Retirement Savings Gone After Investment in Fraudulent Company Resembling SDIRA Custodian

By Stephanie Mojica

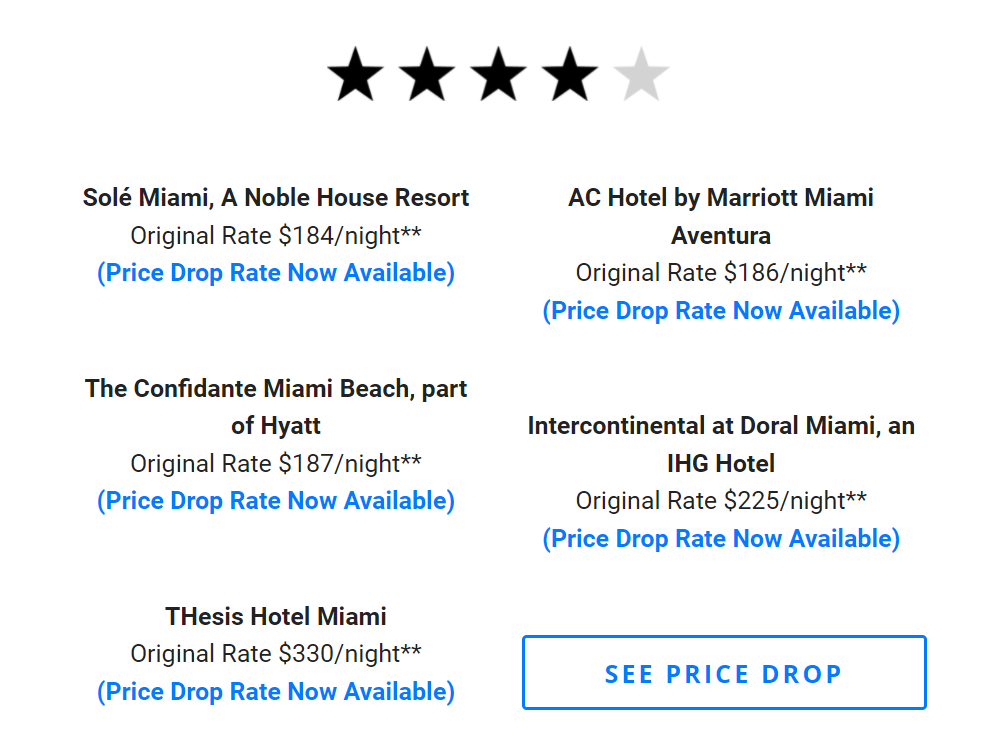

A Wisconsin woman lost her entire retirement savings by investing with a now-deceased friend’s business, My IRA, LLC, according to the Milwaukee NBC television affiliate TMJ4. It seems the company attempted to resemble an SDIRA – a Self-Directed Individual Retirement Account custodian.

My IRA, LLC was started by a tax preparer and purported investor, Michael Cuccia, who suddenly died in November 2020, according to TMJ4. When people who had invested in his company sought the return of their assets, they were stunned to learn that most of them were nowhere to be found, according to TMJ4.

Attorney Anne Cohen stated that her client Diane Conklin had a 401(K) account, but needed to figure out her best options when she broke her back in 2012.

Image from Pixabay

“She had learned that she could no longer work and wanted to make sure that the funds she had in her 401(K) were in a secure account,” Cohen told TMJ4.“Because she quickly was learning that was all of the wealth she was going to amass in her lifetime due to her disability.”

According to Cohen, Conklin knew Cuccia professionally and also considered him a friend. Cuccia told Conklin to take her money out of her 401(K) account and invest in his My IRA, LLC company, according to a lawsuit Conklin filed against Cuccia’s estate.

Cuccia claimed Conklin had no risk of losing her assets and she was guaranteed a 5% return on investment each year, according to Cohen.

“…after years and years of friendship and going to him for tax advice, she trusted his advice,” Cohen told TMJ4.

After Cuccia’s sudden death, Conklin and others could not reclaim their assets, according to Cohen.

People had invested anywhere from $5,000 to $200,000 with Cuccia’s company, according to Cohen. The total was $1 million, but Cuccia only had about $200,000 in assets, according to Cohen.

Image from Pixabay

Anyone considering making an investment should be automatically suspicious if they are told there is no risk involved, according to Robin Jacobs from the Wisconsin Department of Financial Institutions Enforcement Bureau.

“When you invest your money in something, it means you’re going to take a risk in exchange for getting a return,” Jacobs explained during her interview with TMJ4.“Of course there’s no guarantee.”

Investors should also steer clear if one or more of the following warning signs are present:

- A vague or confusing business model.

- Time limits on when you can invest.

- High-pressure sales tactics.

- A lack of disclosure documents.

- No audited financial records.

Would-be investors should also research whether the person they’re talking to has the proper training and licensure.

Image from Pixabay

In Wisconsin, that can be cleared up with a phone call to the Department of Financial Institutions Enforcement Bureau.

“…we can tell (you) whether that person is registered either as an investment advisor or a broker-dealer and if they’re not registered…I would be very suspicious of that person,” Jacobs said during her interview with TMJ4.

Some broker-dealers and investment advisors must register with FINRA (the Financial Industry Regulatory Authority) or the SEC (the Securities and Exchange Commission), while others do not. It depends on whether the professional does business in one or multiple states.

The regulation bodies for other states include:

- California Department of Business Oversight

- Texas State Securities Board

- Idaho Department of Finance

- New York State Attorney General

- Arizona Corporation Commission

- Nevada Secretary of State

- Florida Office of Financial Regulation

Any inquiry to your local business licensing or permits office or a quick Google search should point you in the right direction.

Back to Cuccia’s purported victims, the future is unknown.

Conklin and other people who claim they were swindled by Cuccia are waiting to see if the courts will award them any of what’s left from his estate, according to TMJ4.

Attorneys representing Cuccia’s estate declined to be interviewed by TMJ4.

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411.com or our Eventbrite landing page, CLICK HERE.