Partnering For Profits in High-Priced Markets

Image from Pixabay

By Bruce Kellogg

The Situation Today

A large number of real estate investors and would-be investors live in high-priced markets. Large cash downpayments are necessary to make a purchase, and even more cash is required to achieve a positive cashflow. This can be discouraging.

One alternative that many in this position consider is “Turnkey Investing”, usually in rental houses in distant locations with local real estate support. This involves locations, companies, persons, and properties that are not well-known or familiar, and which might, or might not, work out. For sure, the investor has only limited control over their investing fate. Then, if a problem arises, the investor has to jump in to right the situation to protect their investment. “Passive investing” this is not.Investing Locally With Partners

It is not necessary for an investor to send their money thousands of miles to unfamiliar people to invest for them in unfamiliar neighborhoods with properties of uncertain condition and rental prospects. It is definitely possible to invest locally in high-priced properties with a high degree of control by the use of partners.Three Kinds of Partners

Image from Pexels

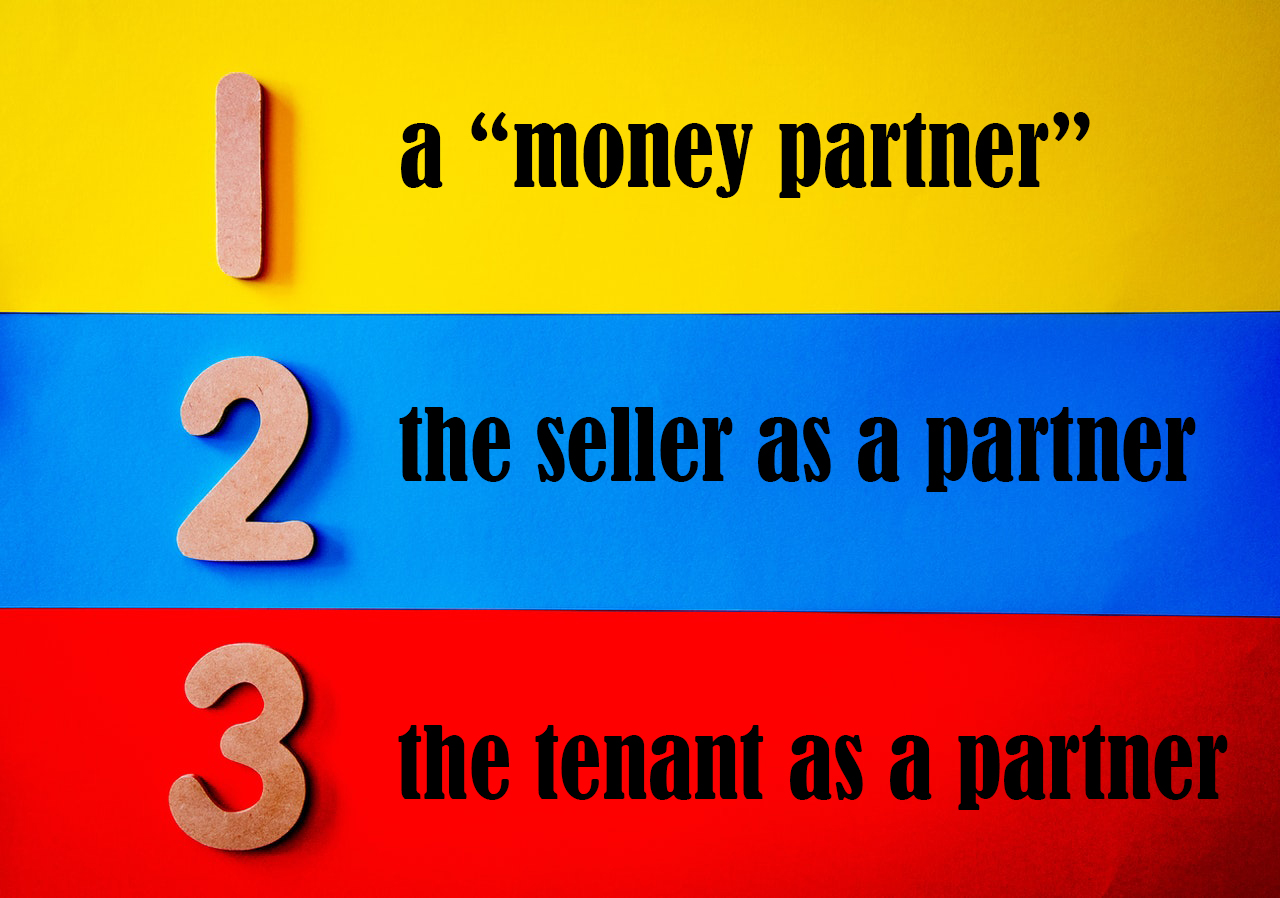

There are three kinds of partners: 1) a “money partner”, 2) the seller as a partner, and 3) the tenant as a partner. In each case, the approach is to set up the transaction so that the partner contributes in such a way that the investor profits, and the partner receives their benefit from the arrangement.Partnering With a “Money Partner”

The principle here is for the “money partner” to bring in the funds necessary to make the purchase and set up a reserve to ensure success. There are four investing structures that are attractive based on the interests of the parties: 1) Limited Partnership (LP) 2) Joint Venture (JV) 3) Tenants-in-Common (TIC) 4) Limited Liability Corporation (LLC) The partnership should be designed so that the “money partner” receives about an 8% annual cash return plus an “equity kicker” upon liquidation of the investment. The investor needs to provide for themselves, as well, even if it means profiting only at the end. Obviously, the better the deal, the more the investor will profit and be able to compensate the “money partner”. Investors are encouraged to use a real estate attorney to draw up customized documents for the partnership rather than doing it themselves “on the cheap” with internet “pdf. documents”. This is not a place to economize! (Hint: You can draw up internet documents, then have an attorney review them. That should save some money.)Image from Pexels

As an example, three brothers pooled their funds to purchase a 3-bedroom, 2-bath rental house in Hayward, near Oakland, in March, for an LLC that they had created. They put down $178,750 (25%) on a purchase price of $715,000, with a new 30-year first loan of $536,250 (75%) at 3.1%. They paid “market price”, but the house was being sold by a retiring corporate facilities manager for a national company who had maintained and upgraded it impeccably. They rented it out for $3,500/month in the Bay Area’s ultra-tight housing market. Their overall return is 2.7% on their downpayment, but since all three brothers are in the top federal and California income tax brackets, and “starter homes” in the Bay Area appreciate strongly, and will for the long term, the brothers will see a nice after-tax return.Partnering With The Seller

There are two major occasions of partnering with sellers. The first is when builder/developers or sophisticated investors enter into a joint venture with the owner of developable land. Typically, the owner contributes the land while the investor obtains the necessary financing, performs the construction, and does the marketing. Then the parties split the profit according to their joint-venture agreement. This is a sophisticated partnering method. The more accessible partnering method with an owner/seller of a property is to use a lease-option. Here, the buyer/”lessee” leases the property on agreed terms and simultaneously negotiates an option to purchase the property in the future at an agreed price and terms. Usually, the buyer/”optionee” pays some “option consideration” for the right to purchase during the term of the lease. This is paid either up-front or on top of the lease payment. It is important to keep the lease and the option separate but attached because judges in disputes have been known to interpret the documentation unfavorably to the investor. Advice from local real estate counsel is important initially when employing your first lease-option. On-line and Realtor® forms can be used, but an attorney should review the first one.Image from Pexels

Another accessible partnering method is to negotiate a “shared-appreciation mortgage” to be carried back by the seller as “owner financing”. The idea here is to structure the note such that positive cashflow to the investor is the result. The seller is usually given some cash flow, but not a lot. Then the seller participates in the profit when the property is eventually sold. This works well with motivated sellers in high-priced areas. Again, legal advice is recommended for the first time.Partnering With The Tenant

The first method where the tenant is essentially a partner is to use a lease-option, to sell this time, rather than to buy. The idea here is to use the lessee/optionee’s “option consideration” to help pay for the purchase of the property. It can be used as part of the monthly loan payment, or as part of the downpayment. Either way, since it is not a rental security deposit, it will never need to be refunded.Image from Pixabay

A second method of partnering with a “tenant” is known as “Equity-Sharing”. Here, the parties purchase the property together on the market. One party, the “resident co-owner”, resides in the property, maintains it, usually makes the entire loan payment, pays taxes and insurance, and might get the income tax benefits. Those are negotiable, as are the percentage of ownership. The IRS allows taxes to be allocated as the parties decide, as long as they are deducted only once. The “investor co-owner” typically makes the downpayment and pays the purchase closing costs. This is all done with extensive documentation, but it is particularly useful for helping first-time buyers get started while allowing investors a high-yield, relatively-passive investment. The author represented one unmarried engineer who set up seven of these to help his relatives get started in homeownership while he grew his retirement plan.Getting Started

This article presents nine different methods for investing with partners in high-priced markets. It is not necessary to wire funds out-of-state in order to make a profit! Find an expert in the application of these, and get started. Good luck!Bruce Kellogg

Bruce Kellogg has been a Realtor® and investor for 40 years. He has transacted about 800 properties in 12 California counties. These include 1-4 units, 5+ apartments, offices, mixed-use buildings, land, lots, mobile homes, cabins, and churches. He writes and edits copy for Realty411 and REI Wealth Monthly magazines. Mr. Kellogg is a recipient of an Albert Nelson Marquis Lifetime Achievement Award, listed in Who’s Who in America – 2019. Mr. Kellogg is available for consulting about syndication, “turnkey” investments, joint-ventures, and other property purchases nationally, and other consulting assignments. Reach him at [email protected], or (408) 489-0131.