Short-Term Rentals and DSCR Loans

Image from Pexels

By Rick Tobin

Over the past several years, most short-term and long-term rental property owners created the bulk of their wealth from the annual equity gains related to buying and holding their properties as values increased anywhere between 10% to 40% per year. In California alone back in 2021, it was reported that the average home statewide increased in value $11,000 per month or $132,000 for the entire year. If so, I doubt that many Airbnb or VRBO hosts collected more than $132,000 in gross or net rent profits.

Image from Pixabay

Did you know that San Diego, California was ranked as the #1 for having the highest gross revenues of any Airbnb region in the world in 2021? Please see the complete Top 10 list of the highest grossing rentals in the world later in this article.

Let’s look next at just some of the short-term rental listing companies which assist vacation rental property owners with the leasing of their properties:

- Airbnb

- VRBO (Vacation Rental By Owner)

- Booking.com

- TripAdvisor

- Expedia

- HomeToGo

- Tripping

- Homestay.com

- Atraveo

- OneFineStay

The prominent travel booking company named Expedia purchased VRBO back in December 2015. As a result, Expedia continues to be one of the most dominant short-term rental companies in the world.

As per published Airbnb data, here are the Top 10 states for average annual host or property owners earnings for 2021:

- Hawaii: $73,247

- Tennessee: $67,510

- Arizona: $60,448

- Colorado: $58,108

- California: $54,461

- Florida: $53,209

- South Carolina: $49,641

- Utah: $48,568

- Oregon: $42,964

- Alabama: $41,937

Image from Pixabay

If a rental property owner confides in you that he or she collected $50,000+ in gross income from Airbnb last year, this number may only represent a small percentage of their overall total revenue collected from both short-term and long-term tenants (30 days+) because they may have multiple income stream options by way of VRBO, Booking.com, or other companies that help supply them with consistent tenants. This is especially true when the property is located in a populous metropolitan region or a prime vacation getaway area like those found in San Diego, Santa Barbara, or Miami.

No Income Verification Loans for Rentals

Most real estate investors usually need third-party mortgage financing to purchase one or more rental properties even if they are very wealthy themselves. Many years ago, it was quite challenging to qualify for a rental property because you were asked to provide two years’ worth of tax returns, a detailed profit-and-loss statement, and the mortgage underwriters would only give you credit for 75% of your gross monthly rents when attempting to qualify or deny your loan request. This 75% number was due to the fact that lenders assumed that you had property management fees, vacancy rates above 0% throughout the year, and operating expenses for repairs.

As a result, that $2,000 gross rent turned into just $1,500 (75%) and many investors were later denied because few lenders wanted to lend on a rental property with negative monthly cash flow if the proposed monthly mortgage payment (principal, interest, property taxes, insurance, and homeowners association fees, if applicable) was $1,501 or higher.

Image from Pexels

Today, many investors are qualifying to purchase short-term and long-term rentals by way of non-QM or DSCR (Debt Service Coverage Ratio) programs which don’t require borrower applicants’ tax returns, W-2s, or other formal income documents to qualify. Now, some lending programs take the closest look at the subject property before determining if the rental property can at least break-even at a 1.0 DSCR number where 100% of the gross monthly rents are at least equal to the proposed mortgage payment. In these underwriting scenarios, 100% of the gross rents are used to qualify instead of just 75% like was more the norm in years past.

For a DSCR loan, it allows borrower applicants to use the market rent (actual or future, in some cases) of the property to qualify rather than the borrower’s business income. This is especially beneficial for self-employed business owners or investors who have a lot of tax write-offs and minimal net income shown on their tax returns.

Some of these DSCR program highlights include:

- 640+ FICO

- Up to 80% LTV

- Available on investment properties only

- Finance up to 20 properties

- Loan amounts up to $2M per property

Some of my other lender programs allow negative cash-flow for rental properties up to 70% LTV for cash-out or purchase transactions while not requiring any additional income from the borrower applicant.

Airbnb Statistic

Image from Pexels

Because Airbnb is the biggest name in the short-term rental business sector, let’s review some of these shocking numbers that confirm how successful this investment property model has been for Airbnb corporate and for individual hosts or property owners.

Airbnb History

- An average of six guests every single second check into an Airbnb listing.

- Airbnb listings represent 19% of the total demand for lodging in the US.

- Over 150 million people have booked over one billion nightly stays.

- The average US Airbnb occupancy rate is 48%.

- The average stay is 4.3 nights.

2021 Data

- The global Average Daily Rate (ADR) was $137 per night in 2021 as compared to $110/night in 2020.

- California properties had a much higher nightly average of $258 per night.

- In December 2021, there were 12.7 million listings worldwide.

- There were 2,249,434 listings in the US in 2021.

- 356.9 million nights were booked on Airbnb in 2021.

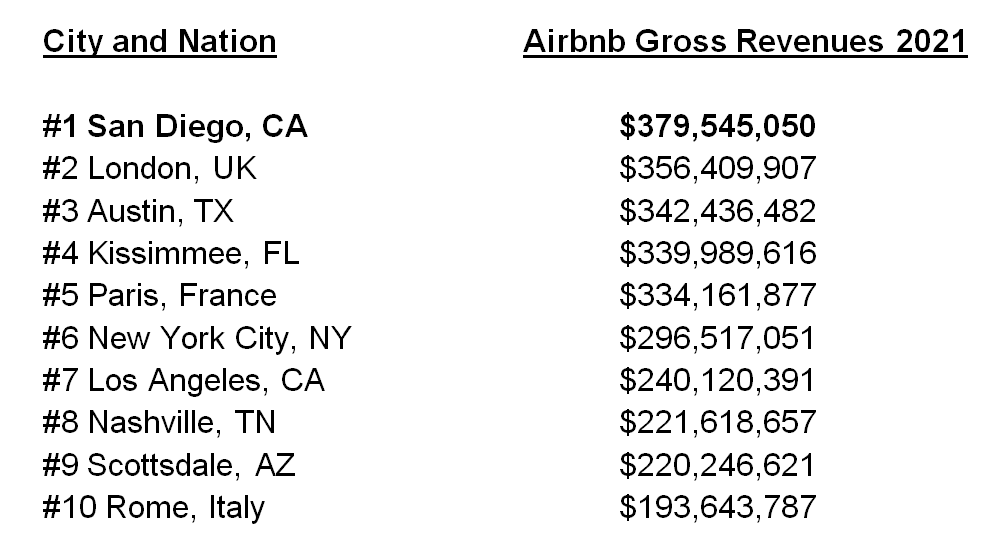

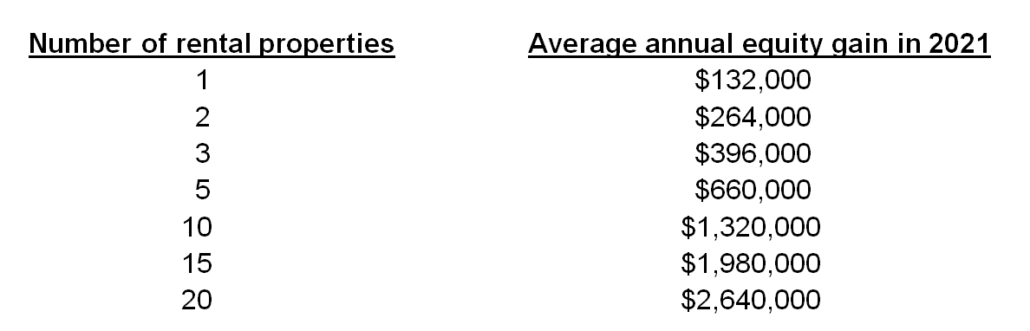

Highest Gross Revenues Worldwide for Airbnb Properties

Image from Pixabay

Surprisingly, these populous metropolitan regions such as Los Angeles, San Francisco, New York City, Paris, London, or Hong Kong weren’t ranked #1 for being the most profitable Airbnb region in the world with the highest gross revenues. No, the honor for the most profitable Airbnb region in the world in 2021 was San Diego, California.

In 2020, seven of the Top 10 highest gross revenues for Airbnb properties were all in the US. One region that stands out is Big Bear, California, which is the best-known mountain resort community in Southern California. Listed below are the 2020 gross revenue numbers for the Top 10 regions in the world:

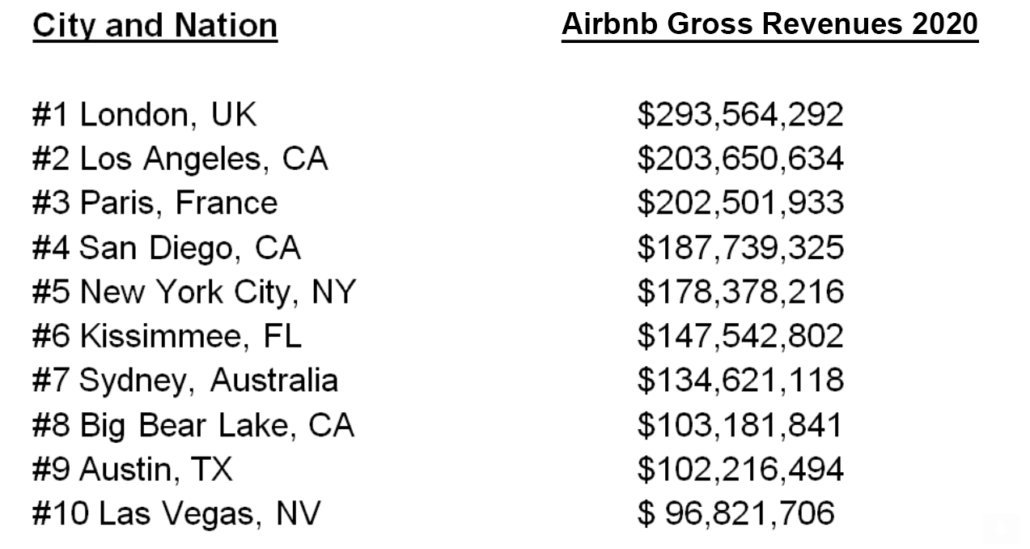

Compounding Wealth With Equity Gains

There are many individual or family investors across the nation who have acquired 5, 10, 15, or 20+ short-term rental properties. The bulk of their family’s net worth doesn’t usually come from the net annual rental income. No, the family’s net worth is compounding each year with double-digit appreciation rates like we’ve all seen for several years now.

To better understand how the acquisition of multiple rental properties is more likely to create the bulk of your net worth, let’s take a look at a fictional California property owner who saw each of his rental homes appreciate $11,000 per month or $132,000 for the entire year in 2021:

Investors can apply any excess net rental income each year to paying off their mortgage faster. With consistent annual rents, a 30-year mortgage or a shorter-term 5-year or 7-year interest-only mortgage with much lower monthly payments than the best 30-year fully amortizing rates can be paid off much faster as more principal is paid off with extra payments.

The sooner that your homes are free and clear, the earlier you can retire and live off of the monthly cash flow while not touching your equity gains. A fairly consistent plan of buying and holding short-term and/or long-term rental properties is a prime example of letting your money work hard for you instead of the other way around.

Rick Tobin

Rick Tobin has a diversified background in both the real estate and securities fields for the past 30+ years. He has held seven (7) different real estate and securities brokerage licenses to date, and is a graduate of the University of Southern California. Rick has an extensive background in the financing of residential and commercial properties around the U.S with debt, equity, and mezzanine money. His funding sources have included banks, life insurance companies, REITs (Real Estate Investment Trusts), equity funds, and foreign money sources. You can visit Rick Tobin at RealLoans.com for more details.

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411.com or our Eventbrite landing page, CLICK HERE.