How to Find Wholesale Deals Other Don’t See

/in Events, News /by dulcePlease join us as the Ventura County Real Estsate Investors Association and the Los Angeles Real Estate Investors Club November meeting, Thursday night, November 12, 2020, 7:30 to 9:30 pm. This will be a virtual meeting and you will need to register at our website:

https://www.accelevents.com/e/NovemberMeeting

GUEST SPEAKER: Our featured speaker will be Jimmy Reed, visiting us from Fort Worth, Texas. Jimmy is an expert on wholesaling and the author of “Fast Track to Wholesaling.“ The title of Jimmy’s presentation to LAREIC is “How to Find Wholesale Deals Others Miss.”

Jimmy Reed has an extensive background in the field of Real Estate Investing having bought, sold and managed over 300 units, all by the age of thirty. Jimmy began his investment career in the late 1980’s while still working full time. As he developed a solid understanding of real estate investing, Jimmy went on to specialize in the areas of Wholesaling, Probate, Owner Financing, Notes, and Cash Flow Rentals, along with other investment strategies including International Investing.

After several years of success in Real Estate Investing (as well as teaching workshops to other investors in the Dallas/Fort Worth area), Jimmy created Wholesale programs. These “trainings” put Jimmy in some of the hottest markets in the world such as Hawaii, New York, Cozumel, Panama and even Costa Rica. Jimmy has presented live seminars to thousands of real estate investors all across the United States.

Jimmy’s newest book, “No Fear Real Estate” discusses how to remove the fear from lack of knowledge that is holding you back, and discusses how to

- Wholesale real estate via Assignments & Double Closings

- Find great deals via Probate

- Buy, Rent, and Hold for long term wealth

- Sell properties with Owner Financing

- Create Notes, and how to hold those notes or sell them

- Use other people’s money instead of your own

- Become wealthy by using IRA’s to do all your buying & selling.

All of these strategies and more provide you with the tools you need to start building your real estate portfolio and take you to a new level of achievement! And it all starts with wholesaling.

Wholesaling topics to be covered include:

• Finding deals others miss

• How to market to motivated sellers

• How to use “Bird Dogs”

• Looking for vacant houses

• Mailing out effective postcards

• Where to look in the MLS

• How to assign your deal to an investor

FREE ADMISSION: Admission to our monthly meetings is always complimentary (free!), but reservations are required.

FREE PARKING: Free parking in YOUR garage!

FREE REFRESHMENTS: Unlimited free refreshments in YOUR refrigerator.

RSVP: please RSVP at our website so that you can receive a login and password for the event:

https://www.accelevents.com/e/NovemberMeeting

VENDOR EXPO. Most importantly, don’t miss our “Vendor Expo,” 6:30 to 7:30 pm (right before the general meeting starts). We’ll have over 40 vendor tables with opportunities for you to “meet and greet” with companies that you’ll want to utilize in your real estate investing.

Got Taxes?

/in News, Tax /by dulcePhoto by Karolina Grabowska from Pexels

By Bruce Kellogg

Dealing With Taxes

Most people, including investors, need to deal with income taxes. Many prepare their own returns manually or using purchased software programs. Others trundle down to franchise tax preparation offices with their brown bags of pay stubs and receipts. (Hah!) Some have their own CPA or EA (Enrolled Agent) prepare their return for them. Everyone here tries to be frugal, to minimize their tax preparation expense.

What often is missing is “Tax Strategy”, which can vastly overshadow the supposed benefits of filing parsimony. For example, Tony Watson (EA), of Robert Hall & Associates, spoke at a recent investor meeting of 323 attendees regarding the features of the just-enacted CARES Act. One feature will allow certain taxpayers to go back and amend prior returns to receive a tax refund. Will the tax software company, or the franchise tax preparer, or your CPA or EA, contact you to alert you to this taxation tactic that could produce thousand$? Right. Not hardly.

Tony Watson, EA

Tony Watson is an Enrolled Agent who focuses on providing personalized financial guidance and tax preparation services to individuals and businesses. As a federally-licensed tax practitioner, Tony helps his clients make sound financial decisions, and works to ensure all eligible deductions are received when preparing taxes. Should a client need assistance with audits, collections, or appeals, Tony is empowered by the U.S. Department of the Treasury to represent taxpayers before all administrative levels of the Internal Revenue Service. In addition to his one-on-one client work, Tony Watson is the keynote speaker for Robert Hall & Associates. He speaks on various tax-related topics at over 200 engagements throughout California each year. His dedication to his clients and expertise in the field of taxation led him to win the Glendale Readers’ Choice Award for Best Tax Preparer in 2016, and 2019. Tony loves tax work!

Photo by olia danilevich from Pexels

Hiring a Tax Professional

Investors who view their property ownership as a business often create entities like Limited Liability Corporations (LLC’s), or partnerships or corporations of various kinds. Even with individual ownership there are good reasons to hire a tax professional. Here are several.

- Small errors that you make can result in large penalties.

- You could miss paying quarterly estimated tax payments, or underpay them, and owe additional tax. If you expect to owe $1,000 or more when you file your return, you should file for your estimated taxes, according to Tony Watson.

- If you have employees and practice withholding of employment taxes for federal, state, and local, including Social Security and Medicare, you need to timely file and pay both the employees’ and the business’ payments.

- Filing late has penalties.

A personal illustration is the author’s son. Age 36, he owns a consulting business that grosses $210,000. He pays his accountant $3,500, and says he saves four times that compared to filing his own tax return. The savings comes from the tax strategy that the accountant provides. That’s where the high dollar benefits come from, strategy. That’s the big benefit from hiring a tax professional.

Following up

Interested readers can follow up by going to https://www.roberthalltaxes.com/contact/ and setting up a complimentary initial consultation.

Bruce Kellogg

Bruce Kellogg has been a Realtor® and investor for 38 years. He has transacted about 800 properties in 12 California counties. These include 1-4 units, 5+ apartments, offices, mixed-use buildings, land, lots, mobile homes, cabins, and churches.

Mr. Kellogg is a contributor and copy editor for two national real estate wealth-building magazines: Realty411, and REI Wealth Monthly. He is a recipient of an Albert Nelson Marquis Lifetime Achievement Award, listed in Who’s Who in America – 2019.

He is available for consulting with syndication, turnkey, joint-venture, and other property purchasers and note investors nationally, and other consulting assignments. Reach him at [email protected], or (408) 489-0131.

A Behind-the-Scenes Look at How to Grow a 7-Figure Real Estate Business

/in Investing Tips, Keys To Success, News /by dulceImage by Nattanan Kanchanaprat from Pixabay

By Victoria Kennedy

When you’re a successful business owner, one question comes up in nearly every conversation: “How do you do it?” If you’re killing it and seeing revenues topping 7 figures, everyone wants to know your secret.

When Aaron Ace Harris launched Key Marketing Interventions, which offers end-to-end real estate marketing and lead generation solutions, he was starting from scratch. Three years ago, he had no online presence, very few connections, and not much more than a deep desire to serve others. But, today, the tides have turned dramatically and Aaron is on a mission to share not only how he did it, but to pull the curtain back and give a behind-the-scenes look into what goes into running a 7-figure business daily.

Image by Pete Linforth from Pixabay

5 Steps to Building a 7-Figure Business from Scratch

Of course, every entrepreneur’s journey looks a little different, but what follows are the 5 steps that Aaron swears by.Step 1: Go all-in on ONE idea.

Every business starts in the same way—as an idea. Clearly then, the first thing you need to build a business from scratch is a big idea. Now, if you’re like most entrepreneurs, you’re thinking, “great, I’ve got tons of ideas.” But the key is finding that ONE big idea that you can go all-in on.“I always shake my head when I meet an entrepreneur who brags about running 6 businesses at once,” says Aaron. “What this tells me is that this person isn’t all-in on any one business. They’re spread too thin and trying to hedge their bets.”To get to 7 figures, you need consistency, focus, and patience. This means choosing one idea and going all-in.

Step 2: Do your research.

Once you’ve found your big idea, the real work begins. It’s time to do your homework so you can figure out how to turn that idea into the revenue-generating machine of your dreams.

Image by StockSnap from Pixabay

But before we get ahead of ourselves, let’s break this step down. Here’s what to research:- Study your competition

- Find the gap in the market

- Figure out who your ideal client is

- Identify the pain points of your ideal client

“When I started my real estate lead generation company, I had already learned a lot about what my ideal clients’ pain points were. I had been doing the agency thing for a few years. So I knew exactly what real estate agents needed most,” says Aaron.

Step 3: Create your way forward.

Now that you have your idea and you’re confident there are clients out there just waiting for your product or service to hit the market, it’s time to create.This phase is full of experimentation, rejection, and even what might feel like failure. But remember, according to professor and motivational speaker, Steven Redhead, “the difference between success and failure is not giving up.”If something you create doesn’t work out, take what you can learn from it and move on.

Step 4: Shout your idea to the world.

Image by Yvette W from Pixabay

You have created something you know has value and now it’s time to share your idea with the world. Sharing this big idea can come in many forms:- On social media (choose 1-2 channels where you know your ideal client hangs out)

- In online communities

- As a guest on podcasts

- As a guest blogger

- With joint ventures

- By participating in virtual summits

- By hosting webinars

- Through paid advertising (Facebook, Google, YouTube, Instagram)

Step 5: Work your systems.

Finally, the key to really building up to that 7-figure goal is not taking your foot off the gas. One of the ways to stay on top of your business and make sure you’re doing the small things that will lead to serious growth, is to build systems everywhere. When you have strong systems, you will work most efficiently. This will free you up to develop multiple revenue streams within your business, which is critical for taking your business to the next level.There’s no secret to building a 7-figure business, but these 5 steps will take you from zero to 7 figures in less time than you might think. And as Aaron Ace Harris will tell you, it takes hard work and dedication, a lot of heart, and a little luck.

Aaron Ace Harris is the CEO of Key Marketing Real Estate and is a devoted husband and father. He was able to grow his real estate marketing business to 7-figures during the pandemic. Click here to find out about his 3 Closings Guaranteed System: https://www.keymarketingint.com/optin28970799

Victoria Kennedy [email protected] atmanrealestate.com

Nominated as a 2020 Brand Ambassador for Inman, Victoria Kennedy is a well-respected authority in Real Estate marketing and branding. She is the CEO of Atman Real Estate, a marketing & branding agency that is committed to helping top producing Real Estate professionals become the #1 Agents in their area. She is a highly in demand speaker on all things digital marketing, and has helped many clients boost their visibility and revenue. Because of her expertise in real estate, she has been a trusted speaker and contributor to such organizations as the National Association of Real Estate Brokers, Inman News, and Yahoo Finance. In addition to running a successful marketing agency, she also has given talks, workshops, and has worked as a trusted consultant for Realties, Title Companies, Investors, and top producing agents. She has been featured in over 175 publications and podcasts both nationally and internationally. In addition to her marketing expertise, Victoria is a #1 selling classical-crossover singer and has sung with the likes of Andrea Bocelli, as well as toured all over Europe with her music. She is excited to share with you the power of her Closing Maximization Method and how it can exponentially grow your business. Find out more here: atmanrealestate.comGiving the Land a Voice

/in News /by dulceImage by mohamed Hassan from Pixabay

By Bruce Kellogg

Gathering Seller Leads

The author has been a real estate agent in Silicon Valley since 1981. Back then, agents gathered buyer and seller leads by open houses, door-knocking, “floor time” in the office as a receptionist, and some direct mail. None of this was sophisticated, and all of it was tedious. Then, Landvoice came along!

Origin of Landvoice

Image by Gerd Altmann from Pixabay

Landvoice began in the early 1990’s as a way to help real estate agents quickly access For Sale by Owner (FSBO) inventory in their area. The first FSBO lists were created by manually assembling lists from newspaper ads and faxing them to the agents. More cities across the country were added, and the system became more automated, and moved to email delivery. In 2010, Landvoice was acquired by Jake Fackrell. At that time, Landvoice was a CD-ROM, available only for a Windows computer. Mr. Fackrell quickly moved to a cloud-based system that could run on any Web browser. Over time, Landvoice expanded by adding Expireds, Pre-Foreclosures, Neighborhood Search, Call Capture, and Old Expireds. Mr. Fackrell is still President of the company, while Bert Compton is the CEO, managing all the day-to-day activities of the business.

Aggregating Data

Landvoice aggregates data from thousands of public sources. Then they sort the data based on a variety of parameters, such as geographic location, data type (FSBO, Expired, etc.), and date. The data then goes through a system of reviews that includes both computer systems and humans. This is why their data is superior on the market. In many cases they also supplement additional data such as phone numbers or email addresses, to make it more useful to their customers. It is then delivered daily to customers through the Landvoice app based on the customers’ subscriptions.

Features and Benefits

Image by John Hain from Pixabay

Image by John Hain from Pixabay

Landvoice helps connect real estate agents, brokers, (and investors!) with motivated home sellers by providing high-quality seller leads with the most contact information in the industry. They save their customers the time and effort of searching local listings, listing websites, county records, and phone records to find potential clients. They do all the tedious, labor-intensive work every day so agents can wake up to new potential clients every morning. Landvoice provides a consistent, predictable source of sellers throughout the US and Canada. Within minutes of logging into Landvoice, a customer can see where they should focus their efforts that day. They know whom to contact and have multiple contact methods at their fingertips to begin making connections. Landvoice customers generate more than $25 million in commissions every month. The average Landvoice customer sees 2-4 new listings a month, while others add more than 20 new listings a month. Landvoice also offers team and broker accounts. Some teams list more than 140 properties in a single month using Landvoice.

Getting Involved

Visit the website www.landvoice.com to learn more. Or call 888-678-0905 to speak directly with a Landvoice success coach. They will look up a specific area, and let agents know where to focus their time, and can customize a subscription to best meet the needs and goals of each agent, team, investor, or brokerage. The success coaches have access to special, unpublished discounts to help agents list more properties.

Bruce Kellogg

Bruce Kellogg has been a Realtor® and investor for 38 years. He has transacted about 800 properties in 12 California counties. These include 1-4 units, 5+ apartments, offices, mixed-use buildings, land, lots, mobile homes, cabins, and churches.

Mr. Kellogg is a contributor and copy editor for two national real estate wealth-building magazines: Realty411, and REI Wealth Monthly. He is a recipient of an Albert Nelson Marquis Lifetime Achievement Award, listed in Who’s Who in America – 2019.

He is available for consulting with syndication, turnkey, joint-venture, and other property purchasers and note investors nationally, and other consulting assignments. Reach him at [email protected], or (408) 489-0131.

Bob Helms – The Godfather of Real Estate

/in Experts, News /by dulceIn June the world lost a pioneer, an icon, a gentleman, and a scholar. Bob Helms, a.k.a. “The Godfather of Real Estate”. He was 85 years old. He had been investing in real estate for over seven decades. Even in his 80’s Bob was active, planning, learning, growing, contributing and creating. He authored his book “Be In The Top 1%: A Real Estate Agent’s Guide To Getting Rich In The Investment Property Niche” when he was in his 80’s.

His book isn’t an advertisement, not a business card. It’s not an ego memoir. It’s a contribution, born out of a genuine desire to teach, to share, to pay it forward. We spend so much of our lives deep in the content of living. What was striking about Bob was the context. Bob’s context was contribution. You never got the impression that he was acting out of self-interest. Bob and I had many deep conversations over the years. But the conversation that stuck foremost in my mind was the very first conversation. He wanted to get to know me. He was genuinely interested in learning about me. He was the quintessential ambassador and made me instantly feel welcome. But I’m not an isolated case. Everyone I speak with who knew Bob had virtually the same first meeting experience. He left that same lasting first impression with everyone he engaged with. Bob was a people’s person. He loved people. It wasn’t an act, or a realtor’s gimmick. His genuine love for people burst through in every interaction. He carried an abundance mindset in an industry that is synonymous with turf wars. He was never insecure about sharing. There would always be enough to go around.Bob was successful in business in his own right. He helped build one of the largest real estate brokerages in the country out of his home market in Silicon Valley. The wave of growth in Silicon Valley no doubt played a role in his success. There’s nothing like being in the right place at the right time. But Silicon Valley is an incredibly competitive environment and only the best rise to the top.Bob distinguished himself as an expert in investment properties. He learned early on that a residential home buyer doesn’t generate a lot of repeat business. Active investors on the other hand, are deal junkies. They cultivate a deal flow. A single investor client with repeat business could bring the same level of business as twenty or thirty individual clients. Focus and attention on serving his target clients catapulted his business. These are concepts that are central to marketing in our current time. But think back thirty or forty years and Bob’s work was pioneering.

Image by Benjamin Hartwich from Pixabay

Bob was well known as the third member of the Real Estate Guys Radio Show duo with his son Robert Helms and Russell Gray. Now in its 24th year, this terrestrial radio show and podcast has listeners in over 190 countries. Whenever Bob was a guest on the show, his elder statesman wisdom shone through. Bob was a life long student. He took copious notes. Even though retired, he would sit at the back of a seminar with his notebook open, paying close attention and integrating what he was learning. There was always a lineup of people waiting to talk to Bob, to share their story, to ask Bob for advice. Bob would cut through the fog and get to the heart of the matter, but in the gentlest of ways. He would lead you to a new way of looking at the problem so that the best answer was clear. But he didn’t make you wrong, or naïve, or dumb in the process. He merely illuminated the path.Bob’s greatest love and accomplishment was his family. He was an integral part of the multi-generational Helms family.That doesn’t mean there weren’t problems. Of course there were. Everyone in life experiences adversity. There was no drama, no rebellion, only a quiet acceptance and a focus on clarity, learning and moving forward. The world lost a mentor. The Helms lost their “Papa”. His gentle but impactful manner is part of his legacy.

Victor Menasce

[email protected] http://www.victorjm.com 613-762-0162 347-708-8383

I have focused the past 9 years of my professional life on real estate investment. This started locally in Canada, and moved quickly into the US markets as the opportunities for great investments presented themselves. This was a right hand turn in my career. I spent the first 25 years of my career in the high tech industry. My past roles include, Vice President of Engineering at Wavesat, a developer of chips for wireless networks, and Chief Technical Officer at Applied Micro Circuits Corporation, a Silicon Valley based public company that develops processors for use in numerous consumer products including televisions and gaming. I was founder and Chief Operating Officer at Somerset Technologies. I also held several senior roles in marketing and engineering with Tundra Semiconductor. I started my career at Bell Northern Research and Nortel where I designed chips that were used to control the telephone network. For approximately a decade, 54% of the phone calls in North America were routed by a chip that I designed. I have conducted business in over 15 countries, have forged numerous partnerships, raised capital, been awarded patents, acquired businesses, negotiated deals, lead organizations, and brought about business improvement. On my 18th trip to Tokyo in a year and a half, it was clear that I was on the wrong path. The way I was working wasn’t right for me, nor for my family. I made the conscious decision to move full-time into the world of real estate investment. I am having the time of my life, leveraging the accumulated business learning and applying my skills to the world of investments. I live in Ottawa, Canada with my family.The Latest “Spooktacular” News about Airbnb

/in News /by dulceImage by Myriam Zilles from Pixabay

By Holly Lynn

Enjoy these treats while they last!

If Halloween decorations, costumes, and a smoky punch bowl are in the forefront of your mind for a great party, keep Airbnb off of your list of potential party spots for the holiday weekend.Image by Alexas_Fotos from Pixabay

In an announcement made by Airbnb, they are prohibiting large gatherings in an effort to do their part in the spread of Covid-19. Airbnb has stated that they will also bring legal action against certain unauthorized parties. This announcement comes a year after the shooting of five young people at a home–listed on the Airbnb platform– in Orinda, California.Airbnb posted on their website, “To strengthen our hosts’ protection against parties amid concerns about a second wave of the pandemic, today we’re announcing that we’ll be prohibiting one-night reservations over the Halloween weekend in entire home listings in the United States or Canada. Further, we’ll bolster our existing protections and technologies aimed at stopping as many large gatherings as possible that weekend.”Starting October 2nd, guests will be unable to book entire homes for a single night on 10/30 or 10/31 in the United States and Canada. For previously booked reservations on these dates, Airbnb will cancel and reimburse the guest. However, hosts that have confirmed bookings will receive a full payment. In addition to the rigid restrictions, Airbnb will be implementing technology that will curtail guests that try to book last-minute, who live locally and do not have a positive history on the platform.

Airbnb also asserted, “Also as the weekend approaches, we plan to remind guests making successful reservations to take place between October 28 and November 1 that parties are not allowed in listings. They will also be required to attest that they understand that they may be subject to removal from Airbnb or legal action if they violate Airbnb’s rules on parties.”Airbnb will be beefing up their neighborhood support line to take calls throughout the weekend to respond to any issues from hosts and neighbors. With pandemic numbers on the rise and the recent rise in civil unrest, Airbnb is striving to protect hosts, guests, and neighborhoods from unnecessary problems and to keep everyone safe.

Holly Lynn, Queen of Capital ™ is an Airbnb and Short-term Rental Management Professional, author, and media influencer. She can be reached at www.hollylynn.com or by email at [email protected].

To short-term rent your property, you can text her at 415-317-6071.

Loans Solutions Designed for Real Estate Investors

/in News, Sponsored Posts /by dulce Here at Finance of America Commercial, we strive to be a one-stop-shop for all your real estate investing needs. We offer investment loans for a variety of residential non-owner occupied property types and needs, including:

Here at Finance of America Commercial, we strive to be a one-stop-shop for all your real estate investing needs. We offer investment loans for a variety of residential non-owner occupied property types and needs, including:

- Fix & Flip Rehab Property Loans –

Short-term purchase or refi loans for rehab. These loans are available to experienced investors, with a minimum FICO of 620. - Bridge Property Loans –

Short-term purchase or refi loans that are ideal for holding assets — also available to experienced investors with a minimum FICO of 620. - Single Rental Loans –

Long-term purchase or refi loans for individual rental properties with the option for cash-out*. Loans are asset-based, so no personal income verification is needed! - Portfolio –

Long-term (5, 7, or 10-year) purchase or refi loans for multiple rental properties (5+ doors). A minimum FICO of 660 is required. Loan amounts from $750K – $5MM. - Portfolio Express –

Long-term (30-year fixed) purchase or refi loans for multiple rental properties (2-8 doors). A minimum FICO of 600 is required. Loan amounts from $300K+.

Interested? Call today to learn more and get a quick quote!

Finance of America Commercial

Reach out for more information!

p: (855) 809-6115

[email protected]

FOAcommercial.com/

Exposure limits and property loans are subject to investor and business credit approval, appraisal and geographic location of the property and other underwriting criteria. Loan amounts and rates may vary depending upon loan type, LTV, verification of application information and other risk based factors. Application fees, closing costs and other fees may apply. Each loan is subject to property approval under Finance of America Commercial terms and conditions. Each property has an individual secured loan. *Approval for cash-out depends on many loan factors and may not be available on every loan. This email is an advertisement.

Questions? We are here for you.

[email protected]

©2020 Finance of America Commercial LLC is licensed or exempt from licensing in U.S. states | NMLS ID #1133465 | 6230 Fairview Road, Suite 300, Charlotte, NC 28210 | (800) 227-8107 | AZ Mortgage Banker License BK #0926974 | Licensed by the Department of Business Oversight under the California Finance Lenders Law | Finance of America Commercial LLC only makes mortgage loans for business purposes.

High Cap Rates, Low Cap Rates, and Successful Real Estate Investing

/in Investing Tips, News /by dulceImage by Alexander Stein from Pixabay

By Rusty Tweed

Using Cap Rates to Make Informed Real Estate Investing Decisions

Don’t be fooled by the simplicity of the cap rate, or capitalization rate — this simple calculation can reveal a trove of insight on potential real estate acquisitions. Some have even argued that this number is the single most important metric for any budding real estate investor to understand.

Our guide makes it easy to wrap your head around cap rates and use them to your advantage. So, without further ado, let’s jump in and learn.

Image by Gerd Altmann from Pixabay

Image by Gerd Altmann from Pixabay

What Can a Cap Rate Tell Me?

In a nutshell cap rates provide a quick and simple way to help get a feel for a property’s overall investment potential and a balance with the property’s levels of risk and return on investment. To better understand how to achieve this, we’ll look at a few examples.

Cap Rate Formula: How to Calculate Cap Rate

The cap rate formula is simple: Divide net operating income (NOI) by the property value (or the purchase price).

Cap Rate = Property’s Net Operating Income/Property Value (or Purchase Price)

We can find net operating income by subtracting the property’s annual expenses from its annual gross revenue. Expenses will include things like operating expenses, management, taxes, and anything else you must pay to keep the property running.

Image by Michal Jarmoluk from Pixabay

Image by Michal Jarmoluk from Pixabay

Careful though — debt payments, capital expenditures, and depreciation deductions are NOT included in the calculation. This is because we are trying to get a sense of the property’s performance irrespective of any mortgage arrangements, improvements we might make or depreciation schedule that may be selected.

For revenue or cash-flow, you’ll simply plug in what tenants currently pay in rent (total rental income), as well as any other sources of income (Ex: a laundromat or a parking garage).

Should I Use Market Value or Purchase Price as my Denominator?

For the bottom of our capitalization rate fraction, market value is generally preferred. A purchase price can be used if the property has sold recently, but using a purchase price from ten years ago won’t result in a meaningful cap rate. If we are considering purchasing the property, it would be very useful to plug in various possible purchase prices to see what rate we’ll achieve. This can be a helpful guide when determining an acceptable offering price.

Examples

Suppose you’re an investor considering buying Property A. The property is valued at $1,000,000 and generates an NOI of $50,000 annually. Plugging this into our equation we get:

Cap Rate = $50,000/$1,000,000 = 5%

Suppose you compare Property A to a similar property that is valued at $1,000,000 and has an NOI of $60,000. This gives us a Cap Rate of 6%. If all else between Properties A and B is equal, the higher cap property is the better buy.

Investors can also think of cap rate as a measure of their rate of return on their investment. For example, with the 5% rate, an investor earns 5% of their purchase price annually and will recoup the purchase price in the 20 years.

What Does a High Cap Rate Mean? What About a Low Cap Rate?

Image by Arek Socha from Pixabay

Image by Arek Socha from Pixabay

There’s a lot more to cap rates than “higher cap = better investment.” No two properties are created equal, and in practice, properties with a very high cap rate often turn out to be higher risk as well.

Let’s think about our capitalization rate equation again, and what factors might contribute to driving it higher. We’ll look at Property A again, which had an NOI of $50,000, a property value of $1,000,000, and a 5% cap rate.

If we want to raise our rate by changing NOI, then NOI will have to increase. This could be accomplished by increasing revenue, or lowering expenses. In either case, increased NOI is typically a good thing.

Now, let’s say we want to raise our cap rate by modifying property value. In this case, property value will have to decrease. A decrease in property value could be driven by several things, including the worsening reputation of a location or the revelation of some costly deferred maintenance.

To summarize: high cap rates are great, but they can also point towards factors that increase the risk of an investment. A property with an 18% cap rate might need work, and might not be in a highly desirable area. Ask yourself, “Is this amazingly high cap rate stemming from high NOI, or low property value?”

What Drives Cap Rate Lower?

Let’s consider what factors might contribute to driving a cap rate lower. If NOI decreases, our cap rate will decrease as well. We also see lower cap rates in the case of property appreciation — and appreciation is a very good thing.

If a property appreciates significantly, but revenue trails this appreciation, the property’s cap rate will go down. Lower cap rates can indicate high-value properties, suitable for investors seeking lower risk. Generally, better neighborhoods trade at lower cap rates.

High vs Low Capitalization Rates

Image by Arek Socha from Pixabay

Image by Arek Socha from Pixabay

High cap rates are driven by two things — higher NOI, and lower property value. If a building needs renovation, this could result in a lower property value and, therefore, a high cap rate. With large amounts of maintenance needed to bring a building up to date, that high cap rate might mislead the investor and leave him with far more work and expense than he bargained for. But, if an investor is interested in updating a property, these high cap properties can potentially provide large rewards.

These property types are best left to investors who have experience, or who have a trusted guide that can help them find the right properties that balance their investment goals with their risk tolerance.

Figure Out What You Need to Know

If you know any two of the three variables of the capitalization rate formula, you can figure out the whichever variable you’re missing. This can be useful in a range of situations. For example, suppose you are trying to determine what you should offer on a property. If you know the property’s NOI and have a cap rate goal you want to target, then you can calculate what purchase price will give you the result you’re looking for.

For example, suppose your target is 8%, and you’re looking at a property that generates $100,000 in NOI:

8% = $100,000/Purchase Price

Purchase Price = $100,000/.08

Purchase Price = $1,250,000

Or, if you have $500,000 to spend on an investment property, and are targeting a 7% cap rate, you can figure out what level of NOI is required for you to meet your goals:

7% = NOI/$500,000

NOI = 7% * $500,000

NOI = $35,000

Re-Cap

There’s no set range for which are “good cap rates” — they’re most useful as a comparative tool between a few potential purchase opportunities that are similar in terms of location and kind.

High cap rate properties can be lucrative, but also come with an increased level of risk. If you’re new to high-cap real estate investing, it’s best to partner with someone who has the experience and know-how to get a deal done right. At TFS Properties, we specialize in pairing investors with properties that match their investment profile and risk comfort-level while guiding them through the journey of building a secure investment portfolio.

Wondering What to do NOW In Real Estate? (Part 2)

/in Investing Tips, Landlording, News /by dulceImage by Gerd Altmann from Pixabay

By Jimmy Reed

So, what do you do when the market is flooded with so much Competition? How do you really get Wealthy in Real Estate? Getting fed up!?? How about Real Wealth Deals???

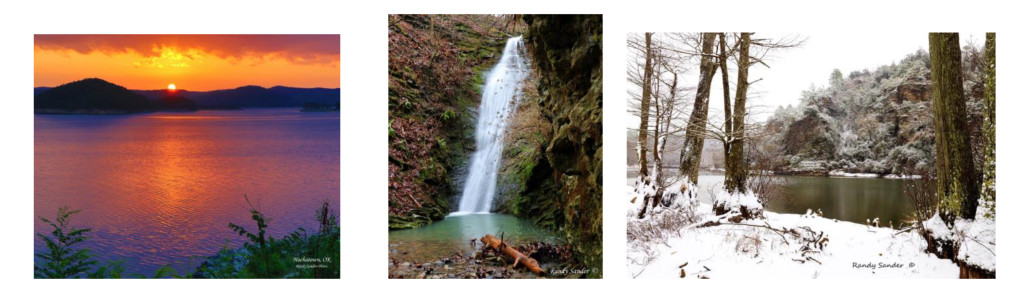

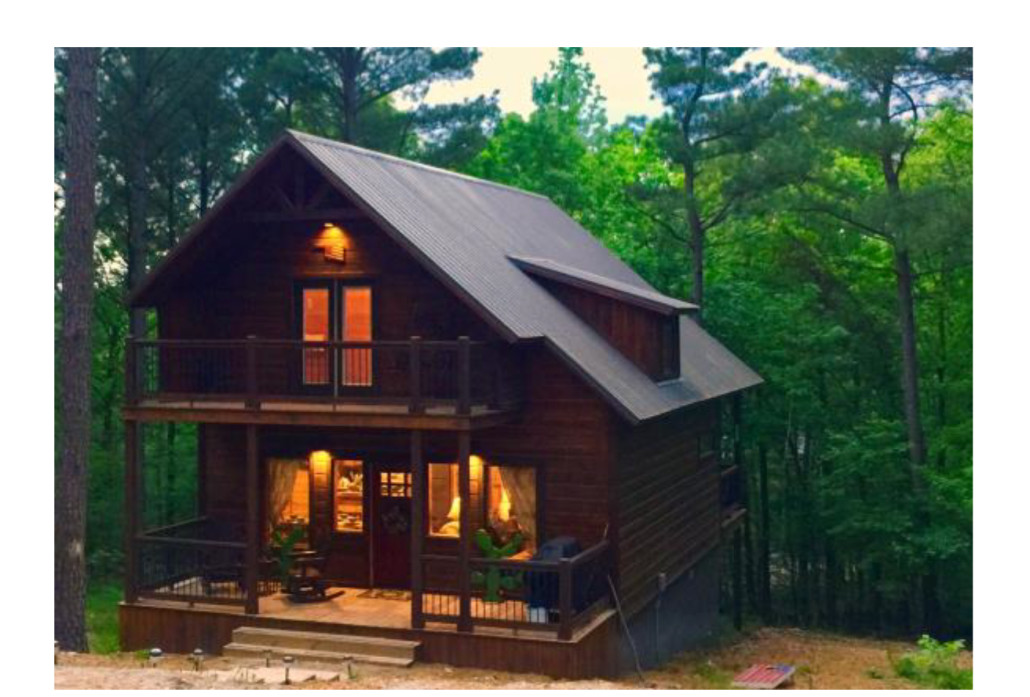

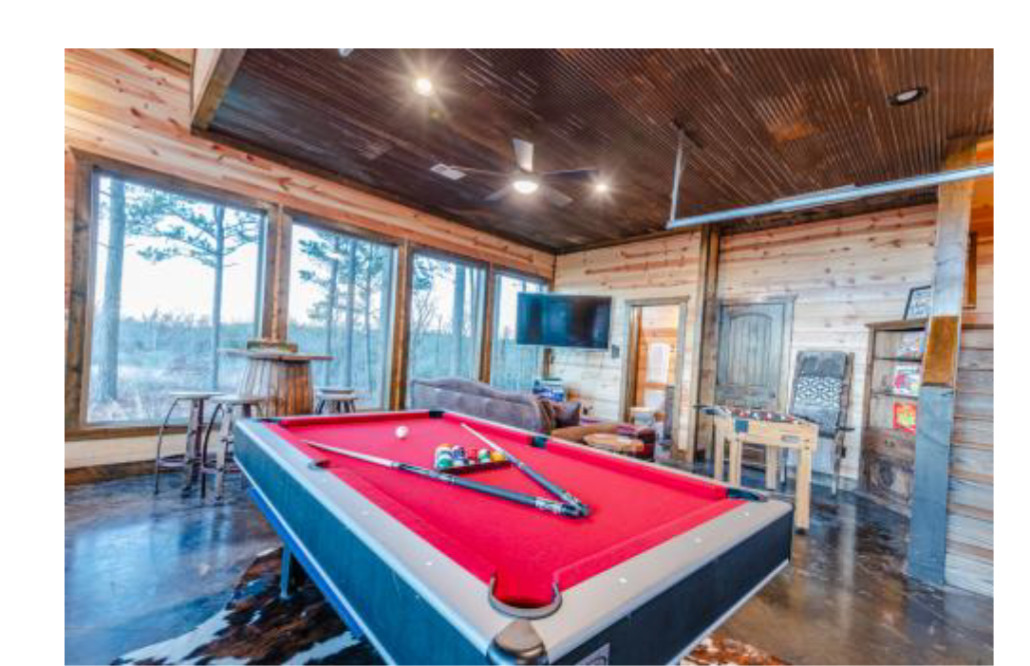

Hope you enjoyed the last article! Part 1 of “What to do NOW in Real estate?” As we ended last time, we started to mention VRBO’s vs a Standard Rental. We also talked about Hot Markets and that the Dallas/Fort Worth (DFW Area) is one of the Hottest in the country. Since the last article we have also had the Covid-19 Virus which at this time has literally shut our economy down. The timing however is really interesting since we are now about to go into a market that is only 3 hours away from the DFW market and growing at the same pace. Now last time I talked a lot about the Granbury market which was only 30 minutes South of Fort Worth where we are building brand new Constructions all Brick for Rentals. But let’s now switch the mind set to VRBO where we can Double & Triple our Cash Flow! You heard me right! So now we move North of DFW to Broken Bow Oklahoma. And to help me out I want to introduce you to a friend, former student, and a Rock Star on VRBO’s in Broken Bow, Miss Kelli Haus. I asked Kelli to help contribute to part 2 of this piece since she has literally taken the VRBO in Broken Bow to a new level. So first keep in mind we are looking at cabins now verses a standard house. We are looking at Nightly rent vs Monthly rent. And this is where you will see how you could nearly triple your Monthly Cash Flow with a VRBO in Broken Bow. Now I meet Kelli a few years ago when she signed up for our Platinum Program here in the DFW area. She soon informed me she was wanting to move into Vacation Rentals, I told her it was not my specialty at all. A few years later and Kelli has become a Rockstar of VRBOS! So here is a little about Kelli, and some info on Broken Bow, OK. Kelli has 6 years’ experience in the real estate field, she is known as the Beavers Bend Realtor. However, Kelli does more than just help her clients buy and sell cabins, her secret sauce is her step-by-step plan for her clients so they can not only enjoy a vacation at their cabin but also turn it into a big money maker. Kelli uses this same plan on her own Beavers Bend investment properties so she practices what she preaches, and she can not only show you how the plan has worked for her, but so many of her clients. Her ideal client is someone who is looking to make memories and extra money.Hello all, I’m Kelli Haus and I am a cabin investor in Broken Bow, OK and a full time Realtor in the Broken Bow area, specializing in helping families’ and investors purchase an income/second home/vacation luxury cabin that pays for itself.Did you know that according to a recent VRBO report “71% of millennial travelers say they consider staying at a non-traditional vacation rental”? VRBO rentals are up 30% from last year! Broken Bow, Oklahoma. I am going to assume you’ve never heard of it. It is an outdoorsman’s paradise! It is only three hours away from the DFW metroplex. A perfect family getaway that makes most feel like they arrived in Colorado. The area is also known as Hochatown, Oklahoma which is a few miles north of Broken Bow. Through good economies and bad economies, this place is always a hot market with vacationers packing the area every chance they can. As long people in the DFW want a quick getaway from the metroplex, this market is going to continue to be on the rise until there are enough cabins to accommodate the mass influx of vacationers. Hochatown is approximately 95% luxury investment cabins that are occupied by residents from Texas, Oklahoma, Arkansas and Louisiana that flock here YEAR-ROUND. That’s right, there is not a down season! VRBO’s travel trend report projects that the Broken Bow/Beavers Bend State Park lake area tourism will grow 50% in 2020. If you have never heard of Broken Bow, Oklahoma your first question is going to be why the heck would anybody want to invest in this remote area? The answer is Broken Bow Lake is one of the most gorgeous lakes in the country. Its pristine natural shorelines are not riddled with boat docks and lake houses. Ten years ago, this lake was a hidden gem of a secret for the locals to enjoy. This lake is crystal clear and provides some of the best fishing in the country. The lower Mountain Fork River feeds off the lake has some of the best fly-fishing in the world. Believe it or not most people never even see the lake when they rent a cabin. They’re too busy hiking some of the most gorgeous trails in the state park, hitting up the local breweries and wineries, roasting s’more‘s on the campfire, renting ATVs, horseback riding, kayaking or canoeing on the river, grilling out on the back porch and hitting the cabin hot tub! The Choctaw Nation has recently purchased 700 acres here in Hochatown and they will be building a family friendly casino right here amongst these luxury cabins. This casino is going to draw so many more visitors to the area that have not heard about Broken Bow. It’s rumored to believe that only 50% of the DFW metroplex is aware of Broken Bow. There are more than 7 million people in DFW and Broken Bow is growing in correlation with the growth of DFW. There is certainly a buzz in Texas about Broken Bow and in my opinion, there are not near enough cabins in the area to support the demand of people that want to vacation here. Even during this Covid crisis, all the cabins here are full of people “sheltering” at a cabin. And there has been no slowdown of investors inquiring about investing in Broken Bow either.

The question I get asked the most often is which is the best size, price, and type of cabin for an investment? There is not a good answer to that question. One-bedroom cabins are booked more nights per year but at a lesser nightly rate. The big cabins that sleep 25 to 30 people are booked less nights per year but at a much higher rate, up to $2,000 a night!If managed properly every cabin in Broken Bow can be paid off in 8 to 10 years. So, would you rather have a $300,000 one bedroom or a $1.5 million cabin paid off in 8-10 years? Every single cabin here pays for itself every…single…month. Some months, like February and April, can be a little slow but this year they have not been at all! Each year this area is growing more and that means more net profits, even in what used to be known as the slow months. Cabins are booked every single weekend, every holiday, and every time school is out of session, I encourage all cabin owners to raise their nightly rates 10-30%. Both of my two-bedroom two bath cabins that have a loft, both sleep eight or nine people are booked 18 days a month on average year-round. June and July are the busiest months of the year. Both of my cabins were booked solid in the summer months except for the rare times of a one-night opening between bookings. Generally speaking, a cabin will make 45% net profit. If you hire a management company, they are going to expect 25% to 40% of your gross income. 95% of my client’s self-manage their cabins with my proven method of doing so. But that is a whole other and I am certainly happy to answer questions like them, such as:

- How do I manage my cabin from 2000 miles away?

- How do I minimize phone calls from my guests to the point where I do not get any?

- How do I maintain five-star reviews on Airbnb and VRBO?

- What do I do if I have a maintenance emergency in the middle of the night?

- Do you share your team of people on the ground in Broken Bow to help Cabin Owner’s?

I encourage my clients to purchase new construction or a cabin that is less than three years old. That is another discussion for a different day. About70% of cabins for sale can be found on Realtor.com. Not all real estate agents list their cabins on any MLS. New construction cabins cannot be found online anywhere. You must have a connection to a builder to find those hidden gems! 80% of my clients purchase a new construction cabin that has not yet been completed.I know I have just scratched the surface with this article and there are many more questions to be asked. I am extremely grateful I discovered the Broken Bow area. I have two young children and with the two cabins that I do own now, I will be able to use the $2,000 monthly net profit to pay for my children’s college education.

I do not see this market slowing down anytime soon as I do not see the DFW market slowing down. It has been rumored that Broken Bow will be the next Branson, Missouri, or Lake Tahoe.I do not have enough cabins to show my clients even during this possible recession. Construction has not slowed down either. Can you think of a hotter market? I hope to hear from you soon, and Thanks Jimmy for allowing me to contribute to your article! Well I hope you just realized the opportunity you have been presented with. How regardless of where you live you can own a Vacation/Investment Cabin that can produce up to nearly Triple the Cash Flow vs that from an ordinary rental. Yes, I know if you are Old School you understand Monthly Rentals. Trust me I’ve had rental for over 30 plus Years! But go back and read the last article “Part 1”Remember the Make Money vs Wealth? Wealth is what you are looking for in real estate. But I understand if you want a rental, we have them for you as I said back in the first article down in Granbury. By the way you could VRBO the Granbury properties. See these articles were written to open your eyes to see the opportunity of not so much what you invest in but where! Hot, Emerging Markets will always out pace Appreciation and Cash Flow due to demand, and the location with in what I call the Hot Zones. Texas is a Hot Zone always has been and even more so today. Make sure you go back in read the first article from last month in Realty 411. Refresh yourself to what our Goals were. Buying and Selling vs Buying and Holding, real Wealth! Look back at some of those trainings we offer on my site at www.JimmyReed.net. Create some Cash but parlay that into Creating Wealth through Rentals are maybe even VRBO’s so you can Double & Triple that Cash Flow. Well I hope this opens your mind up to investing in Hot Zones. To understand so many people come from all over the World to invest in America because of all the opportunities. My question to you are you willing to travel a few states and end up in the middle of the country and the most lucrative Hot Zone, TEXAS! So if you’re still riding the fence here’s a thought make sure to keep an eye out in the magazine and Realty 411Marketing emails so you can make it to Texas for the Lone Star Expo! Yes in October the Lone Star Expo is right here in my backyard, Arlington, TX. And if you remember from the first article we plan on doing a bus tour down to Granbury to look at those New Construction Rentals. Who knows Kelli may be at the Expo to answer questions about Broken Bow. Fact stay a few extra days and rent a cabin in Broken Bow! In Closing, the main thing is position yourself so you can maneuver positively so no matter where the market turns. If you keep your eyes on the market and not so much on the quick buck, you can become very successful even Wealthy at this real estate game! Be Blessed with Success! Jimmy Reed

Jimmy V. Reed

Jimmy V. Reed of Fort Worth, Texas has been investing in real estate since 1987. In 1991, he started conducting full-day training sessions on Wholesaling. He then began teaching and mentoring others throughout the country. He is currently the founder of the Fort Worth Real Estate Club www.1REclub.com and has his own real estate training company that includes Wholesale, Probate, Mentoring & a Biblically based Debt Free training course and more! More info available at www.JimmyReed.net