Why Millennials Can’t Afford Homes in 2022

Image from Pixabay

Special submission by Alyssa Evans with Clever Real Estate

Millennials are the largest cohort of home buyers in the United States, slightly edging baby boomers and Generation X. You might think that gives them a lot of buying power, but the opposite is true. As a generation, millennials struggle to afford homes because of inflated housing prices and expensive student debt.

With the largest group of home buyers unable to afford homes, that could affect the entire market. In the future, it’s possible that a small coterie of real estate investors could use an online investment property calculator to acquire property, claim home tax deductions, and even manage those rental properties remotely while the large majority of Americans remain permanent renters because they’ve been priced out of the market.

A new study from Anytime Estimate evaluates home prices versus inflation and examines the unique financial pressure millennials face, why homes are less affordable, and what that could mean for the housing market.

Inflation Has Been a Problem for Decades

Image from Pixabay

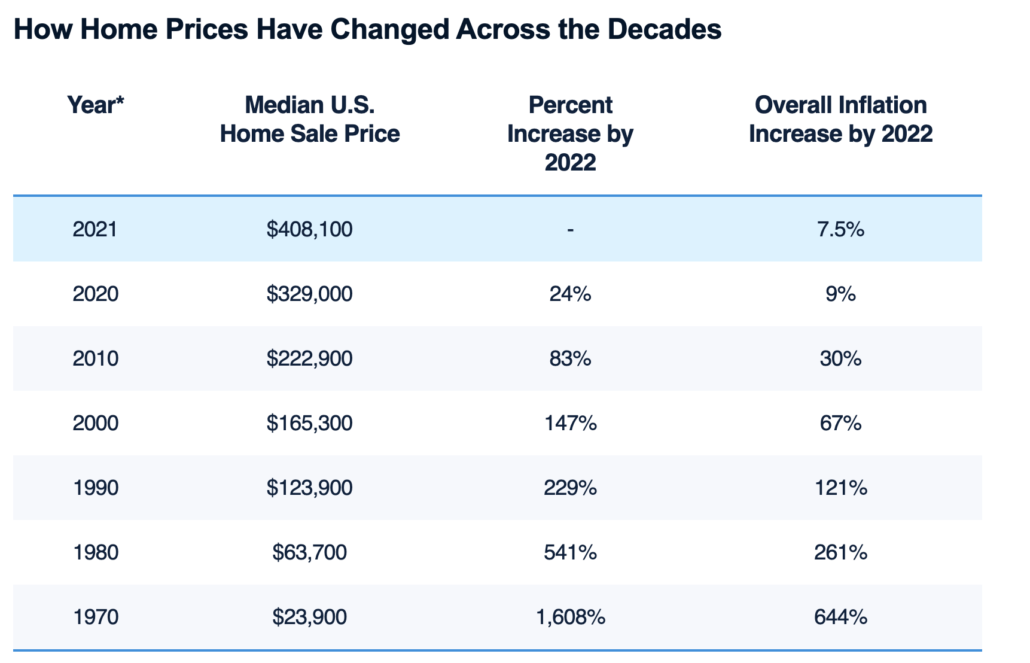

Inflation has been a hot-button topic over the past few months, but it’s been a problem for decades. Since 1970, home prices have increased more than 1,600%, while inflation has increased only 644%.

The problem seems to be accelerating. In 2021, home prices skyrocketed 20%, while inflation grew 7.5%. If home prices grew at the same rate as inflation, today’s median home price would be just under $178,000. In reality, the median home sale price is about $408,000.

Meanwhile, median U.S. household income has increased just 7% in total since 2000 — only 0.3% per year. In simple terms, homes are getting more expensive, minimizing income increases Americans receive.

The Home-Price-to-Income Ratio Is Higher for Millennials

The real estate market is historically hot right now. Sellers who once might have accepted a lowball offer from a company that buys houses for cash are now finding a real estate agent to list on the market and get multiple bids above asking price.

Some buyers are paying top dollar for a house, but that doesn’t mean they should. Financial experts say a healthy home-price-to-income ratio is around 2.6. In other words, buyers shouldn’t purchase a home that’s more than 2.6x their annual income.

Today, the average household income in the U.S. is around $68,000. To maintain a healthy price-to-income ratio of 2.6, the average American would need to buy a home priced at $177,000 or below. However, the average home in the U.S. costs almost twice that amount — $332,000. The average home-price-to-income ratio is 5.4, double what’s recommended.

ADVERTISEMENT

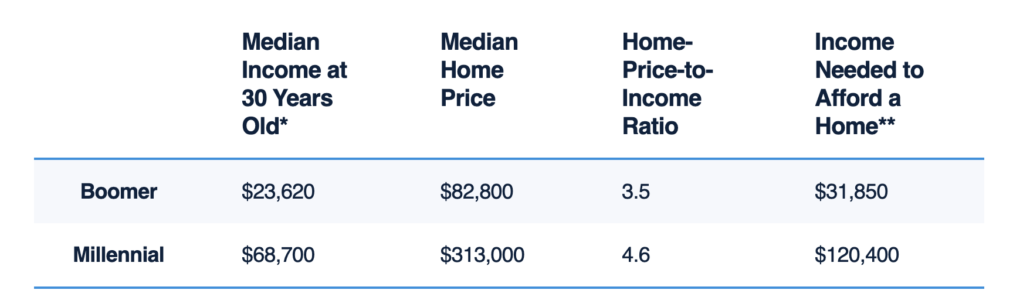

As millennials enter prime home buying age, they’re also entering a market that’s historically expensive. In 1985, when the average boomer turned 30, the median sale price of a home was about $83,000, and the median household income was just under $24,000. That’s a home-price-to-income ratio of 3.5.

For a baby boomer to meet the recommended 2.6 home-price-to-income ratio, they needed to make around $32,000 — 35% higher than the median income at that time.

Fast forward to 2019, when the average millennial turned 30. The median household income was just under $69,000, and the median home sale price was $313,000 — a 4.6 ratio. That’s 31% higher than the ratio for boomers, not to mention nearly twice the recommended ratio.

For the average millennial in 2019 to buy a house within the recommended home-price-to-income ratio of 2.6, they needed to earn a household income of around $120,000 — 75% higher than the 2019 median.

It’s clear millennials enter a much tougher housing market than baby boomers. Boomers were able to buy homes relatively cheaply, and they have enjoyed decades of appreciation. Many boomers have built their net worth through homeownership and real estate investments, using smart maneuvers like a 1031 exchange to defer their capital gains taxes.

Millennials, on the other hand, may not even be able to get their foot in the door because of the simple relationship between home prices and income.

The Cost of College Has Skyrocketed

Image from Pixabay

Adjusting for inflation, tuition costs have increased 143% since 1963 and 52% since boomers started college. For millennials, rising costs have translated into student debt.

Millennials carry about one-third (32%) of all student debt in the U.S. The average millenial has a student loan debt burden of nearly $41,000.

It’s not surprising that 60% of millennials say that student debt is holding them back from buying a home.

Low Supply Has Inflated Home Prices

Even for millennials who have money to buy a home, there aren’t that many homes on the market, and competition remains high.

ADVERTISEMENT

The pandemic snarled supply chains and paralyzed the labor market. Builders are just now recovering. Many experts say that today’s low housing supply can be traced back to the construction slowdown caused by the Great Recession. Others add that zoning restrictions have blocked high-density housing that could alleviate the shortage. All those factors have contributed to a historically tight housing market, with supply far lower than demand.

One further complication for millennials is that a lack of available housing has caused many boomers to stay in their homes when they might otherwise downsize. The homes that boomers would be selling would, in many cases, be starter homes for millennials. However, those homes aren’t making it to the market.