By Rick Tobin

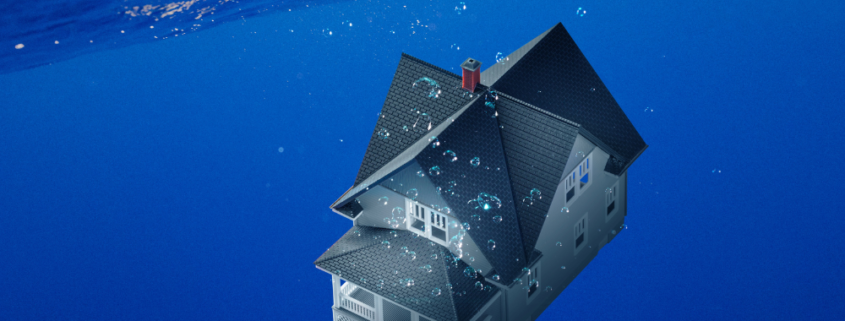

Many homebuyers who purchased their homes near the peak of the latest 7-year “boom” or positive valuation cycle earlier in 2022 now may have zero or negative equity. This is partly due to the fact that so many owner-occupied home buyers came in with very low to no down payments anywhere between 0% (VA loans) to 3% (Conforming) or 3.5% (FHA). It may cost the average seller 6% to 8% in real estate commission fees, title, escrow, and transfer taxes to sell their homes which actually makes the number of underwater (mortgage debt exceeds current market value) properties higher than what’s reported.

Black Knight’s October 2022 Mortgage Monitor report shared details about how 8% of homes purchased in 2022 were already underwater and that almost 40% of properties had less than 10% equity left in their homes. The hardest hit property owners were first-time home buyers with small down payments such as seen with FHA, Conforming, and VA. Should home values fall 5% to 20%+ next year, then the number of underwater properties will rise like the tides during a peak moon cycle.

ADVERTISEMENT

According to Black Knight, more than 20% of the 2022 FHA/VA purchases had negative equity as of October 2022 and a whopping 66% had less than a 10% equity stake. Black Knight also reported that excluding the time near the start of the pandemic the “early-payment default” (EPD) rate, which tracks mortgage delinquencies within the first six months of origination, hit the highest level since 2009.

The good news is that there’s still some high percentages of equity for homes purchased prior to 2022 due to how fast those homes appreciated nationwide over the past 10+ years. For example, the negative equity rates for all properties nationwide still remains historically low near 0.84% as of the third quarter of 2022. These very low negative equity numbers may change and rapidly increase in 2023 if mortgage rates keep rising and home values flatten or decline.

The #1 reason after the loss of income for why a homeowner is likely to walk away from their home and mortgage payment obligations is when their property is upside-down or underwater with negative equity. While the homeowner may be drowning in debt with a financial anchor that takes their home equity is underwater and figuratively sinking as well.

Maritime Admiralty Law and Money Terms

You are primarily made up of water. In fact, upwards of 70% of your body and 80% of your brain is derived from water. Iodine is the body’s natural disinfectant, so effectively you’re made up of saltwater somewhat like found in one of the Seven Seas (Atlantic, Pacific, Arctic, and Indian Oceans, the Mediterranean Sea, the Caribbean, and the Gulf of Mexico). If you’re fortunate enough to live near the sea, you probably own a much more valuable home due to the higher demand for coastal properties.

Did you know that the early origins of US law and taxation authority come from Old English Common Law and Maritime Admiralty Law? Common Law is determined by past judicial or courtroom decisions or verdicts in civil and criminal courthouses.

Maritime Admiralty Law is also referred to as the Law of the Sea. It’s a body of private international law that governs relationships between private parties or business entities which also operate ships or vessels. The law of water dominates the entire planet partly since about 71% of the Earth’s surface is covered in water.

Let’s take a look next at how money, real estate, water, and taxation share many hidden and not-so-hidden meanings or double meanings:

Merchant banker: Merchant banks were the first modern banks which evolved from medieval merchants that traded in various commodities such as cloth merchants. These merchant bankers also helped finance the sales of these goods. “Mer” is also defined as sea as seen with the word Mermaid (woman of the sea).

Flipper: The name of a beloved dolphin in a television show from the 1960s because the dolphin completed amazing flips in the air. A home flipper, on the other hand, is an investor who purchases distressed and discounted fixer-upper properties prior to remodeling and later selling or “flipping” them. A flipper who sells his rental property in less than a year will probably pay much higher tax penalties for his or her short-term gains.

Whale: A very wealthy client or organization with lots of money.

Loan Shark: A third-party lender who typically offers very expensive loans for fairly short periods of time over weeks, months, or a few years to motivated clients who may be short of funds.

Cash flow: Real estate investors strive to find assets that create positive and consistent cash flow or income streams just like they may see at their nearby river where they may fish. For real estate investors who are fortunate enough to have a positive monthly cash flow while letting their money work hard for them instead of vice versa, they will have more time to fish or go boating.

Sink: A poorly managed rental property or significant debt can sink you financially and pull you to the bottom like a falling anchor.

Float: When you’re running out of cash, a bank loan can float you like a lifebuoy so that you keep your head above the water and don’t figuratively “drown” in debt.

Liquid: A person with lots of access to money or capital is described as being liquid or having exceptional liquidity. Conversely, a person with no money is illiquid.

(River)bank: A courtroom judge rules from the bench. In Latin, bench translates as bank. Most courtroom disputes are monetary disputes, so the judge acts somewhat like a merchant banker while trying to balance out the assets and liabilities. Banks also are located on both sides of a river or riverbank.

Docs: Boat or larger ships are tied to docks when not at sea. Clients sign loan docs or documents when purchasing a property with a mortgage.

Current-sea: All nations have their own acceptable currency like the dollar. Seawater also flows via an ever-changing current.

Underwater: A property that has more mortgage debt than the current market value.

Soak: You may be familiar with the “Let’s soak the rich” phrase when some people are demanding that wealthier Americans pay their “fair share” of taxes.

Levy: For taxation purposes, a levy is the government’s right to seize your property if you don’t pay your taxes. For water purposes, a levee protects dry land from water damage that may originate from a nearby river or flood channel.

Sinking Prices and Short Sales

“I can’t change the direction of the wind, but I can adjust my sails to always reach my destination.” – Jimmy Dean

If you think a financial storm is coming on the horizon, you can either do nothing as the figurative waves crash over the front of your boat’s bow until it sinks or you can adjust your sails and head off towards safety, sunshine, and new prosperity. Today, you’re more likely than not to read negative news about real estate and the financial markets as we’re near the low point or trough of the economic wave or cycle.

Kieran Clancy, a senior economist at Pantheon Macroeconomics, published a recent analysis about how he thought that home values may fall 20% from their June 2022 peak wave highs. New home listings fell 19% from the 2017-2019 levels, which was the largest deficit in six years aside from the early pandemic and lockdown months in 2020.

Home delistings reached an all-time record high by November 2022 as more sellers got frustrated with fewer buyer prospects who also weren’t offering high enough purchase price offers for many of the sellers. A record 2% of homes for sale across the nation were delisted as being offered for sale every single week on average for 12 consecutive weeks through November 20 as per Redfin.

ADVERTISEMENT

An underwater and a potential short sale deal is a home sales situation where the mortgage debt exceeds the current market value at the time of the sale. The seller and advising real estate and mortgage licensees can assist with persuading the existing lender or mortgage loan servicer to significantly discount their debt concurrently at the payoff of the short sale. This way, the seller doesn’t lose more money, the buyer pays fair market value, and both the listing and buyer’s agents receive their commissions.

Some of our past clients who came to us for financing have worked on several thousand short sale deals, so our team is very experienced with offering solutions for all parties involved. For motivated sellers, you should set realistic home listing prices in the near term to maximize your profits or to minimize your losses. For real estate licensees, you should learn more about how short sales and creative seller-financed sales can help you and clients at a much faster pace while increasing gains or reducing losses at the same time.

What goes up must come down, but it also can build up powerful future momentum like a peaking wave crest as we “surf” or “sail through” the continuous boom and bust wave cycles!!!

Rick Tobin

Rick Tobin has a diversified background in both the real estate and securities fields for the past 30+ years. He has held seven (7) different real estate and securities brokerage licenses to date, and is a graduate of the University of Southern California. Rick has an extensive background in the financing of residential and commercial properties around the U.S with debt, equity, and mezzanine money. His funding sources have included banks, life insurance companies, REITs (Real Estate Investment Trusts), equity funds, and foreign money sources. You can visit Rick Tobin at RealLoans.com for more details.

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411.com or our Eventbrite landing page, CLICK HERE.