Tokyo’s Urban to Suburban Migration

Image from Pixabay

By Priti Donnelly

For years, Japan has tried to prevent its population from being overly concentrated in Tokyo, a city sprawling with nightlife, work life, and a tourist hotspot. Economic and social shifts of the pandemic developed into the start of a natural progression of migration out of the capital. Although the greater Tokyo area grew in 2021 by 26,323 for a gain of 0.07%, that figure was down roughly 110,000 from a year ago. In 2020 net migration by locals into Tokyo shrank by 27,000, or roughly one-third from previous years as people embraced telework and crowd distancing.

Initially, at the start of the pandemic, to avoid commuting, Japan adopted the work-from-home concept already popular in many parts of the world. As employers learned to adapt to matters of productivity and controlling hours of work, employees discovered the concept value in work and family balance plus the benefits of saving time from hours of commuting. Then, ongoing lockdowns turned flexibility into a lifestyle leading to the realization of the potential to settle outside urban centres. And, so began the urban to suburban or even rural movement.

Image from Pixabay

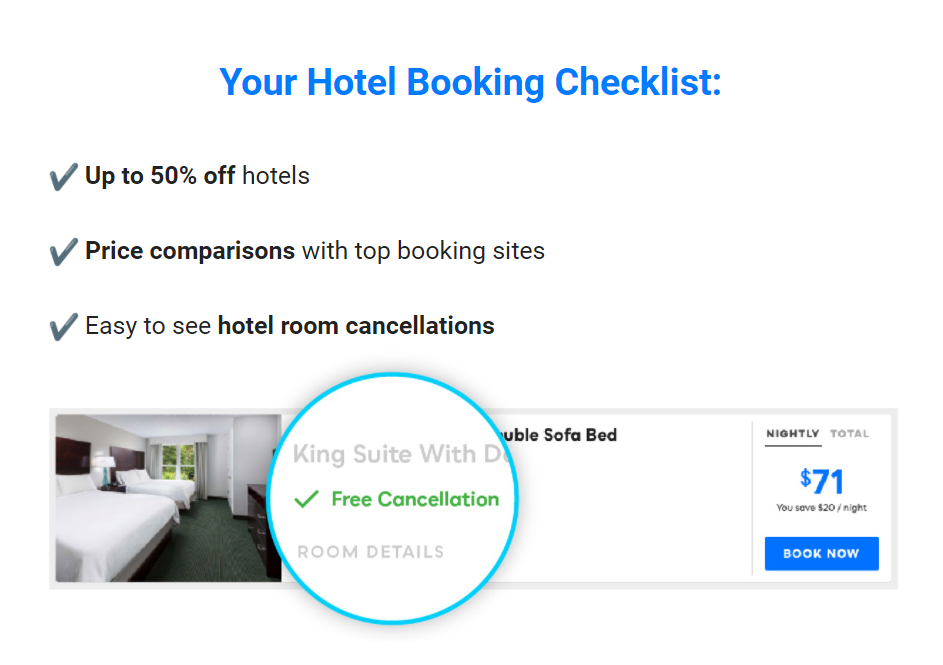

One Tokyoite, Kanamori sought to leave his luxurious life and job of the Roppongi Hills complex in Tokyo’s Minato ward for solace in the city of Yamagata. A place familiar to him as the place of business of his parents’ long established sake store. Initially he moved to Tokyo to attend university, then joined an IT company in 2017 selling computer tablets with an application that helped retail operators keep track of sales. But, after three years, the business took a couple of hits. First, the consumption tax was raised to 10% in October 2019. Then profits were hit harder after Covid. This, in addition to the long working hours and overtime deeply rooted in Japan’s industrial ethics. It is not unusual for employees to work more than 80 hours of overtime a month, according to a 2016 government survey and those extra hours are often unpaid. Kanamori’s lifestyle became all about work and he didn’t like who he was turning into.

Recognizing that those long work hours translated less into productivity and more into exhaustion, he left his job for a change in lifestyle and moved to Yamagata. There he became a member of the city’s community development team that aims to make better use of vacant homes, working four days a week, no overtime. On his days off, yes, he has days off, he goes camping with his friends. Peaceful living.

Image from Pixabay

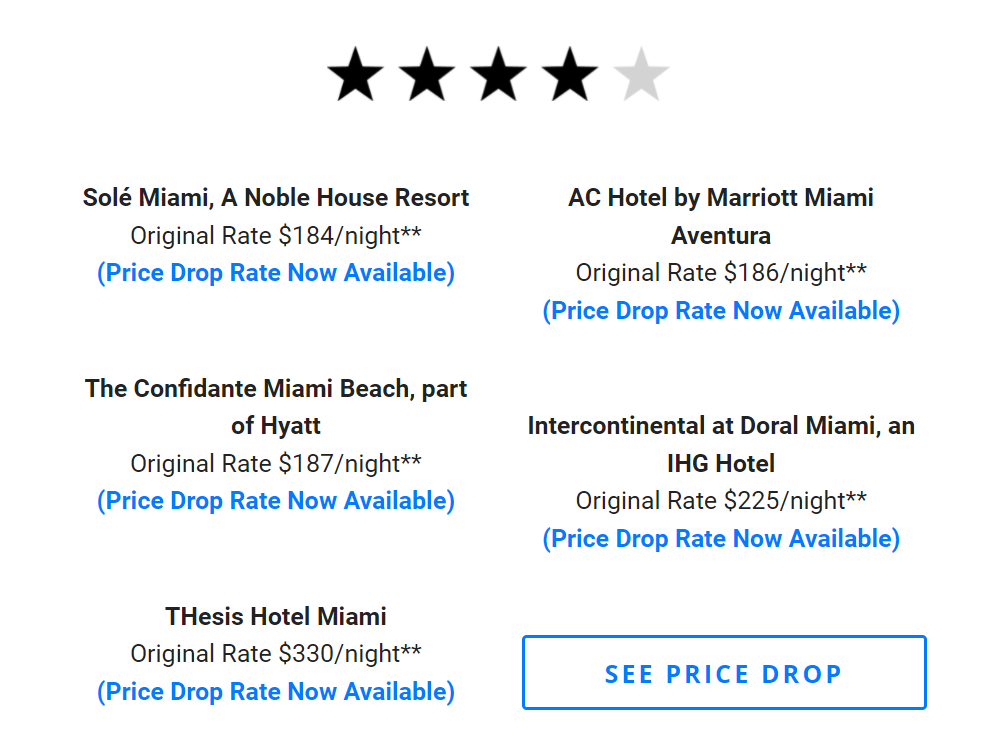

Kanamori is not alone. The mountain resort town of Karuizawa in Nagano prefecture added 595 people via migration, the largest increase of any town. For the first time since July 2013, the number of people moving out of Tokyo outnumbered the number of people moving in by 1,069. In June 2020, inbound migration topped outbound migration once again, but from July 2020 through February 2021, more people moved out of Tokyo than people moved in and the trend has continued, with the exception of the months of March and April when more people generally move into Tokyo because of starting new jobs or enrolling at university, at the beginning or end of the fiscal year.

Should I stay or should I go? Although Tokyo is attractive for its job opportunities, thriving business hub, and growth-focused initiatives for start-ups, people are discouraged by the high cost of living. The nationwide average monthly rent, not including utilities, for a one-room apartment (20 to 40 sqm) is between 50,000 and 70,000 yen. Rent for similarly sized apartments in central Tokyo and popular neighbourhoods nearby usually start from around 100,000 yen.

Image from Pixabay

But, the high cost of living is just one deterrent from permanent settlement. Where people once enjoyed the ease of fast food to satisfy the palate and the belly, they are now finding solace in places surrounded by greenery with access to fresh seafood, fruits and vegetables. For the sole purpose of slowing down to take care of oneself, the concept of growing and preparing foods for its freshness, nutritional value including low sodium and carbohydrates by comparison to fast-food, has been revived.

The attraction to the suburbs or rural areas is real, but it is hard to tell if it is more of a sabbatical, or a trend as we strive to stay safe. Either way, Tokyo is not entirely out of the picture. Even Kanamori still thinks he might return to Tokyo in the future for business opportunities. The city is after all a thriving international hub and continuously evolving for entrepreneurs to launch and be successful. As the old adage goes, “You can take the person out of Tokyo but you can’t take Tokyo out of the person.” But, this time on healthier terms.

Sources: The Japan Times, Nikkei Asia, Japan Guide

Priti Donnelly

Priti Donnelly is the sales and marketing manager at Nippon Tradings International, a Japanese proxy helping foreigners access the second largest real estate economy in the world. As a Canadian with a background in mortgages and marketing, Priti keeps foreigners informed of the latest trends, business news and featured properties in the Japanese real estate market. Her articles have been featured in REtalk Asia, REthink Tokyo, REI Wealth, and Asian Property Review.