East Coast Investor Summit + Virtual Event

-Advertisement-

We are back in the East Coast to connect with our readers. Realty411 will host an Investor Summit in the City of Brotherly Love to network and learn the latest REI strategies. Our last event united investors from across the nation and many Eastern states for a fantastic day of education and collaboration. In addition, a delicious catered breakfast and lunch will also be served.

Take advantage of our discount code: 411 — to receive a discount on tickets.

To learn more, CLICK HERE

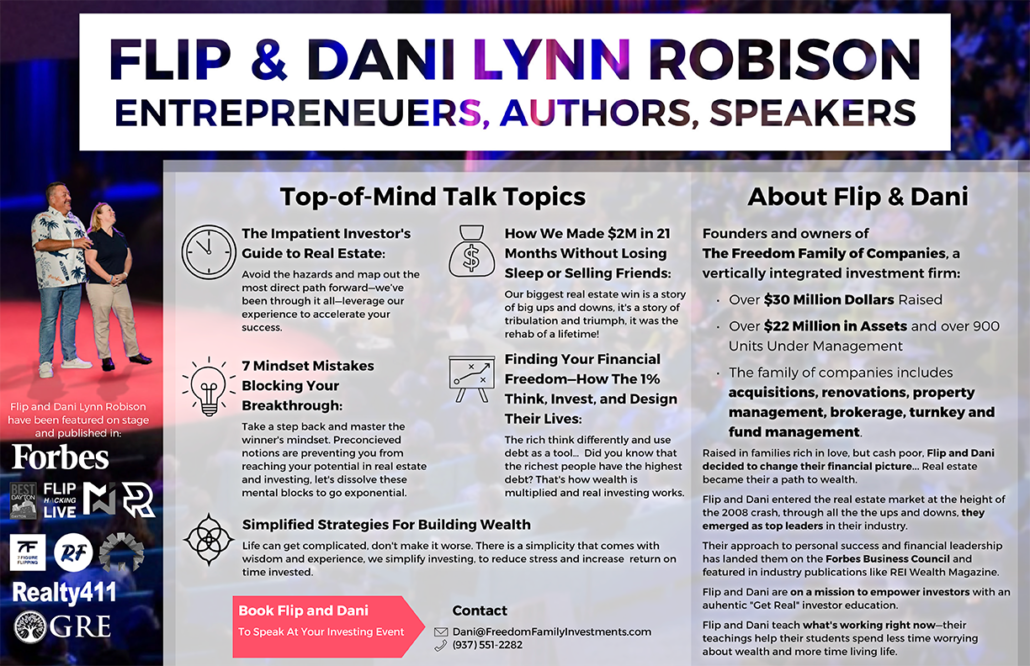

Be Sure to Register, Educators Include:

Joseph V. Scorese, National Private Lender

Marco Kozlowski, Investor & Author

Jonah Dew, The Cash Compound

Randy Hughes, Mr. Land Trust

Paul Finck, The Maverick Millionaire

Eric Mauz, MB Capital Solutions

Michael Poggi, Investor and Author

Andrea Lane, Coast2Coast Turnkey

Linda Pliagas, Realty411.com

and More!

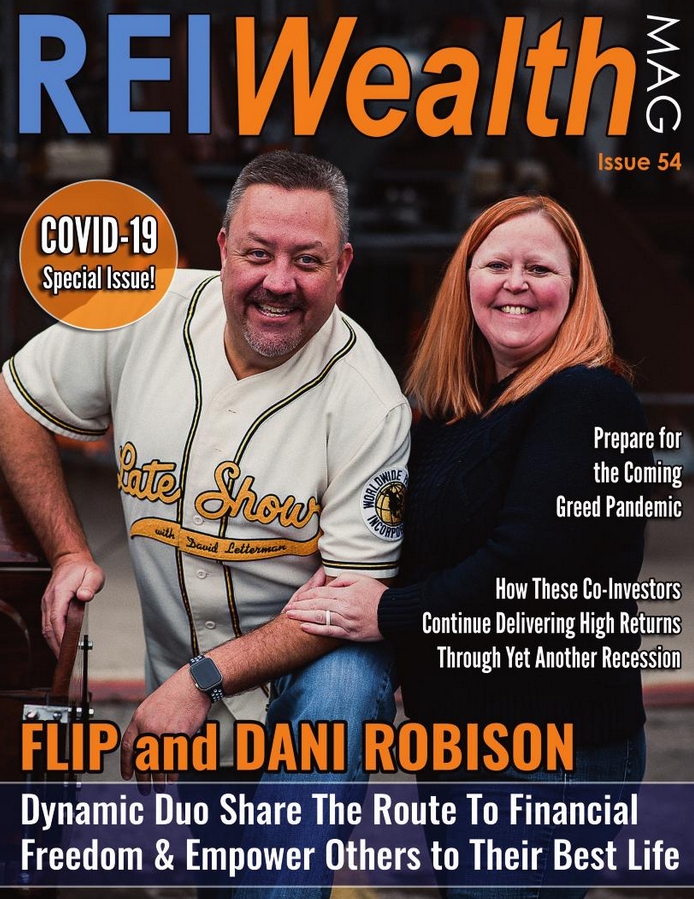

-Advertisements-

Attention savvy real estate investors, it’s time for another educational and exciting Realty411 Virtual Investing Summit uniting readers for an amazing day of information and motivation.

Register for Our NEW Virtual Investing Summit on Friday, April 26th, from 9 AM to 2 PM PT (East coast time: 12 PM to 5 PM ET) and Saturday, April 27th, from 9 AM to 2 PM PT as well.

Guests can join Realty411’s complimentary VIRTUAL investing summit and learn from experts sharing important knowledge, strategies and insight.

Realty411 will virtually unite some of the most successful, knowledgeable and savvy investors in the REI (Real Estate Investing) industry to help our readers make educated and informed decisions.

Join us for an amazing day of real estate education. Every online event we produce is unique, be sure to reserve this day for REI learning at its best.

DOWNLOAD AND LEARN TODAY!

-Advertisements-

Since 2007, Realty411.com has assisted top companies expand their visibility and grow their business. Contact us for a complimentary marketing session. Investors, do you have questions about real estate investing? Are you looking for a turnkey rental? Need a solid REI referral?Book a meeting with a Realty411 team member: CLICK HERE.