By Rick Tobin

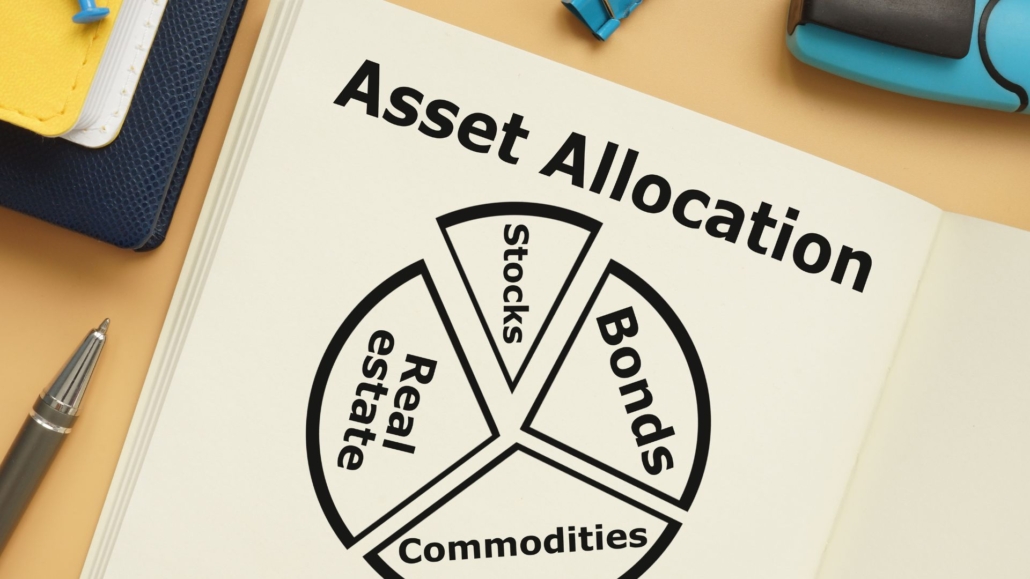

The biggest purchase of a person’s life for the average American is their primary home where they live. Later in life, the equity in this same owner-occupied home will likely represent the bulk of the homeowner’s entire net worth.

A wise purchase can make you very wealthy, while an unwise purchase can be financially devastating. Would you prefer to take this risk alone or with a team of experienced professionals by your side?

article continues after advertisement

How many of you have seen how thick a real estate purchase and mortgage file can be at the time of closing? I’ve seen files for residential or commercial real estate loans that were three, six, twelve, and twenty-four plus inches thick by the time of closing. Could you imagine handling the closing of a purchase transaction without the expert assistance provided by real estate licensees, mortgage brokers, loan processors, underwriting teams, escrow, title insurance, appraisers, home inspectors, and several others?

As a result of the recent $418 million dollar anti-monopoly lawsuit settlement that the National Association of Realtors® (NAR) approved, let’s take a closer look at how these new buyer agency relationship regulations may directly impact you as a buyer or seller.

The potential reduction of brokerage commissions

The potential elimination of buyer’s agents from a larger percentage of future sales transactions will obviously hurt many real estate licensees. Prior to this NAR settlement, the average commission paid per real estate transaction was about 5.5%. It can be split evenly at 2.75% to the listing agent and 2.75% to the buyer’s agent or with more of the commission split going to the listing agent such as 3% for list agent and 2.5% for the buyer’s agent. Will future commission splits fall to lower amounts?

There are upwards of 1.5 million Realtors® who belong to NAR and about 500,000 additional real estate licensees who don’t belong to NAR for a grand total of nearly 2 million real estate licensees.

Upwards of 80% of real estate licensees (about 1.6 million) own at least one home. With the future loss of income from discounted or eliminated buyer’s brokerage fees, many of these real estate licensees may be forced to list their home for sale while pushing the national home listing inventory rates higher.

Generally, the buyer’s agent does the most work in a real estate transaction because they tend to interact with almost every party involved in the transaction (listing agent, mortgage broker or banker, escrow, attorney, and/or title insurance, appraiser, home inspectors, environmental specialists, etc.). Wouldn’t the elimination of a buyer’s agent be problematic for many transactions across the nation?

article continues after advertisement

How will first-time buyers afford to buy their buyer’s agent directly?

The average first-time homebuyer invests approximately 6% of the purchase price. For all homebuyer types (move-up, 2nd home, investor, etc.), it’s closer to 13% nationwide and as high as 18% here in California.

VA (Veterans or active military personnel) homebuyers are not allowed to pay buyer’s agent fees. Most of them qualify with no money down 100% LTV loans. FHA buyers usually come in with somewhere between 0% and 3.5% down. Many times, FHA home buyers do not have any extra cash to pay their buyer’s agents directly.

If homebuyers are now expected to find and hire their own buyer’s agent and pay them anywhere between 1% and 3%, it will be very challenging for many homebuyers to come up with the additional funds to pay their buyer’s agent directly and purchase their dream home.

Commissions and seller credit negotiations

Commission fees for the listing agent and buyer’s agent have always been negotiable. This new NAR settlement doesn’t change that option. Yet, it makes it more challenging for buyers, sellers, and real estate licensees to complete a transaction.

If a buyer prospect signs a buyer’s agency agreement with a real estate licensee for 2% and the seller or new home builder offers to pay 3% to the buyer’s agent, then can the buyer’s agent be paid the higher 3% commission offered by the seller or is the commission amount limited by the 2% fee mutually agreed to by the buyer and buyer’s agent? For licensees, this is a topic to be discussed with your employing broker and/or advising legal experts.

Many times, a purchase deal is structured with seller credits that cover the buyer’s agent and listing agent fees and overall closing cost credits (loan, escrow, title, inspection, and/or appraisal fees), which may vary between 5% and 10% of the total purchase price. Without these seller credits, the buyers may not have enough of their own funds to cover the required down payment and closing costs with or without being required to pay their own buyer’s agent.

The rise of dual agency, attorney closings, and self-represented deals

This NAR case settlement may set a legal precedent for future courtroom cases to completely outlaw dual agency where one licensee represents both the buyer and seller. I’ve written real estate courses in more than 30 states over the years and have held eight different real estate, mortgage, and securities brokerage licenses, so I’m somewhat familiar with the fact that many states already outlaw dual agency.

Many legal groups are behind the push to eliminate real estate licensees so that lawyers handle a higher percentage of closings like they do in New York state and elsewhere. Attorneys like to say that dual agency for Realtors® is akin to an attorney unfairly representing both sides in a lawsuit.

A buyer’s agent is focused on protecting their buyer more than any other licensed or unlicensed professional involved in a purchase transaction. Why would so many people be happy to eliminate the main party who is truly working in the buyer’s best interests?

Contingency dates and disclosure risks

Real estate contracts and inspection reports are incredibly complex. A buyer or seller who attempts to represent themselves in a purchase contract may miss important contingency dates for the completion of the appraisal, home inspection reports, or formal mortgage approval and lose their 1% to 3%+ in earnest money deposits.

Sellers, in turn, who don’t fully disclose all known or potential home and environmental risks to their buyers may later be subject to multi-million dollar lawsuits related to mold, cracked foundations, leaky roofs, or toxic air from a nearby chemical plant. The seller’s $300,000 home price sales gain later turns into a – $1.7 million dollar loss after the $2 million dollar court judgment is filed for not clearly disclosing all known or potential risks.

The median U.S. home sales price is at or just below $400,000. The average buyer’s brokerage commission fee is 2.5% or about $10,000. A buyer who is self-represented may pay too much for the home at prices well above $10,000 and put themselves at greater risk for missing out on the disclosure risks that could later cost them tens or hundreds of thousands of dollars.

A future lawsuit against the seller may net them zero if the seller files for bankruptcy protection unless fraud can be proven. The buyer still may collect zero from a recorded judgment if the seller has no assets.

For more successful real estate licensees who can afford a rather large marketing and networking budget while controlling a high percentage of the listings in their region, how many buyers’ agents will show your listing if there’s no buyer’s agent commission being offered by the seller? Why would someone work for free and take on such significant risk for nothing?

Mortgage brokers who hold a real estate broker’s license like me could step in and write up the purchase contract, negotiate the seller credits, and bring in the money to close it. Yet, why would I want to double my workload if I act as the buyer’s agent to collect no additional commission and significantly increase my liability risks? In many of my purchase deals, I value the assistance provided by the buyer’s agent more than any other professional.

Will home values be impacted by new agency regulations?

The real estate sector represents upwards of 20% of the national economy. For people who don’t hold real estate licenses, they may still be directly impacted as future home inventory numbers possibly rise and property values start to decline. As foreclosures rapidly increase, these become the neighborhood sales comps that either hurt or help your home value.

Some in the media are claiming that this buyer’s agency commission reduction or elimination will be very good for homeowners. Again, the average buyer’s brokerage commission is closer to 2.5% than 2.75% or 3%, yet I will increase it to 3% for the average $800,000 home sales price in California to arrive at an alleged $24,000 commission savings for the buyer and/or seller.

If home prices fall just 5% in California due solely to these massive Realtor® regulation changes, that’s equivalent to a $40,000 price reduction for the seller. If so, the seller is now losing $16,000 in gains ($40,000 – $24,000 = $16,000 in total losses) with just a 5% reduction in sales prices in spite of paying no buyer’s agent commission fee on a typical $800,000 home sales transaction. What happens if home prices fall 10%, 20%, or more?

The rise in mortgage rates, insurance costs, utilities, and overall skyrocketing inflation rates will also inspire more homeowners to list and sell. Real estate prices are influenced the most by the old economic theory known as supply and demand, for better or worse.

As more and more residential and commercial property go underwater or upside-down (mortgage debt exceeds value), how will buyers or sellers be able to handle the complex process of forbearance, pre-foreclosure, or short sale discounts on their own without the help of an experienced advisor?

To learn more details from the perspective of the National Association of Realtors®, here’s an informative post that’s entitled The Truth About the NAR Settlement Agreement.

Whether you’re in favor of this NAR settlement agreement or hate it, please research as many different sides of this topic to better understand how it may help or harm you as a buyer, seller, landlord, tenant, real estate licensee, or third-party professional.

Rick Tobin

Rick Tobin has worked in the real estate, financial, investment, and writing fields for the past 30+ years. He’s held eight (8) different real estate, securities, and mortgage brokerage licenses to date and is a graduate of the University of Southern California. He provides creative residential and commercial mortgage solutions for clients across the nation. He’s also written college textbooks and real estate licensing courses in most states for the two largest real estate publishers in the nation; the oldest real estate school in California; and the first online real estate school in California. Please visit his website at Realloans.com for financing options and his new investment group at So-Cal Real Estate Investors for more details.

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411.com or our Eventbrite landing page, CLICK HERE.