UBTI and Mortgage Debt Funds

By Edward Brown

According to Investopedia, Unrelated Business Taxable Income [UBTI] is income regularly generated by a tax-exempt entity by means of taxable activities. This income is not related to the main function of the entity and prevents or limits tax-exempt entities from engaging in businesses that are unrelated to their primary purposes.

UBTI greater than $1,000 is subject to taxation. For 2019, the highest tax rate was 37%.

Most forms of passive income, such as dividends, interest income, and capital gains from the sale of capital assets, are not treated as UBTI.Many investors use their IRAs to invest in Mortgage Debt Funds [MDF]. MDF lend money similar to a bank where they take a deed of trust as collateral for the loans they make to borrowers. Typically, income derived from MDF are not subject to UBTI even though the income derived at the MDF level is not passive in and by itself. The IRA investor, however, is a passive investor; consequently, it is not usually subject to UBTI. There are times, however, when this is not so. Ways that UBTI can be triggered for the investor in a MDF can involve a few different scenarios; if the IRA borrows on margin to purchase the MDF; if the MDF borrows within itself to generate income [called a leveraged MDF], or if the MDF ends up foreclosing on too many assets and the IRS treats the MDF as a dealer in real estate. [This last risk is relatively small, as most MDFs would not be treated as being in the business of buying and selling real estate by the IRS under normal circumstances]. The first risk [the IRA borrows to invest in the MDF] is also not a normal risk, and the investor has control over this by not borrowing to invest in the MDF]. It is the second risk that is the main one, as the MDF controls how much [if at all] it borrows.

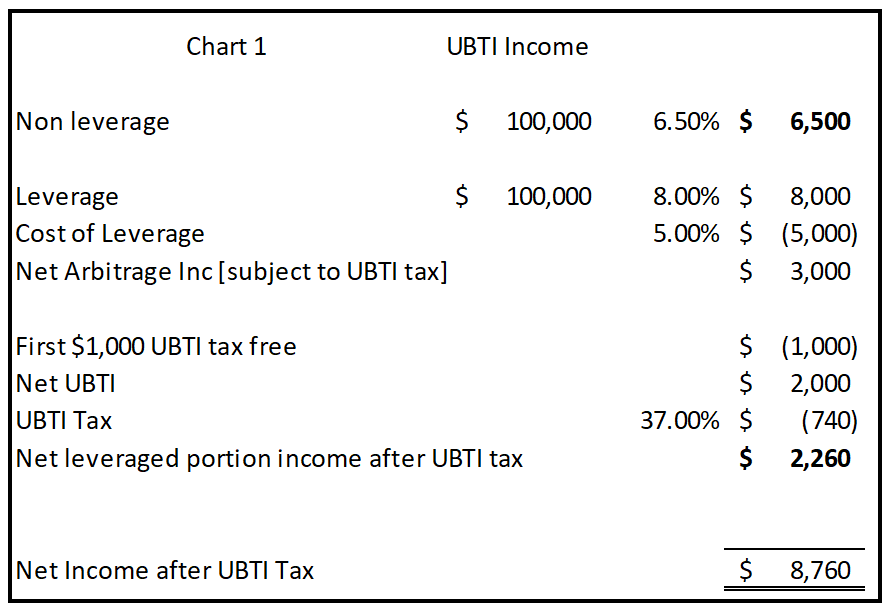

Most MDFs that use leverage usually center around attempting to enhance its yield to investors. If the MDF can borrow from a bank at 5% and lend it out at 8%, there is a 3% arbitrage in favor of the MDF; however, this may possibly put undue risk in its portfolio – depending on how much leverage is used and the bank covenants required to obtain this leverage. In addition, for those investors in the MDF who use their IRAs [or 401(k)s, pension, or profit-sharing plans], this leverage may subject the income derived to create UBTI.Certain key factors for the investor’s IRA are; how much the IRA has invested in the MDF [because the first $1,000 of UBTI is not taxable to the IRA, the income derived by the MDF, and how much leverage was used to produce that income. In addition, it is important the length of time that leverage was used, as the UBTI will be calculated using a formula. For example, Chart 1 shows an IRA investor having $100,000 in a MDF generating a rate of return of 6.5% [without leverage] will not have its $6,500 income subject to UBTI as no leverage was used. If the MDF chooses to leverage the Fund 50% [50% investor funds and 50% bank funds] for the entire year and can borrow at 5% and invest that portion at 8%, the net income to the IRA [after subtracting the bank interest expense and UBTI tax ] would be $8,760.

Many IRA investors may not feel that the extra $2,760 earned in this example is worth the risk. When a real estate syndication goes bad, it is usually only for one reason – leverage. If no leverage is used, then, usually, the only way for a real estate investor to lose substantially most or all of his/her investment in these types of investments [be they REITS, Limited Partnerships, Limited Liability Companies, etc.] is if the real estate taxes associated with the underlying real estate are not paid. When leverage is used, the banks have first priority over the assets. Simply, the more leverage that is used, the riskier the investment.It is important for those investors using their retirement savings to invest in assets that can produce UBTI to ask the manager how much debt/leverage is used in the investment. A small amount of leverage is not usually taking on undue risk, especially if that leverage is used sparingly. Mark Hanf, president of Pacific Private Money, says that he likes to use a small amount of leverage, and on a very short term basis for his MDF for specific reasons; mostly, to help fund short term loans in his Fund when he is expecting payoffs on other loans or anticipated investor money flowing in. As soon as payoffs or investor money comes in, he immediately pays down line of credit [leverage]. This creates the benefit of having the ability to close deals that he might not otherwise have been able. The short-term nature of this leverage does not usually create enough UBTI income to concern the retirement investor. In addition, the short duration of the leverage puts his Fund at minimal risk; however, since the rate of interest to obtain the leverage is less than the income derived from it, his Fund still benefits from a small amount of positive arbitrage.

The retirement investor would be wise to look for Funds that conservatively use leverage in their MDF to avoid UBTI as well as undue risk. In addition, the investor should calculate the anticipated UBTI ahead of time to determine how much should be invested, as only the first $1,000 of UBTI income is tax free; The investor can then decide the risk reward of investing in a MDF that uses leverage.

Edward Brown

Edward Brown currently hosts two radio shows, The Best of Investing and Sports Econ 101. He is also in the Investor Relations department for Pacific Private Money, a private real estate lending company. Edward has published many articles in various financial magazines as well as been an expert on CNN, in addition to appearing as an expert witness and consultant in cases involving investments and analysis of financial statements and tax returns.