Is Austin The Wrong Place to Invest In 2021?

Image from Pixabay

By Adiel Gorel

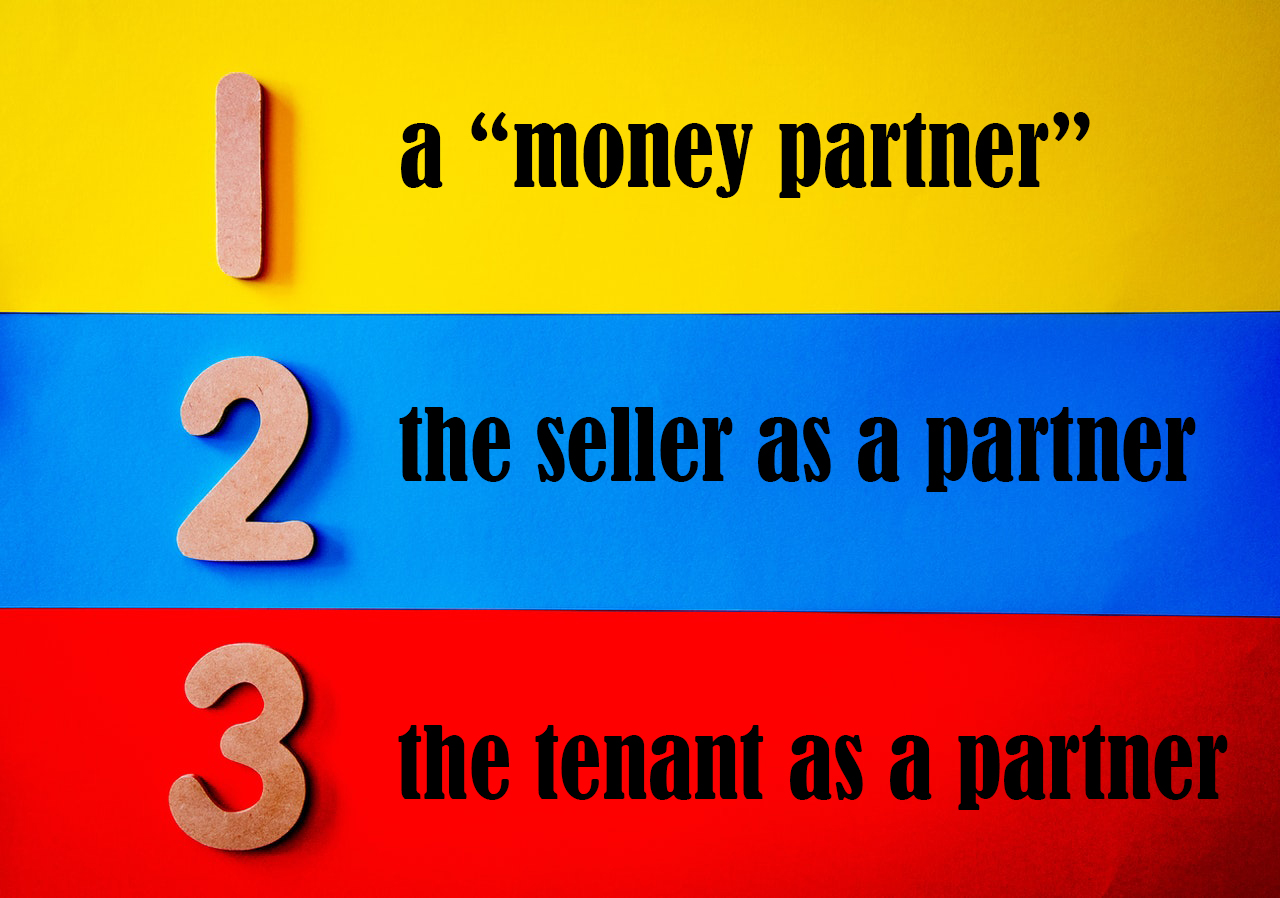

I get many calls from people interested in buying in various cities and want my opinion.One of the popular markets right now is the Austin metro area (people get excited about the overall thriving of the local high-tech scene, Elon Musk publicly decamping to Austin, and others moving there from California). It is tempting to think of Austin as a good destination to buy in 2021. However, in my opinion, it is not! Austin, in fact, is a good city to be a SELLER in 2021. Austin prices have climbed rapidly in the past six years, while rents went up much more slowly. As a result, the rents are too low to cover all expenses. One expense in Austin (and in the state of Texas overall) is the very high property taxes. The property taxes in the Austin metro can get to almost 3% of the home value per year (depending on county and town). That is over 2.5 TIMES the property tax rate in Oklahoma (or California). Together, the high prices, relatively low rents (relative to the prices, that is), and the high property taxes, as well as high insurance costs, create an untenable cash flow.

Image from Pexels

Here is a partial headline of a Business Insider article “Elon Musk and other tech powerhouses are flocking to Texas, pushing an already bonkers real-estate market to new heights”. Just logically, do you want to be a buyer in a market that is “already bonkers” and now is being pushed up even more? They have a name for such a market in the real estate world: “A strong Seller’s’ Market”.Do you want to be the BUYER in that strong Sellers’ market? You will be the one paying “bonkers” price to the savvy sellers, fending off multiple offers higher than list price.It is very tempting for a California resident to say, “What? I can buy a new home in Austin for “only” $320,000? That is so cheap! Yes, it is. “Cheap” relative to San Francisco prices. However, it is not cheap to buy as a sound rental home, and has bad cash flow. Austin is a place where many of our savvy investors are now SELLING, as the selling market is strong. It is not uncommon to see an investor selling one Austin home and buying 3 brand new homes in a 1031 tax-deferred exchange in Oklahoma City, or Tulsa, or Baton Rouge, or Central Florida. This move creates much more quality real estate owned, more 30-year fixed loans at todays’ super low rates, and brand-new properties with brand new roofs, ACs and all other parts of the homes. Similar logic applies to the Dallas Ft Worth metro area (DFW), Houston, Phoenix, Las Vegas, Nashville, Denver, Salt Lake City, Boise, and others. I even get some investor talking about Seattle and Portland, which make no sense at all. Some misguided reporters (who in many cases have no actual experience in real estate investing themselves) confuse high prices and growth with an attractive place to invest in. The two are not necessarily linked. An example of another very popular destination for Silicon Valley people leaving to other states, is Miami. Miami is popular, large (much larger than Austin, for example), has an international airport, great weather, beautiful beaches, and proximity to great vacation spots. Miami also has a thriving tech sector. Sounds perfect, right? We should invest in Miami, right? No! Miami prices are way too high to make sense at this time. While the property tax is “only” about 160% of that in Oklahoma or California, the price/rent ratio makes it an unattractive place to invest. Miami has been a magnet for the wealthier set of tech and finance people as of late. The prices reflect it. There is an interesting article in Business Insider written by a tech person who had moved from San Diego to Austin and regrets it. It’s titled: “I moved my family from California to Austin, Texas, and regretted it. Here are 10 key points every person should consider before relocating.” The author mentions the harsh Texas heat, coupled with humidity, which, in the summer keeps you indoors and runs your AC 24/7, while also bringing scorpions and the like, and being hard on the houses. Of course, he mentions the super-high property taxes and high insurance costs. He talks about the very high cost of power and water, much higher than he had in California. Overall, he was surprised by the cost of living being much higher than he had anticipated. He mentions the travel difficulty, as Austin doesn’t have a large airport, requiring an extra “hop”. He laments the relative lack of public parks and spaces, to which he was used in California. While this is only the account of one high tech family who moved to Austin, and may not reflect everyone’s experience, some of the points are absolute.

Image from Pixabay

We have investors who actually LIVE in Austin. They are absolutely not interested in investing in Austin. They live there. They know how little sense it makes to buy in Austin in 2021. They seek investments in saner markets where the prices, rents, and property taxes, are in much better balance. We also have investor who live in Miami, Phoenix, AND Las Vegas, as well as Portland and Seattle, among many other places. All these investors wouldn’t dream of buying rental homes in the market they live in at this time. They know the insane sellers’ market that exists there, and the way-too-high prices.This phenomenon is not new. Investors declare they want to “Buy Low, Sell High”. However, in reality, many investors end up “Buying High and Selling Low”. Right now, Austin is the darling market touted for its growth and Elon Musk. The people who are buying super-high in a “bonkers” market, pumped by the media hype, will be the first ones to sell frantically when a recession hits, or even lose those homes to foreclosure. We have seen these scenarios throughout history, time and time again. You see the same phenomena in the stock market. People secretly love to “Buy High”.The reason is usually “But this market will appreciate a lot!” Really? You mean you know the future? No one else does. Just because a market behaves a certain way, and even booms, it is not necessarily a guarantee of everlasting constant appreciation. We have seen it in many areas of the country. One other factor that is important to discuss is, again, the heart and soul of single-family home investing in the United States. The reason single family rental homes change futures so effectively and powerfully: The 30-year fixed-rate loan. I talk a lot about the wonder of this loan. A very quick recap for new readers: The monthly PI payment never changes, while everything else in the US economy constantly changes with the cost of living. Same is true for the mortgage balance, which goes down due to amortization, but also never keeps up with the cost of living. This creates incredible futures for people, as inflation constantly erodes the real value of the loan balance and monthly PI payment. No need to wait for 30 years. Typically, after 12, 14, 16 years, the loan balances are very small relative to the home price. The monthly payment is very small relative to the rent. It is not uncommon for a person to find, after 14 years, that the loan balance (even though the loan still has 16 years to go), is merely 20%-25% or so of the home price. Many sell a couple of homes at this point, and use the after-tax proceeds to pay off several other small loans, and leaving several free and clear homes, enabling them to retire. People also see how this can send kids to college (even costly colleges), and achieve many other long-term financial life goals.

The reason I hark back to this point in this article, is to remind you that the most important point is to buy a good new single family rental home, put a down payment, and then get the constant power of inflation and the payments by the tenant, to pay off and erode the loan balance, building equity for your future wealth. With today’s astoundingly low rates, strong results may be seen even sooner, perhaps 10, 11 years.The single-family home is the VEHICLE to let inflation work its magic on the 30-year fixed-rate loan. The location of where you buy the home (as long as it’s large metro areas in the Sun Belt states, where the numbers make sense), is of secondary importance. It would behoove the smart investor to buy in a market where the prices are not “bonkers” and where the rents measure up to the price well, preferably in an environment where property tax and insurance costs are low. This enables the owner to enjoy cash flow (especially with today’s low rates), which building their wealth for the future with the help of inflation.

ICG (International Capital Group) Real Estate Investments was established in the 1980’s. Adiel Gorel, founder and CEO, has been helping people achieve financial security for over three decades, and in that time worked with investors to purchase over 10,000 homes. Gorel is a real estate broker in several states in the U.S., an international keynote speaker, and notable author of three books: Remote Controlled Retirement Riches – The Busy Person’s Guild to Real Estate Investing, Invest Then Rest – How to Buy SingleFamily Rental Properties and Remote Control Retirement Riches – How to Change Your Future with Rental Homes. He has been featured on major television and radio networks across the country and in Fortune Magazine. He has also been featured on Public Television with his show, “Remote Control Retirement Riches with Adiel Gorel.” To invite Adiel Gorel to speak for your group, email [email protected] and visit AdielSpeaks.com. For more information on ICG Real Estate Investments visit icgre.com.