Survey: Americans Prefer Portugal, Costa Rica & Mexico for Overseas Real Estate Investment

Survey of International Living Readers Also Shows Preference for Beach, City Properties, Good Healthcare, Safety

By Ronan McMahon

Cabo San Lucas, Mexico – Ronan McMahon’s Real Estate Trend Alert, a leading source of real-time information for investors on off-market, insider real estate deals in up-and-coming locales, today released the results of a survey that ran in late October with 434 readers of International Living responding. Both people who are professionally active and retirees were surveyed. Portugal is the preferred destination, in second and third place are Costa Rica and Mexico respectively. When deciding to invest in a property, quality of healthcare and safety and crime rates are among the most important criteria investors consider.

article continues after advertisement

Investing in property abroad is no longer an option that is only available to affluent investors, but has gradually become more and more popular with middle class families in the last decade. Through the survey that was conducted with the readers of International Living, Real Estate Trend Alert set out to understand the preferences of American investors in terms of where they want to invest, how much they want to invest, and what they are looking to achieve with their investments.

Investments

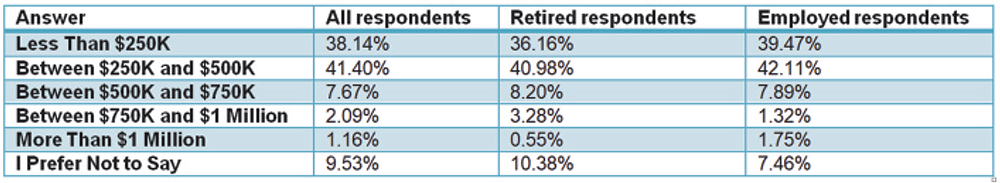

The first question pertained to the amount people are planning to invest.

What is the total amount of investment(s) you are planning to make?

A large majority (79.54%) of respondents plan to invest less than $500,000. 38.14% even plan to invest less than 250,000. The numbers look very similar across retired and employed respondents. While at first sight, one might consider the investment amounts modest, it is important to take into account that in many foreign countries the price of real estate is considerably lower than it is in the United States. In Mexico, for example, it is possible to acquire a luxury condo in a five star beach and golf resort for $250,000.

Objectives

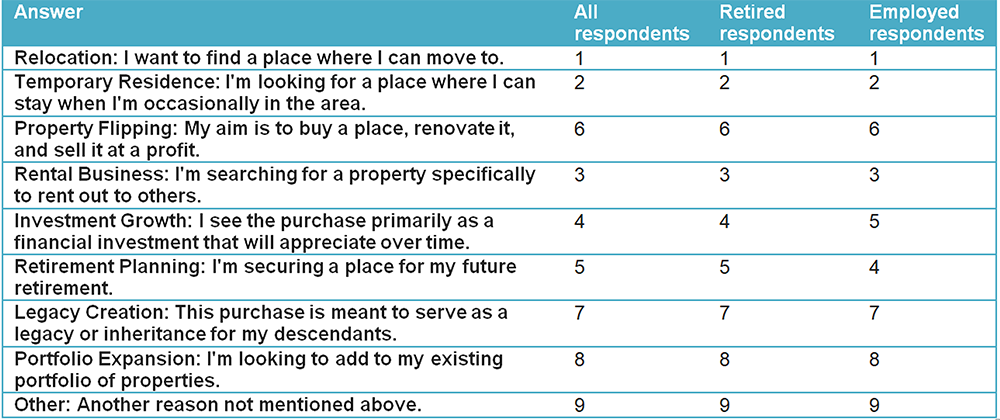

Respondents were also asked about the objectives they seek to realize with their investment(s).

What are your primary objectives with your planned purchase(s)? (Ranked)

The number one reason Americans invest in property abroad is that they want to relocate. In second place comes the search for temporary residence and in third place follows the search for a property that can be rented out. With only a few exceptions, the way respondents ranked their objectives are the same for people who are retired versus people who are employed.

Countries

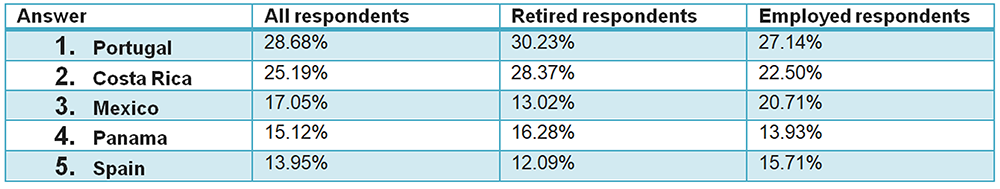

Respondents were also asked where they plan to purchase real estate.

In what countries are you considering purchasing properties? [Top 5]

Portugal came out as the clear winner here, followed by Costa Rica. Mexico, Panama and Spain complete the top five (but the order in which they do so is different for retired Americans versus Americans who are employed).

Types of areas

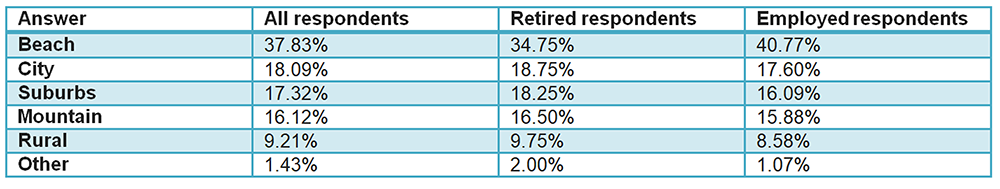

Investors were also asked in what type of areas they would like to invest.

In what type of area(s) are you considering purchasing properties?

Beach property is the number one category of property purchased by Americans abroad. The city and suburbs follow in second and third place respectively.

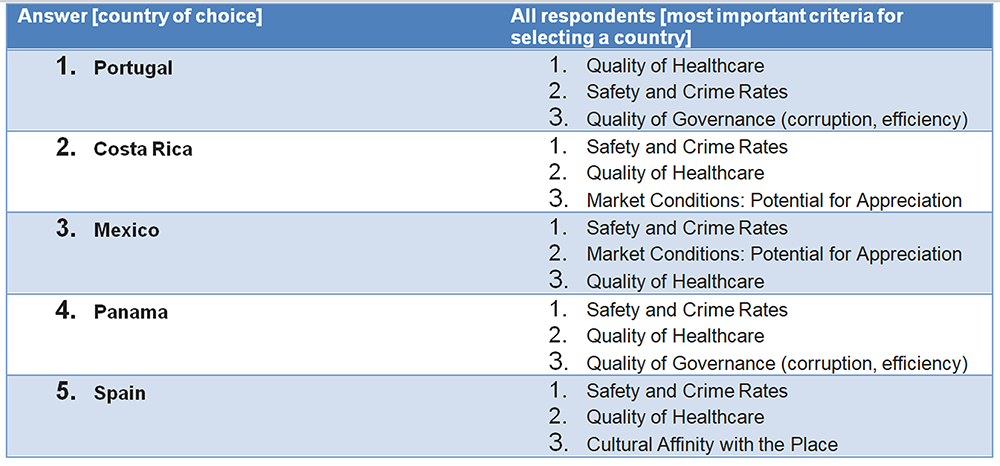

Criteria for choosing a country

Finally, respondents were asked what criteria matter most to them when selecting a place to invest. For every country of the top five most popular countries, the three most important criteria were listed for the people who selected that specific country.

View on what people consider important when buying property abroad who selected one of the top five countries.

Safety and crime rates and quality of healthcare are predominantly present in the top three criteria for people who considered any of the top five countries to invest in. Both Costa Rica and Mexico have market conditions (perceived potential for appreciation) in their top three. For people who selected Panama, quality of governance was (on third place) an important factor to consider and Americans who want to invest in Spain attach (on third place) great importance to cultural affinity with the place.

“Americans want to feel safe.”

“The picture we got from the survey is very clear. Americans want to live close to the beach in a country where there is plenty of sun. They also want to feel safe and have high-quality healthcare,” said Ronan McMahon, founder and editor of Real Estate Trend Alert, who’s been a part of more than $2 billion in international real estate transactions over the past two decades.

“When Americans look to invest in property abroad, they do so for many different reasons with relocation being the most important one. People want to move to Portugal, Costa Rica and Mexico first and foremost. Panama takes the third place with retired Americans. When we look at the budgets that people have available to spend on property abroad, with a large majority not planning to spend more than $500,000, it is no surprise that we see Central American countries so prominently represented in the top three most favored countries.”

article continues after advertisement

MEET RONAN MCMAHON

AND REAL ESTATE TREND ALERT

Ronan McMahon’s Real Estate Trend Alert (RETA) is a real estate investment newsletter founded in 2008 by international real estate investor and author Ronan McMahon. It’s sourced and written by Ronan and his team of real estate experts who search the globe with boots on the ground for six-months out of the year looking for the best real estate deals. Since its inception, RETA has helped thousands of individual investors access off-market, insider deals in up-and-coming locales the world over. More info at www.ronanmcmahon.com.

Media Contact

Ray Young

Razor Sharp PR

512.694.6097

[email protected]

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411Expo.com or our Eventbrite landing page, CLICK HERE.