focus and mission is “helping our members build, preserve, and harvest multi-generational wealth” in the areas of real estate investments, business ownership and personal development.

BY TIM HOUGHTEN – EXCLUSIVE REI WEALTH COVER FEATURE

BY TIM HOUGHTEN – EXCLUSIVE REI WEALTH COVER FEATURE