By Garrett Sutton, Esq.

Throughout history, kings and nobles have sought to protect and defend their valuable real estate. Castles were once the preferred method of keeping marauders at bay. In today’s world, with lawyers and governments now leading the attacks, protection is no less important. In my latest book, Loopholes of Real Estate, we compare castle fortifications and asset protection, as they are quite similar in history and purpose.

But for today, without the expense and zoning issues of actually building a castle, what is the best way for you to hold real estate? There are several scenarios for real estate investors with varying asset protection options, so let’s look at a new client of mine who uses a few of the different options himself.

Sammy is an astute real estate investor. He had started out as a carpenter working for a company that both built homes and filled in their time with remodeling jobs. He soon realized that the clients who spent $10,000 with the company to remodel a property were turning around and making $50,000 when they later sold the property.

Sammy liked his job, but even more so, he liked to make money. So he started by buying a run-down property at a discount that he could fix in his spare time. While he experienced a few setbacks and some learning pains, when the remodeling and painting was completed, Sammy had a $20,000 profit after the sale.

That was enough to launch Sammy into his new career. Since then, Sammy has been buying distressed properties, fixing them up and selling them. In the last six years, Sammy has also been fixing up duplexes and 4 plexes and keeping them for his own portfolio. To further his real estate options Sammy has also started building spec houses for sale and profit.

Sammy has assembled a good team of professionals. He has learned from his CPA and attorney that each of his three real estate activities – remodeling for quick sales, holding and keeping, and building homes for speculation, or spec home sales – require a different legal strategy and a different means of taking title. His strategy is as follows:

- Remodel for quick sales. This is the strategy Sammy had first started with and it continues to constitute a significant portion of his profits. Still, as more new investors are getting into “fixing and flipping,” the sale prices for distressed real estate are increasing. Sammy knows what his margins are and won’t bid on dilapidated yet overpriced properties as others have done. Nevertheless, there have been plenty of good fixer-uppers in his area to acquire.

Because Sammy has been flipping several properties a year, he is subject to ordinary income taxation. Since flipping properties is his business, it is how he earns his salary. This means he has to pay a 39.6% tax (the highest federal income tax rate) on all his flips instead of only a 20% capital gain tax rate for his long term holds (with a 3.8% Obamacare surtax on income above $250,000 for married couples). Sammy definitely needs a CPA on his team for all the new rules.

This brings us to the best way to take title for Sammy’s (and for your) flipping activities.

While in a large majority of cases, you will want to take title to your real estate in an LLC, for flipping you will consider using an LLC taxed as an S corporation. The reason for this, as with so many other things in life, has to do with taxes. Because flipping constitutes ordinary income, with the S corporation tax rules we can minimize payroll taxes (that darn 15.3% extra tax we’ll never get back as it falls into the dark hole of Social Security promises). Pay yourself a reasonable salary (and pay payroll taxes on that amount) and flow the rest through to you as a distribution (without payroll taxes). Be sure to work with your CPA on this to make sure you are taxed appropriately on your real estate endeavors.

- Hold and keep. As Sammy analyzes each new property, he always asks himself whether it was one to flip or keep.

While he knows how to accelerate the return on his money by quickly flipping properties, he also knows that his long-term retirement needs would be in part satisfied by rental real estate income. Typically, his ideal candidate is a duplex or 4-plex that needs some repair. In such cases he can buy below market and perform improvements over time at his convenience. When he doesn’t have a quick flip to work on, he keeps his crew busy on his hold and keep properties.

Sammy always holds his hold and keep properties in separate LLCs. He values the asset protection benefits of keeping his properties in separate entities, especially after suffering two lawsuits early in his career. The first lawsuit arose when he operated his construction business as a sole proprietor and held his first investment property, a duplex, in his individual name. A client had sued Sammy over some very careless work a subcontractor had performed. The plumber had gone out of business and left the state, leaving Sammy holding the bag. A judgment was rendered whereby Sammy’s sole proprietorship was held liable for the significant damages. Since the sole proprietorship offered no asset protection whatsoever, all of Sammy’s personal assets were fair game for collection. And because Sammy hadn’t used a protective entity to hold title to his duplex, the property was completely exposed to the claims of the judgment creditor.

As a result, Sammy lost all of his sole proprietorship assets, his trucks and equipment, as well as the duplex. All lost to satisfy the claims for damages he did not cause. It was a bitter experience Sammy vowed would never happen again.

Sammy immediately started operating his construction business for flipping properties through an LLC taxed as an S corporation. He began acquiring hold properties with a vengeance, putting them all into one LLC. Before long, he had three 4-plexes and one triplex in his one LLC.

Then the second lawsuit was filed.

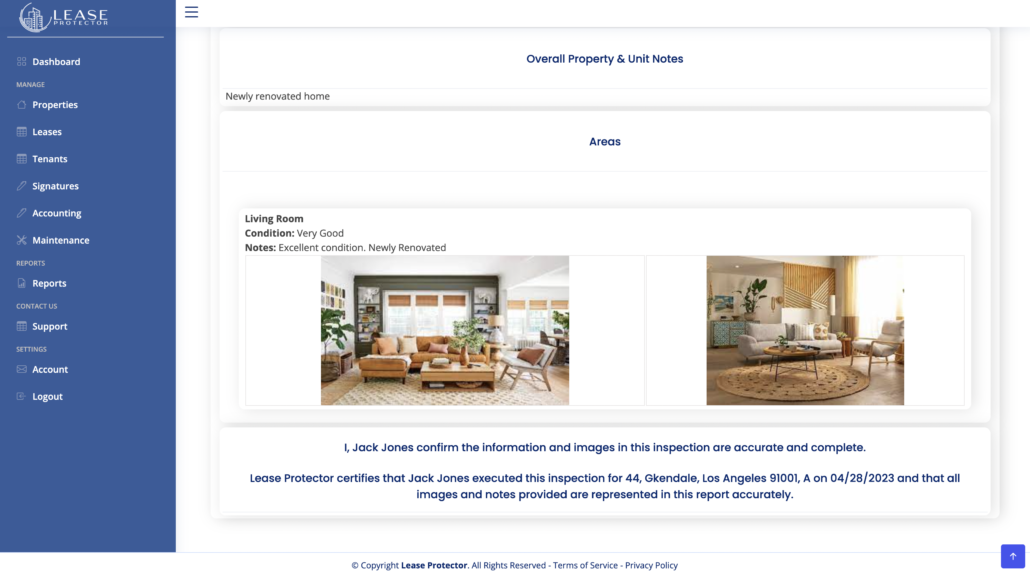

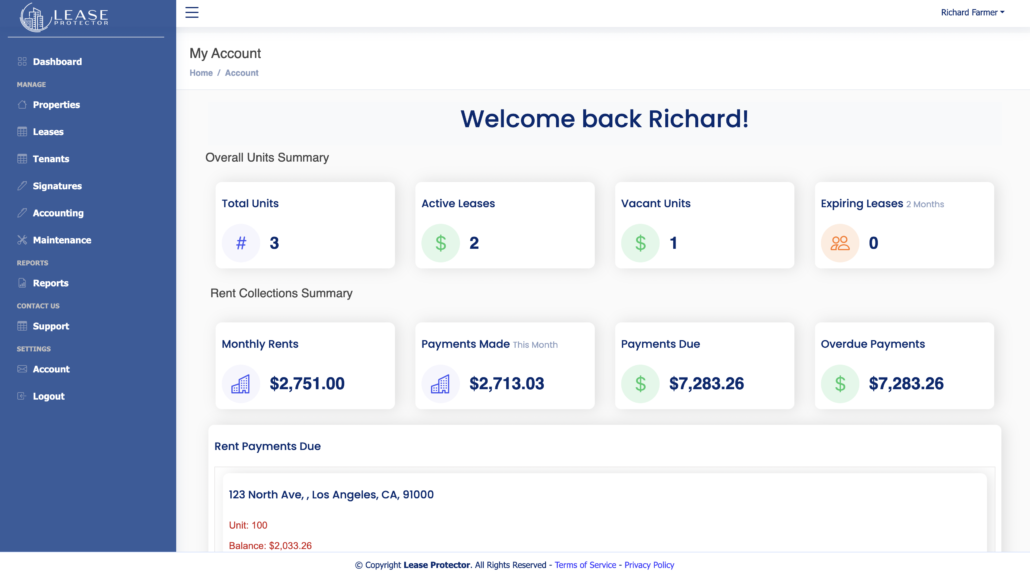

A tenant had fallen at the triplex. Sammy’s insurance company used a loophole to avoid paying the claim. As the chart below indicates, the tenant prevailed in a lawsuit brought against the LLC that owned the triplex.

The good news was that Sammy’s construction business and personal assets were not exposed to the claim. The bad news was that the judgment allowed the tenant to proceed against all of the assets in Sammy’s Real Estate LLC. Two of the 4-plexes were owned free and clear. The tenant’s attorney was able to easily attach the 4-plexes and sell them to satisfy the claim.

It was after this experience that Sammy came to appreciate that one did not want to own too many properties in one LLC or LP. By holding four properties in one LLC, a tenant with a claim involving one of the properties can reach the equity in all four properties.

Sammy decided that in the future, only one property would be held in each LLC. Putting too many properties in one LLC created an attractive target for the professional litigants of the world.

- Spec home sales. Whether building one home for speculative sale purposes or building a subdivision full of identical tract homes, Sammy knew that a unique protection strategy was needed when he started in spec home sales. This was because more and more lawyers across the country were bringing lawsuits alleging damage from mistakes during construction, known as construction defect litigation. Plaintiff’s lawyers were filing lawsuits on behalf of homeowners alleging monetary damages due to settling, cracks, improper construction practices, and the like. These suits were especially prevalent in California and Nevada, where a ten year statute of limitations allowed suits to be brought a decade after a house was built.

Each time Sammy builds a spec home he uses a new entity. Again, because of its asset protection benefits and efficient flow-through taxation of income, Sammy uses a separate LLC for each custom home he builds. In California, because of the extra state taxes on LLCs, he uses an LP with a corporate general partner as his developer entity.

The key to Sammy’s strategy is to keep each entity active after the house had been sold. This is to thwart the aggrieved homeowners and their lawyers who have ten years to bring a construction defect claim. Too many builders believe that by having tail insurance they can dissolve the construction entity. But insurance doesn’t cover every claim, and dissolving the entity leaves you personally responsible. By keeping the entity alive during the ten-year statute of limitations period, any claim would be brought against the LLC or LP, not personally against the owners.

But isn’t it expensive to keep an entity alive for ten years? What about all the filing fees and tax returns? As Sammy knows, it isn’t a burden if done the right way.

As far as tax returns are concerned, once each house is sold a final tax return for the entity is prepared. The LLC or LP stays alive but has no activity and thus does not have to file an ongoing return. In terms of annual filing fees, some states are more expensive than others. In California it is $800 per year per entity. Including a $125 annual resident agent fee, the ten-year cost per entity is $9,250.

But what if your California entity was originally formed in a low-cost state such as Wyoming? That is Sammy’s money-saving strategy. The developer entity is formed in Wyoming and qualified to do business in California. Qualifying in California is required since the house is being constructed in California. But once the house is sold, the entity no longer conducts any California business. It is free to stop paying California fees and only has to pay the minimal Wyoming fees of $50 per year. Assuming the same $125 annual resident agent fee, the cost of maintaining a Wyoming entity for 10 years is only $1,750 versus $9,250 for California. By forming the entity in Wyoming, qualifying in California for only as long as necessary and then keeping the entity alive in Wyoming until the ten-year statute of limitations runs out, Sammy is able to affordably protect himself and his other assets.

Sammy’s three strategies for remodels, holdings, and spec home developments serve him well and he has prospered without any further devastating litigation. His modern day castle keep are properly formed and properly maintained LLCs and LPs.

For more information on this and other title matters, please read my book Loopholes of Real Estate or visit CorporateDirect.com

Links:

Loopholes of Real Estate: http://www.corporatedirect.com/loopholes-of-real-estate/

Corporate Direct: http://www.corporatedirect.com/

Garrett Sutton

Garrett Sutton is an attorney, speaker and best selling author. As part of Robert Kiyosaki’s Rich Dad’s Advisor group he has written six books which have been translated into 11 languages. Garrett focuses on corporate and asset protection law and speaks to audiences on the importance of asset protection. His advice is pertinent, timely and valuable.

Garrett received his Juris Doctor Law Degree in 1978 from Hastings College of the Law, the University of California’s law school in San Francisco. He received a B.S. in Business Administration from the University of California, Berkeley, in 1975. He is licensed to practice in Nevada and California.