10 Roads To Real Estate Investing Profits

“Divide your portion to seven, or even to eight, for you do not know what misfortune may occur on the earth.” The Bible – Ecclesiastes 11:2

This is good advice as long as you don’t get so spread out that you are doing too many things but nothing with success. It’s important we understand the fine line between focusing on one real estate niche without putting all your eggs in one basket, (so to speak).

To simplify the terms of real estate investing, there are really only three ways for investors to make money in real estate:

- Real Estate Appreciation and Equity

- Cash flow while you own it

- Assignments: Payment when you flip a real estate contract without owning it.

So where do you start? Let’s try to answer this question on every aspiring real estate investors mind. Since real estate investing encompasses so many types of exit strategies or I like to call profit centers, it’s important to study and pick those you are most passionate about. otherwise called exit strategies.

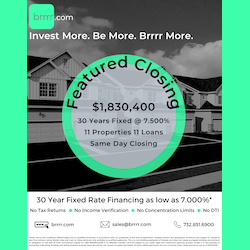

article continues after advertisement

The following is a summary of Ten of the Most Popular Real Estate Investment Strategies with their advantages and disadvantages.

1. Rentals or Cash flow Investment Property: These types of investment properties are the ones which generate rental income. These are mainly apartment buildings and rental houses.

- Advantages: One of the easier ways to get started, and good long term return on investment while also earning monthly income.

- Disadvantages: Risk of not renting property leaving you with the mortgage payment and no income. Property management can be a challenge. You typically will wait awhile to sell your property so payoff is slow.

2. Lease Option. This is when you buy a property, then sell to someone else via a rent-to-own arrangement.

- Advantages: You get higher rent, and the buyer is usually responsible for maintenance. Cash flow can be good.

- Disadvantages: Most rent to own buyers don’t complete the purchase (this can be an advantage too, but it does mean more work for you). Bookkeeping must be done properly and can be complicated.

3. Fixer Upper Investment Property. These types of investment properties are the ones which are in ugly condition and need renovation. These properties can be acquired to flip after fixing-up quickly or held to rent out.

- Advantages: You can receive a quick return on your investment (months). You usually get below market value pricing on properties bringing you instant equity.

- Disadvantages: Higher risk. (Many unpredictable expenses come up in construction). You get taxed heavily on the gain when you sell in under a year.

4. Vacant Land. Many options including just holding while appreciating. You can also split it and sell it.

- Advantages: History has shown that land always appreciates in value (it’s the buildings on the land that go down. It is simpler than most real estate investments, with the possibility of great profits.

- Disadvantages: It can take a long time to increase in value. You have expenses, but no cash flow while you wait unless you sell the contract before closing.

5. Commercial Real Estate. These are any building containing 5 units or over and/or buildings sited for commercial use.

- Advantages: Long term triple-net leases mean little management and high returns. Lending is usually based on the value of the property vs. personal credit.

- Disadvantages: Commercial property valuation requires a more complex method, taking into account the income potential of the property. This is recommended for the more experienced investors as there is a lot more involved to set up and maintenance.

6. Buy property with Forced Appreciation. Buy in the path of growth and holding until values rise. For instance buying a lot in a residential development prior to roads being completed.

- Advantages: Can yield large profits, especially if you buy low to start.

- Disadvantages: Future price is not predictable – the market can turn, the developer can go out of business. You have expenses with no income while you’re waiting.

7. Preconstruction Investment Property: These types of investment properties are acquired directly from a developer before the construction or renovation is completed.

- Advantages: Low money out of pocket to tie up property while being built. If purchased in appreciating markets, you make money in equity at closing and can instantly re-sell at a profit.

- Disadvantages: You can’t always predict what a market is going to do. If market depreciates, you have lost money. Also higher tax rates in selling quickly.

8. Pre-Foreclosure Investment Property: These types of investment properties are the ones which you buy from sellers who are behind in their payments and may lose their property to the bank via foreclosure.

- Advantages: You have opportunities to buy properties at below value pricing – “Instant equity”.

- Disadvantages: Legal liabilities are higher. Finding these properties requires a lot research and footwork to find a deal that works. You can do all the work and still not have a deal with enough equity to profit after expenses to sell, (taxes, realtors, etc).

9. Assignments: This strategy has you get into a property at a discount, preferably with a known buyer in place before you commit to your purchase. After you are in contract to purchase a property, you would sell your contract for a fee to someone else. For example you get into purchase contract to buy a $120K property for $100K. You turn it to an investor for $110K and profit $10K cash without the cost and hassles of ever closing on the deal.

- Advantages: This is a great way to make quick cash with low or no upfront investment, low risk and fewer headaches from closing and ownership. This strategy creates a win win win outcome for everyone involved.

- Disadvantages: This will only work if the property you are buying has equity so that you may buy it a discount. In declining markets, this type of property is harder to find. Also when dealing with banks on REO’s or Short Sales you will find they will not allow you assign your contract. However, there are ways to get around this if you plan and handle the contract correctly up front.

Do you want to know how I have managed to get around not being able to assign a contract? I have purchased properties in the name of an LLC set up exclusively to buy properties. I then sold the LLC to someone, making them the owner of the LLC, therefore making them responsible for closing on the purchase contract and end buyer of the property.

10. Flipping – Wikipedia defines Flipping as is a term used primarily in the United States to describe practice of buying an asset and quickly reselling (or “flipping”) it for profit ..

This description pretty much explains property flipping, with there being a slight difference from that description of flipping assets. In real estate you can get into an agreement to flip a contract you have gotten into before you even buy it. This can be done with ease when you know exactly what your buyers want and with no money out of your pocket utilizing transactional funding. Flipping can also mean closing and quickly reselling your property, sometimes even doing both transactions the same day – this being subcategorized a “double closing”.

- Advantages: My favorite strategy. You work the deal backwards. You create relationships with buyers who can close quickly with cash. Then you find a property meeting the needs of your buyers. This strategy allows you to profit literally from no money down, with lower risk and very little of your own time.

- Disadvantages: The law requires you to disclose your intent to resell quickly to sellers. When dealing with banks, this can sometimes cause your offer to be rejected. You must buy properties in the name of an LLC in order to utilize transactional funding. Setting up and maintaining an LLC will cost you money. Though the intent of a buyer might be to close on the transaction, sometimes “life happens” and something causes the buyer to be unable to follow through. You may have to walk away from earnest money if you cannot find another buyer quickly

article continues after advertisement

Now that you that you have learned strategies to consider, you will need to consider the type of properties you want to go after, developing a marketing strategy to find motivated sellers of those deals. Over the next months I will be sharing steps and strategies on how to profit investing in real estate 12 different ways.

Please leave a comment if you have anything you would like add to what I have written here with the heart to support fellow real estate investors. (Any solicitations for business will not be published) I appreciate the feedback!

Tamera Aragon

Tamera Aragon is a professional online entrepreneur and has bought and sold over 300 properties, establishing her as an expert in the real estate investing field. Since 2003, she has purchased over 10 million dollars in real estate and currently holds properties all over the world. Tamera’s focus is on the booming Foreclosure market, buying Pre-foreclosures, REOs and Short Sales. Tamera who is a noted Author, Success Trainer, Speaker & Coach, shows her passion for helping others with the 17 websites she has created and several specialized products to support fellow investors throughout the world. When Tamara is not busy running her website, she is very involved with her Fiji joint ventures and investments. Tamera Aragon is one of the few trainers and coaches who is really “doing it” successfully in today’s market. Tamera’s experience has earned her a solid reputation in the industry as well as the respect and friendship of many of the top national real estate investment and internet marketing experts. Tamera Aragon believes her success has garnered her the financial freedom to fully enjoy her marriage and spend quality time with her children.

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411Expo.com or our Eventbrite landing page, CLICK HERE.