Enjoying The Mindset Of A Successful Real Estate Investor

Quote to live by: “The one thing you can’t take away from me is the way I choose to respond to what you do to me. The last of one’s freedoms is to choose ones attitude in any given circumstance.” ~Viktor Frankl

You Own Your Thoughts, Now Control Them

What if it was possible to be happy even when things aren’t going your way? What if there was a simple way to be happy, despite your environment, while staring adversity straight in the eyes? Would you like to know how to ignore the “nay sayers” and the media full of gloom and doom telling you every reason why you cannot be successful investing or flipping properties in today’s market?

Would you like to get rid of the noise in your head telling you every reason why you shouldn’t make an offer on a property or you cannot really make money at buying and selling houses or some other crazy negative thing. That’s right – no more hurtful critical thoughts! Can you imagine?

I know it sounds like a great idea, but doesn’t seem to be very realistic at first glance. The good news is, it doesn’t have to be realistic, it just has to work, and it will, if you stick with a few basic principles. The key here is in the simplicity, and in keeping yourself accountable for sticking with the following principles.

ADVERTISEMENT

My Experience

This is a system I’ve been using for quite some time, and can testify to its merit. I decided that I was tired of being unhappy, and letting my own made up fears or even the real environment and the people around me control how I felt.

Be Selective In What You Think About

The wonderful thing about thoughts is that you genuinely own yours. No one else has power over what you think about. With this power, you are faced with a big choice that can impact your entire existence.

- Positive Thoughts. You can choose to think about goals, ambitions, people you love, beautiful scenery, and things you enjoy. This affects your physiology by making you stress free and healthier.

- Negative Thoughts. You can choose to think about death, disappointment, destruction and misery. It’s so stressful to think about how unfair life is, which causes your immune system to take a dip.

Ask Yourself the Important Question

Yes, a single question is powerful enough to change your thoughts. Just ask yourself: How do I want this to affect me?

When you ask yourself about what you want, you are able to take control. If being happy in the face of adversity is what you want, than you choose to let yourself be affected positively. You take negative situations, and treat them as a learning experience.

Instead of taking minor discomforts and turning them into major frustrations, let them affect you in a positive way. For example, you can turn a 48-hour commute into a learning experience.

ADVERTISEMENT

Switch Channels

Treat your life as a television set, and when your thoughts project channels of unhappiness, hit the next button on your mental remote. Switch to something pleasant and stick to the happy networks.

Remember, you control whether your thoughts are positive or negative and with this choice you own your happiness – which, in affect, will make you healthy, wealthy and wise.

Steps to Success

- Put a rubber band on your wrist (not too tight – don’t want to cut off your circulation)

- Every time you notice yourself thinking something negative, pull that rubber band and snap it… just enough to make you jump. This is called cognitive conditioning. By inflicting some discomfort when you perform a behavior you want to change or stop, this will help you to subconsciously avoid doing that thing over time.

- In addition to inflicting discomfort, change your mind’s channel by asking yourself the question: How do I want this circumstance I was just thinking about to affect me? Of course you “want it” to affect you positively somehow. This question, though you may not have the answer in the moment, will get your brain working on the solutions rather than focusing on the problem.

“Positive and negative are directions. Which direction do you choose? When you affirm the positive, visualize the positive and expect the positive, and your life will change accordingly.” Remez Sasson

Tamera Aragon

Tamera Aragon is a professional online entrepreneur and has bought and sold over 300 properties, establishing her as an expert in the real estate investing field. Since 2003, she has purchased over 10 million dollars in real estate and currently holds properties all over the world. Tamera’s focus is on the booming Foreclosure market, buying Pre-foreclosures, REOs and Short Sales. Tamera who is a noted Author, Success Trainer, Speaker & Coach, shows her passion for helping others with the 17 websites she has created and several specialized products to support fellow investors throughout the world. When Tamara is not busy running her website, she is very involved with her Fiji joint ventures and investments. Tamera Aragon is one of the few trainers and coaches who is really “doing it” successfully in today’s market. Tamera’s experience has earned her a solid reputation in the industry as well as the respect and friendship of many of the top national real estate investment and internet marketing experts. Tamera Aragon believes her success has garnered her the financial freedom to fully enjoy her marriage and spend quality time with her children.

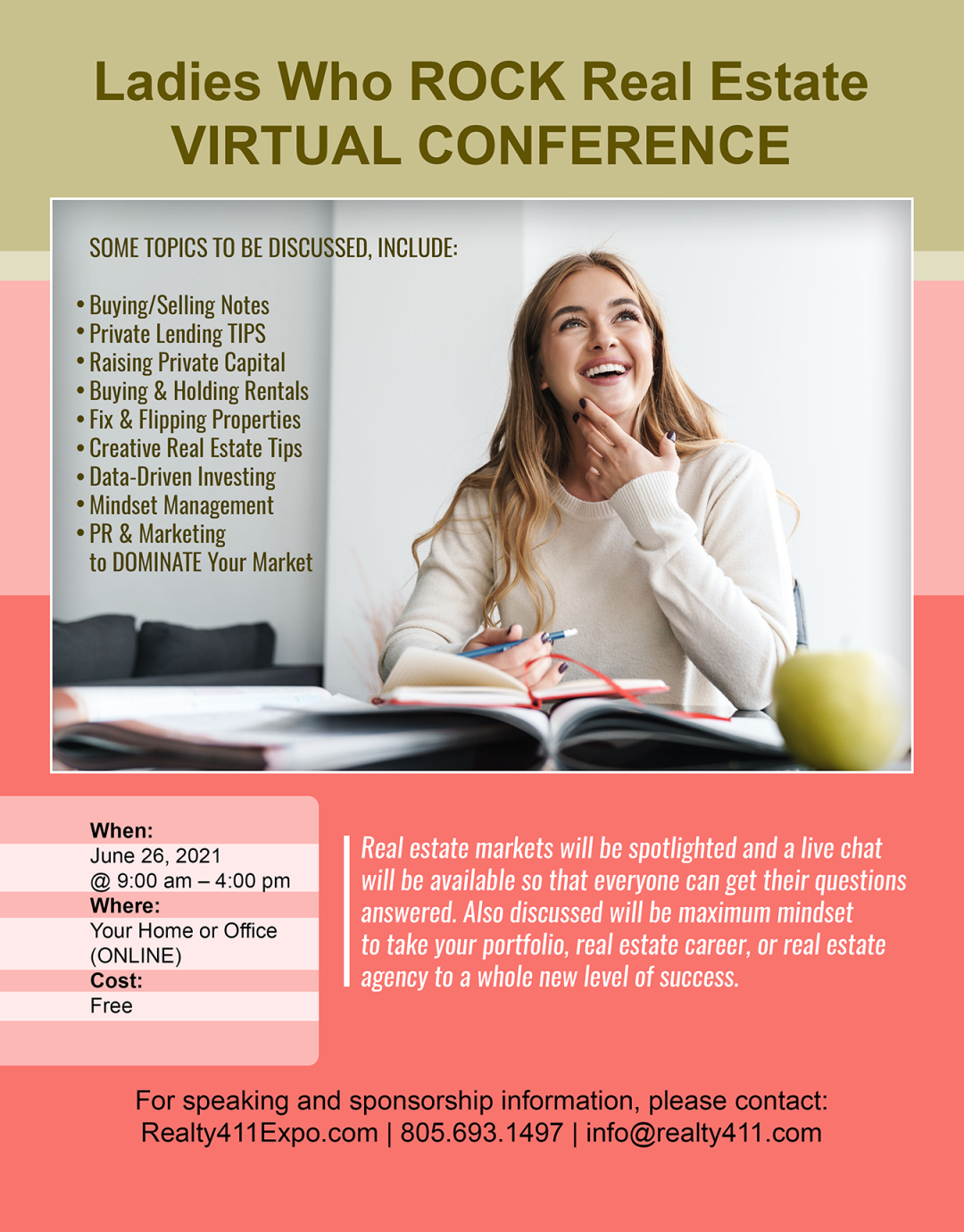

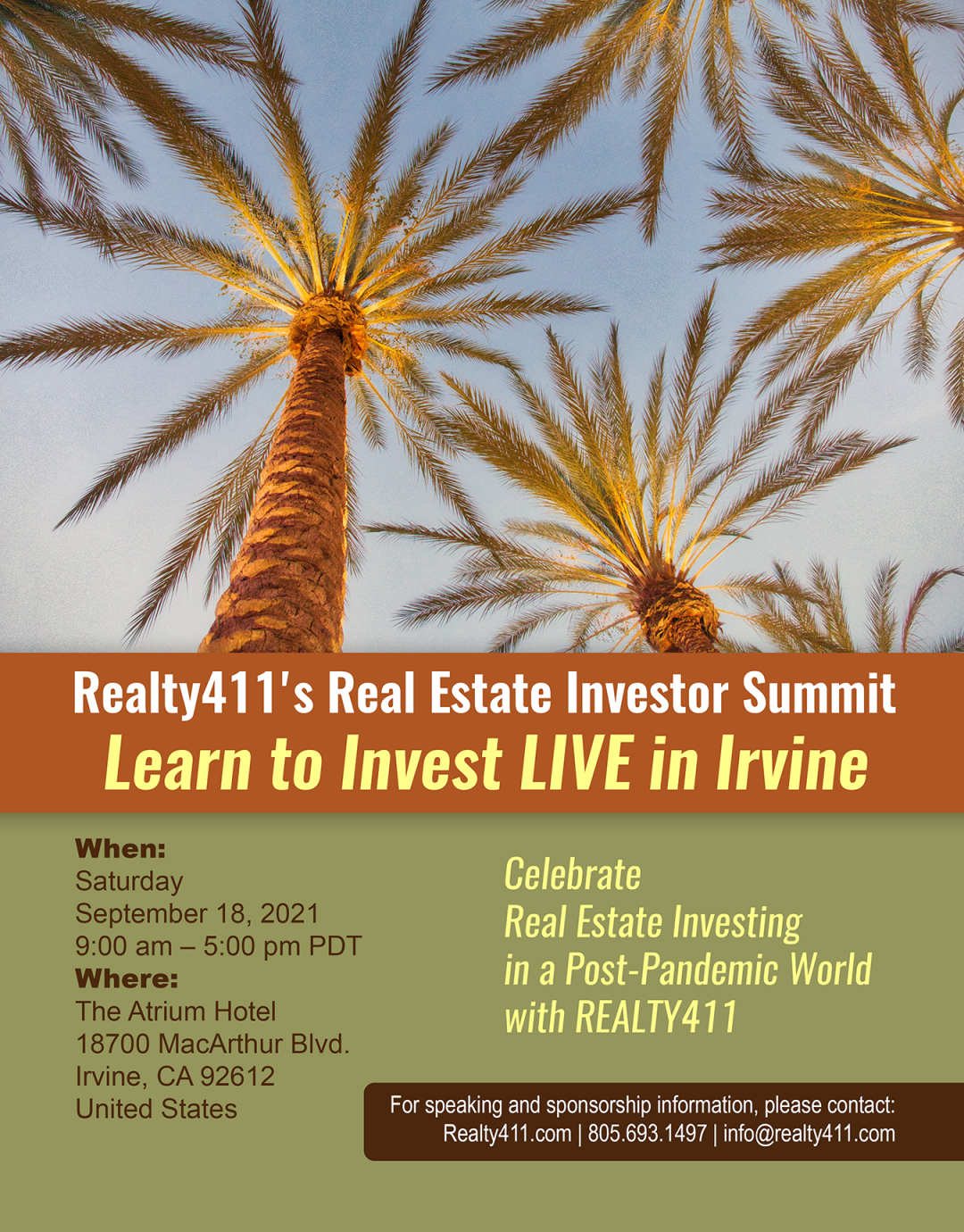

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411Expo.com or our Eventbrite landing page, CLICK HERE.

Michael Morrongiello is an author, education, and long-time active real estate and real estate “paper” investor who specializes in “fix & flips” property rehabilitation projects primarily in the North Bay region, north of San Francisco, as well as investing in and trading real estate secured “paper” (i.e., notes, mortgages, trust deeds). Over his 35+ years in business, he has completed thousands of transactions, and he is an active investor who is “in the trenches” on a daily basis. Thus, the teaching and instruction given are extremely practical, real world, and immediately useful, unlike many so-called “guru” teachers who recite what that have copied in the past from others.

Michael Morrongiello is an author, education, and long-time active real estate and real estate “paper” investor who specializes in “fix & flips” property rehabilitation projects primarily in the North Bay region, north of San Francisco, as well as investing in and trading real estate secured “paper” (i.e., notes, mortgages, trust deeds). Over his 35+ years in business, he has completed thousands of transactions, and he is an active investor who is “in the trenches” on a daily basis. Thus, the teaching and instruction given are extremely practical, real world, and immediately useful, unlike many so-called “guru” teachers who recite what that have copied in the past from others.

Bruce Kellogg has been a Realtor® and investor for 36 years. He has transacted about 800 properties in 12 California counties. These include 1-4 units, 5+ apartments, offices, mixed-use buildings, land, lots, mobile homes, cabins, and churches.

Bruce Kellogg has been a Realtor® and investor for 36 years. He has transacted about 800 properties in 12 California counties. These include 1-4 units, 5+ apartments, offices, mixed-use buildings, land, lots, mobile homes, cabins, and churches.

After his job was threatened by the aftermath of 9/11, Steve Rozenberg, co-founder of Empire Industries, LLC realized that obtaining financial freedom through investing in property is a much surer way of building wealth than working for someone else.

After his job was threatened by the aftermath of 9/11, Steve Rozenberg, co-founder of Empire Industries, LLC realized that obtaining financial freedom through investing in property is a much surer way of building wealth than working for someone else.

Realty411: What are some markets that your team is most interested in acquiring properties in?

Realty411: What are some markets that your team is most interested in acquiring properties in? KENT:I do. I own properties or notes in Florida, Tennessee, Texas, Arizona, and California. To your point, I have business interests in many facets of real estate, digital marketing, online training, software as a service, an investment fund.

KENT:I do. I own properties or notes in Florida, Tennessee, Texas, Arizona, and California. To your point, I have business interests in many facets of real estate, digital marketing, online training, software as a service, an investment fund. Realty411: How did you and your family turn your real estate passion into an empire? When did you decide to leave your previous occupations and focus only on real estate?

Realty411: How did you and your family turn your real estate passion into an empire? When did you decide to leave your previous occupations and focus only on real estate?

Ms. Holly Lynn’s Bay Area Multifamily Meetup Group attracts networking mavens for hungry investors to connect, invest, and retire rich.

Ms. Holly Lynn’s Bay Area Multifamily Meetup Group attracts networking mavens for hungry investors to connect, invest, and retire rich.